Strategic alliances enable businesses to combine resources and expertise, driving innovation and expanding market reach effectively. Such partnerships often lead to shared risks, cost savings, and access to new customer bases that might be difficult to achieve independently. Discover how forming the right strategic alliance can transform your business by reading the rest of this article.

Table of Comparison

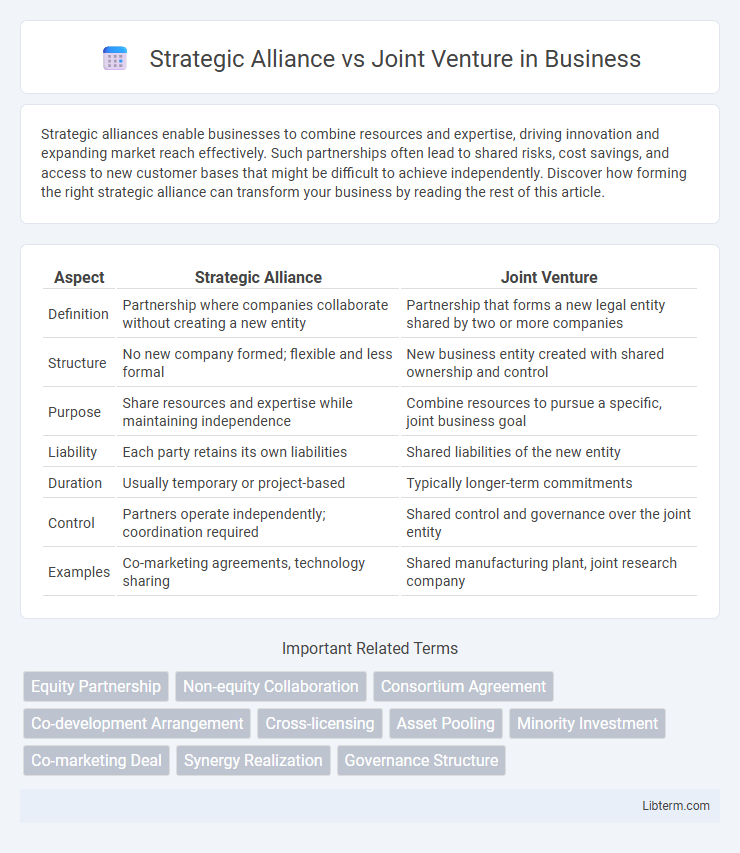

| Aspect | Strategic Alliance | Joint Venture |

|---|---|---|

| Definition | Partnership where companies collaborate without creating a new entity | Partnership that forms a new legal entity shared by two or more companies |

| Structure | No new company formed; flexible and less formal | New business entity created with shared ownership and control |

| Purpose | Share resources and expertise while maintaining independence | Combine resources to pursue a specific, joint business goal |

| Liability | Each party retains its own liabilities | Shared liabilities of the new entity |

| Duration | Usually temporary or project-based | Typically longer-term commitments |

| Control | Partners operate independently; coordination required | Shared control and governance over the joint entity |

| Examples | Co-marketing agreements, technology sharing | Shared manufacturing plant, joint research company |

Introduction to Strategic Alliance and Joint Venture

A strategic alliance is a collaborative agreement between two or more companies aiming to leverage each other's strengths without creating a new legal entity, enabling shared resources and expertise while maintaining operational independence. In contrast, a joint venture involves the formation of a separate legal entity jointly owned by participating companies to pursue a specific business objective, allowing shared risks, profits, and governance. Both strategies are essential for market expansion and innovation but differ in structure, liability, and level of integration.

Key Definitions: Strategic Alliance vs Joint Venture

A Strategic Alliance is a collaborative agreement between two or more companies to pursue shared objectives while remaining independent entities, focusing on resource sharing without creating a new business entity. A Joint Venture involves the formation of a new legal entity by two or more parties to undertake a specific business project, sharing risks, profits, and governance. Both structures aim to leverage complementary strengths but differ in legal, financial, and operational integration levels.

Types of Strategic Alliances

Strategic alliances encompass various types such as equity alliances, where partners invest in each other's companies, non-equity alliances involving contractual agreements without investment, and global strategic alliances that span international borders for expanded market reach. Equity alliances often provide stronger commitment and shared control compared to non-equity alliances, which offer flexibility and lower risk. Joint ventures, a distinct form of partnership, create a separate legal entity owned by the collaborating firms, differing from strategic alliances that typically do not involve forming a new company.

Types of Joint Ventures

Types of joint ventures include equity joint ventures, where parties pool resources and share ownership, and contractual joint ventures, based on agreements without creating a separate legal entity. Strategic alliances often involve less formal arrangements emphasizing collaboration on specific projects or goals without shared equity. Understanding these distinctions helps businesses select suitable partnership models for market entry, innovation, or resource sharing.

Core Differences Between Strategic Alliance and Joint Venture

A strategic alliance is a collaborative agreement between companies to share resources and expertise while remaining independent, whereas a joint venture involves creating a separate legal entity owned by the partnering firms. Strategic alliances typically focus on mutual benefits without equity involvement, while joint ventures require shared investment, risks, and profits. The core difference lies in the level of integration and commitment, with joint ventures demanding deeper structural and financial collaboration compared to strategic alliances.

Legal and Structural Implications

Strategic alliances involve cooperative agreements without creating a new legal entity, allowing partners to maintain separate ownership while collaborating on projects or resource sharing, minimizing legal risks and maintaining flexibility. Joint ventures establish a distinct legal entity jointly owned by partners, requiring formal agreements that outline ownership percentages, governance structures, profit sharing, and liability, resulting in shared legal obligations and regulatory compliance. Understanding these structural and legal differences is crucial for aligning risk exposure, capital contribution, and control mechanisms in business partnerships.

Advantages and Disadvantages

Strategic alliances allow companies to collaborate while maintaining their independence, offering flexibility and reduced risk compared to joint ventures, which involve creating a separate legal entity and sharing profits and losses. Advantages of strategic alliances include access to new markets, resources, and technologies without significant capital investment, but they may face challenges in coordination and control. Joint ventures provide deeper integration and shared resources, enhancing operational synergies, yet they carry higher risks, potential conflicts, and complex management issues.

Factors to Consider When Choosing a Collaboration Model

Choosing between a strategic alliance and a joint venture depends on factors such as the level of control desired, resource commitment, and risk tolerance. Strategic alliances offer flexibility and lower resource investment, making them ideal for companies seeking to leverage complementary strengths without creating a new legal entity. Joint ventures require shared ownership and governance, suitable for organizations aiming for deeper collaboration and long-term integration in specific markets or projects.

Case Studies: Successful Strategic Alliances and Joint Ventures

Successful strategic alliances, such as the collaboration between Starbucks and PepsiCo, leveraged complementary strengths to expand global distribution without creating a new entity. In contrast, joint ventures like Sony Ericsson combined resources into a separate company to innovate in mobile technology, sharing risks and profits. These case studies highlight how strategic alliances emphasize cooperation while joint ventures focus on shared ownership to achieve business growth.

Conclusion: Which Model Fits Your Business Goals?

Choosing between a strategic alliance and a joint venture depends on your company's objectives, resource commitment, and desired level of control. Strategic alliances offer flexibility and faster market access without shared equity, ideal for collaborative innovation or limited partnerships. Joint ventures suit businesses seeking deeper integration, shared risks, and long-term commitment through creating a new legal entity for joint operations.

Strategic Alliance Infographic

libterm.com

libterm.com