Assets represent valuable resources owned by individuals or businesses, including cash, property, investments, and equipment that contribute to financial stability and growth. Understanding the different types of assets, such as current, fixed, and intangible, is essential for effective financial planning and management. Explore the full article to learn how maximizing your assets can enhance your financial future.

Table of Comparison

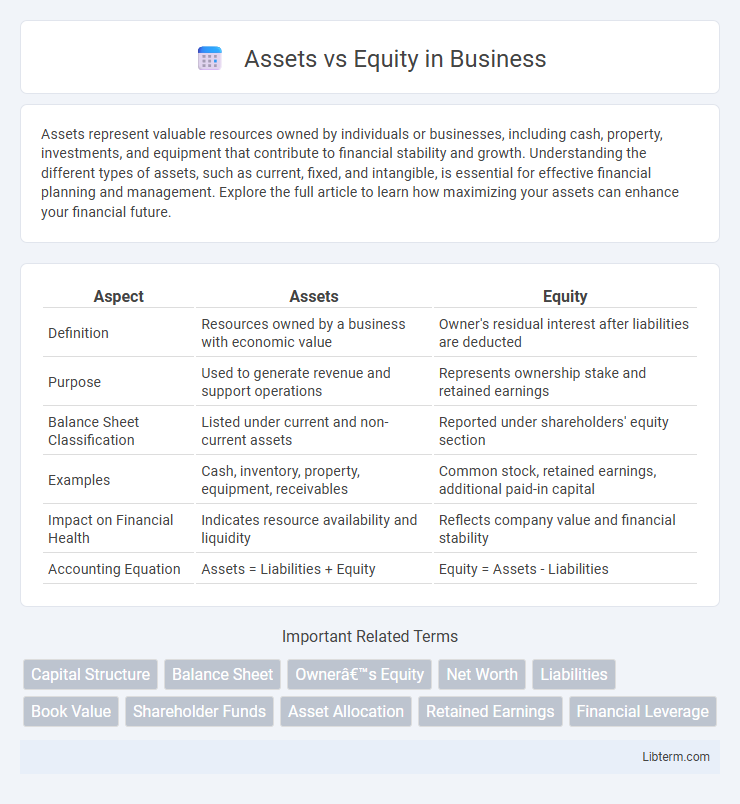

| Aspect | Assets | Equity |

|---|---|---|

| Definition | Resources owned by a business with economic value | Owner's residual interest after liabilities are deducted |

| Purpose | Used to generate revenue and support operations | Represents ownership stake and retained earnings |

| Balance Sheet Classification | Listed under current and non-current assets | Reported under shareholders' equity section |

| Examples | Cash, inventory, property, equipment, receivables | Common stock, retained earnings, additional paid-in capital |

| Impact on Financial Health | Indicates resource availability and liquidity | Reflects company value and financial stability |

| Accounting Equation | Assets = Liabilities + Equity | Equity = Assets - Liabilities |

Understanding Assets: Definition and Types

Assets represent valuable resources owned or controlled by a business, providing future economic benefits essential for operations and growth. They are categorized into tangible assets such as machinery, buildings, and inventory, and intangible assets including patents, trademarks, and goodwill. Understanding asset types helps businesses manage their financial health, optimize resource allocation, and improve balance sheet accuracy.

What is Equity? Core Concepts

Equity represents the residual interest in the assets of a company after deducting liabilities, reflecting ownership value held by shareholders. It encompasses components such as common stock, retained earnings, and additional paid-in capital, which collectively indicate the net worth of a business. Understanding equity is essential for evaluating a company's financial health, investment potential, and the distribution of ownership rights.

Key Differences Between Assets and Equity

Assets represent the total resources owned by a company, including cash, inventory, property, and equipment, while equity reflects the owner's residual interest after liabilities are subtracted from assets. Key differences include that assets are tangible or intangible items with economic value, whereas equity signifies ownership value or shareholders' stake in the company. Assets appear on the balance sheet's left side as resources controlled, whereas equity is recorded on the right side as the net worth attributable to owners.

How Assets Influence Financial Health

Assets directly impact a company's financial health by representing resources with economic value that generate cash flow or can be converted into cash. High-quality assets such as cash, receivables, and inventory improve liquidity and operational stability, enabling firms to meet short-term obligations and invest in growth. Conversely, inefficient asset management can lead to reduced equity value and increased financial risk, signaling potential distress to investors and creditors.

Equity’s Role in Business Value

Equity represents the ownership interest in a company, reflecting the residual value after liabilities are subtracted from assets, crucial for understanding business value. It serves as a key indicator for investors and stakeholders assessing a firm's financial health and potential for growth. The growth in equity often signals increased business value, driven by retained earnings and capital contributions.

Relationship Between Assets, Liabilities, and Equity

Assets represent the total resources owned by a company, while equity reflects the residual interest of the owners after deducting liabilities. The fundamental accounting equation, Assets = Liabilities + Equity, establishes that the value of assets is always funded by either creditor claims (liabilities) or owner claims (equity). Understanding this relationship is crucial for analyzing a company's financial structure and assessing its solvency and shareholder value.

Calculating Equity from Assets and Liabilities

Equity is calculated by subtracting liabilities from total assets, expressed as Equity = Assets - Liabilities. This fundamental accounting equation determines the owner's residual interest in the company after all obligations are settled. Accurate measurement of assets, including current and non-current assets, alongside precise recording of liabilities, such as short-term and long-term debts, ensures reliable equity calculation.

Impact of Asset Management on Equity Growth

Effective asset management directly influences equity growth by optimizing the use of company resources to generate higher returns. Improving asset turnover and reducing depreciation enhance net income, which subsequently increases retained earnings and shareholder equity. Strategic allocation and maintenance of assets ensure sustainable financial health and stronger equity positions over time.

Real-world Examples: Assets vs Equity

A residential property valued at $300,000 with an outstanding mortgage of $200,000 illustrates the asset-equity relationship where the house is the asset and the homeowner's equity is $100,000. In business, an equipment purchase costing $50,000 financed partly by a $30,000 loan means the asset's value is $50,000 while equity amounts to $20,000, representing ownership stake. These examples demonstrate how assets reflect total resources owned while equity signifies the residual interest after liabilities.

Choosing the Right Financial Focus: Assets or Equity?

Choosing the right financial focus between assets and equity depends on a company's strategic goals and financial health. Assets represent the total resources owned, crucial for operational capacity and growth potential, while equity reflects ownership value and financial stability important for investor confidence. Analyzing asset liquidity versus equity structure helps in optimizing capital allocation and ensuring sustainable financial management.

Assets Infographic

libterm.com

libterm.com