Preemptive rights protect shareholders by giving them the opportunity to purchase new shares before the company offers them to the public, preserving their ownership percentage and preventing dilution. These rights are crucial during funding rounds or share issuances to maintain your voting power and control within the company. Explore the rest of the article to understand how preemptive rights can safeguard your investments.

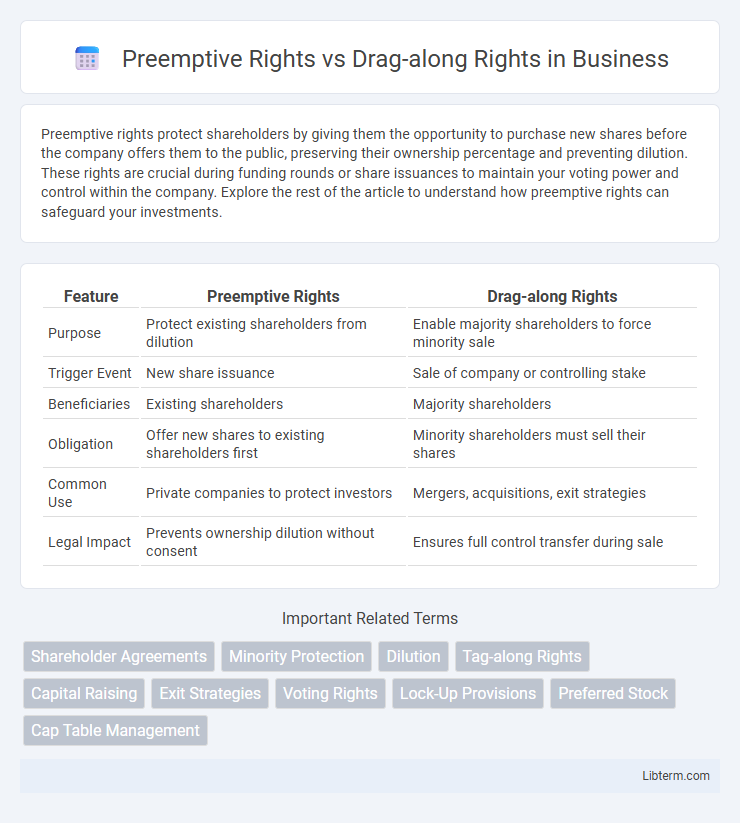

Table of Comparison

| Feature | Preemptive Rights | Drag-along Rights |

|---|---|---|

| Purpose | Protect existing shareholders from dilution | Enable majority shareholders to force minority sale |

| Trigger Event | New share issuance | Sale of company or controlling stake |

| Beneficiaries | Existing shareholders | Majority shareholders |

| Obligation | Offer new shares to existing shareholders first | Minority shareholders must sell their shares |

| Common Use | Private companies to protect investors | Mergers, acquisitions, exit strategies |

| Legal Impact | Prevents ownership dilution without consent | Ensures full control transfer during sale |

Understanding Preemptive Rights

Preemptive rights grant existing shareholders the opportunity to purchase additional shares before the company offers them to outside investors, protecting their ownership percentage from dilution. These rights are crucial in maintaining control and influence within the company, particularly during new equity financing rounds. Understanding preemptive rights is essential for investors seeking to preserve voting power and investment value in startups and private companies.

What Are Drag-along Rights?

Drag-along rights are provisions in shareholder agreements allowing majority investors to compel minority shareholders to join in the sale of a company, ensuring a smooth transaction without holdouts. These rights protect majority shareholders by enabling them to sell the entire company to a third party under unified terms, typically activated during acquisition or merger events. Drag-along rights help streamline exit strategies and maximize sale value by preventing minority shareholders from blocking or complicating the sale process.

Key Differences Between Preemptive and Drag-along Rights

Preemptive rights grant existing shareholders the opportunity to maintain their ownership percentage by purchasing additional shares before new investors, preventing dilution of their stake. Drag-along rights enable majority shareholders to compel minority shareholders to join in the sale of the company, ensuring a smoother transaction for potential buyers. The key difference lies in preemptive rights protecting ownership proportions, while drag-along rights facilitate the sale and transfer of shares under specific conditions.

Legal Foundations of Shareholder Rights

Preemptive rights originate from corporate law principles designed to protect existing shareholders from dilution by granting them the option to purchase additional shares before new investors, ensuring proportional ownership retention. Drag-along rights, grounded in shareholder agreements and corporate statutes, enable majority shareholders to compel minority shareholders to join in the sale of a company under the same terms, facilitating streamlined exit transactions. Both rights are essential legal mechanisms that balance control and protection within equity ownership structures.

Advantages of Preemptive Rights

Preemptive rights protect existing shareholders by allowing them to purchase additional shares before the company offers them to new investors, maintaining their proportional ownership and preventing dilution. These rights ensure shareholders retain control and influence during new equity issuances, preserving voting power and financial stake. Preemptive rights also provide a safeguard against hostile takeovers by enabling current investors to increase their shareholdings proactively.

Benefits of Drag-along Rights

Drag-along rights benefit majority shareholders by enabling them to compel minority shareholders to join in the sale of a company, ensuring a smoother and more attractive transaction for potential buyers. These rights prevent minority holdouts from blocking or complicating the sale process, thereby maximizing the sale value and promoting shareholder alignment. By streamlining ownership transfer, drag-along rights enhance liquidity and facilitate exit strategies for investors.

Common Scenarios for Exercising Preemptive Rights

Preemptive rights are commonly exercised during new equity financing rounds, allowing existing shareholders to purchase additional shares proportional to their current ownership to prevent dilution. These rights are also triggered in company expansions where capital increases are anticipated, ensuring shareholders maintain control and voting power. By contrast, drag-along rights typically come into play during the sale of the company, compelling minority shareholders to join a majority-led buyout, while preemptive rights are key to shareholder protection and maintaining equity stakes in regular capital events.

How Drag-along Rights Impact Minority Shareholders

Drag-along rights compel minority shareholders to join in the sale of a company when majority shareholders decide to sell, ensuring a smoother transaction by preventing minority holdouts. This mechanism can limit minority shareholders' control over the timing and terms of the sale, potentially forcing them to accept less favorable conditions. Minority shareholders may benefit from the sale price negotiated by majority holders but face reduced leverage in influencing strategic decisions.

Negotiating Shareholder Agreements: Preemptive vs Drag-along

Preemptive rights allow existing shareholders to maintain their ownership percentage by purchasing new shares before outsiders, protecting against dilution during equity financing. Drag-along rights enable majority shareholders to compel minority shareholders to join in the sale of the company, ensuring a smoother exit process in mergers or acquisitions. Negotiating shareholder agreements requires balancing these rights to align investor protections with flexibility for future capital raises and potential sale opportunities.

Choosing the Right Protection for Investors

Preemptive rights protect investors by allowing them to maintain their ownership percentage during new equity issuances, preventing dilution and preserving voting power. Drag-along rights enable majority shareholders to compel minority investors to join in the sale of the company, ensuring smoother exit processes and maximizing sale value. Selecting the right protection depends on investor priorities: preserving control favors preemptive rights, while facilitating liquidity and exit strategies aligns with drag-along rights.

Preemptive Rights Infographic

libterm.com

libterm.com