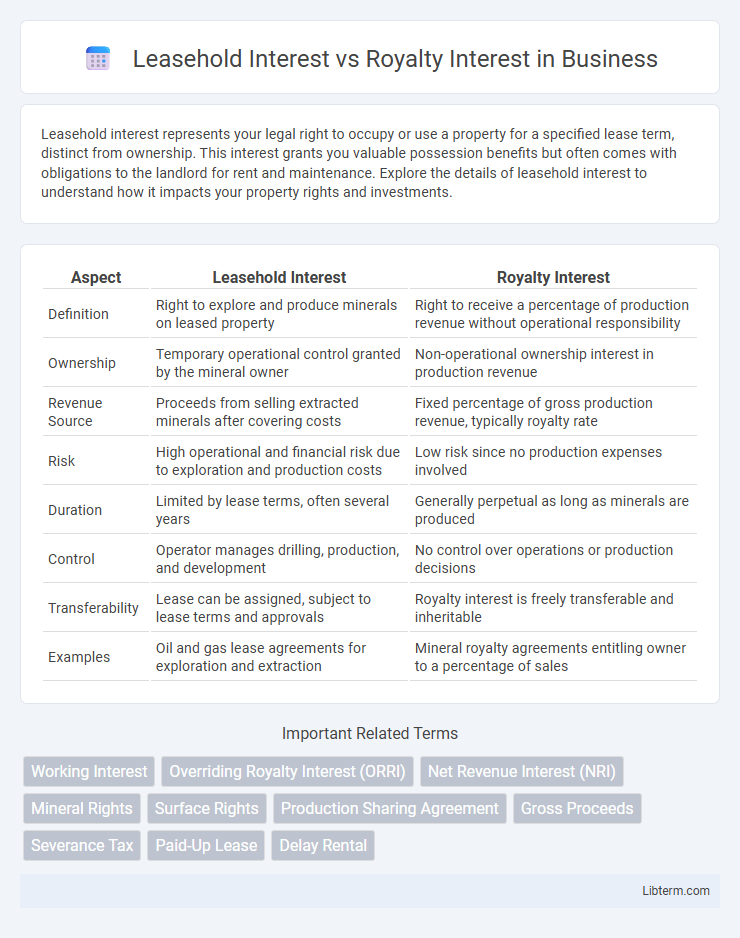

Leasehold interest represents your legal right to occupy or use a property for a specified lease term, distinct from ownership. This interest grants you valuable possession benefits but often comes with obligations to the landlord for rent and maintenance. Explore the details of leasehold interest to understand how it impacts your property rights and investments.

Table of Comparison

| Aspect | Leasehold Interest | Royalty Interest |

|---|---|---|

| Definition | Right to explore and produce minerals on leased property | Right to receive a percentage of production revenue without operational responsibility |

| Ownership | Temporary operational control granted by the mineral owner | Non-operational ownership interest in production revenue |

| Revenue Source | Proceeds from selling extracted minerals after covering costs | Fixed percentage of gross production revenue, typically royalty rate |

| Risk | High operational and financial risk due to exploration and production costs | Low risk since no production expenses involved |

| Duration | Limited by lease terms, often several years | Generally perpetual as long as minerals are produced |

| Control | Operator manages drilling, production, and development | No control over operations or production decisions |

| Transferability | Lease can be assigned, subject to lease terms and approvals | Royalty interest is freely transferable and inheritable |

| Examples | Oil and gas lease agreements for exploration and extraction | Mineral royalty agreements entitling owner to a percentage of sales |

Understanding Leasehold Interest

Leasehold interest represents the lessee's right to use and develop mineral or property rights under a lease agreement for a specified term, granting exclusive possession but not ownership of the land or minerals. This interest allows the leaseholder to explore, drill, or extract resources within the lease boundaries, subject to the lease terms and conditions. Understanding leasehold interest is essential for evaluating investment potential and legal obligations in oil, gas, and mineral extraction industries.

Defining Royalty Interest

Royalty interest refers to the right to receive a percentage of production or revenue from oil and gas extracted from a leased property, without bearing the operational costs. It contrasts with leasehold interest, which involves holding the lease and managing exploration or production activities. Royalty interest grants passive income based on resource extraction, while leasehold interest entails active management and responsibility for lease obligations.

Key Differences Between Leasehold and Royalty Interests

Leasehold interest grants the tenant the right to use and develop mineral resources on a property for a specified period, typically involving operational control and responsibilities such as drilling and production. Royalty interest entitles the owner to receive a percentage of production or revenue from the extracted minerals without bearing the costs or risks associated with exploration and development. Key differences include leasehold interest involving active management and capital investment, while royalty interest is a passive income stream based on production output.

Legal Rights of Leasehold Interest Holders

Leasehold interest holders possess exclusive legal rights to possess, use, and extract minerals from a leased property for the duration specified in the lease agreement, often including the right to develop and operate mineral resources. These rights are subject to compliance with lease terms, regulatory requirements, and payment of royalties to the mineral owner. Unlike royalty interest holders, leasehold interest owners bear operational risks and responsibilities but benefit from control over resource extraction and production decisions.

Legal Rights of Royalty Interest Holders

Royalty interest holders possess legally protected rights to receive a portion of production proceeds or revenue generated from oil, gas, or mineral extraction without bearing operational costs. Their rights are defined and secured by lease agreements and state regulations, ensuring entitlement to payments regardless of property ownership changes. Unlike leasehold interest holders who control and operate the property, royalty owners maintain passive income rights tied directly to resource extraction activities.

Financial Benefits of Leasehold vs Royalty Interests

Leasehold interests provide stable, long-term income through lease payments and potential bonus payments upon signing, generating predictable cash flow for the leaseholder. Royalty interests offer a percentage of production revenue, allowing for higher upside potential tied directly to resource extraction but with income volatility dependent on production rates and market prices. Financially, leasehold interests mitigate risk with fixed income streams, while royalty interests maximize profit participation, appealing to investors seeking either steady returns or speculative gains.

Obligations and Responsibilities for Each Interest

Leasehold interest holders bear obligations to maintain the leased property's condition, adhere to lease terms, and pay rental fees or royalties as specified, ensuring operational compliance and avoiding damages. Royalty interest owners have responsibilities to monitor production volumes, verify accurate royalty payments based on production data, and comply with contractual reporting requirements without direct involvement in property operations. Both interests necessitate understanding legal frameworks to enforce rights and manage financial returns effectively.

Impact on Oil and Gas Revenue Distribution

Leasehold interest grants the holder the right to explore and produce hydrocarbons from a specific tract of land, allowing them to receive revenue from the sale of oil and gas after deducting royalty payments. Royalty interest entitles the owner to a fixed percentage of production or revenue without bearing production costs, resulting in a passive income stream. The distinction between these interests significantly impacts oil and gas revenue distribution, as leasehold owners manage operational expenses and risks, while royalty owners receive revenue directly based on production volume or sales prices.

Transferability and Inheritance Considerations

Leasehold interests grant lessees exclusive rights to use and extract minerals for a specified term, with transferability often subject to lease terms and operator consent, impacting ease of sale or assignment. Royalty interests provide ongoing payments from production without operational control, are generally more freely transferable, and pass to heirs without disrupting operations. Inheritance of leasehold interests may require probate and can be constrained by lease conditions, whereas royalty interests typically transfer automatically to beneficiaries, ensuring a smoother succession process.

Choosing Between Leasehold and Royalty Interests

Choosing between leasehold and royalty interests depends on risk tolerance and income preference. Leasehold interest requires operational involvement and carries upfront costs but offers control over property development and potential for steady income. Royalty interests provide passive income streams based on production without management responsibilities, appealing for investors seeking lower risk and ongoing profit participation.

Leasehold Interest Infographic

libterm.com

libterm.com