Limit orders allow you to specify the exact price at which you want to buy or sell a security, ensuring you don't pay more or sell for less than your set price. This trading tool provides control over market entry and exit points, helping manage risk and optimize returns. Explore the rest of the article to understand how to effectively use limit orders in your trading strategy.

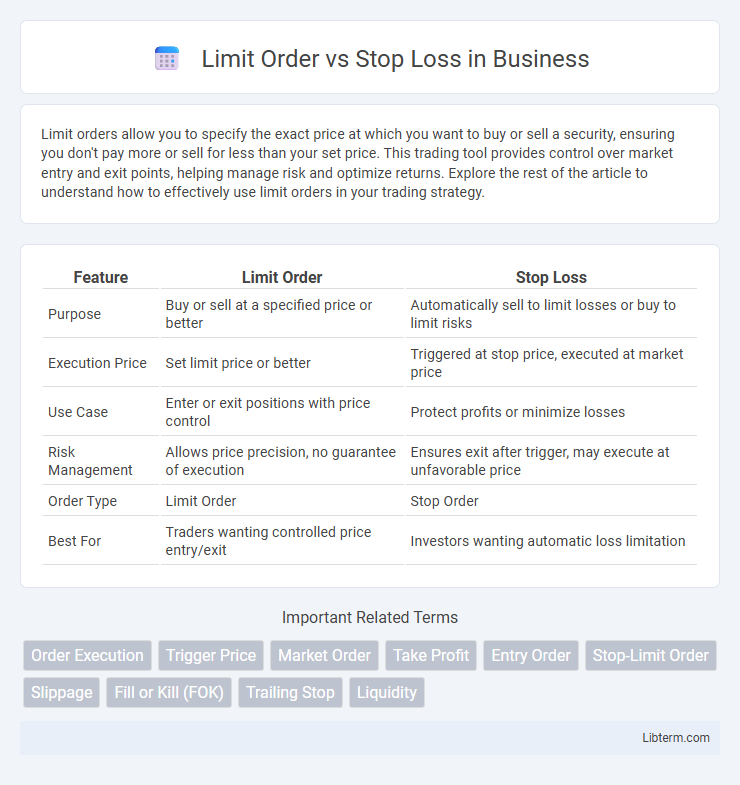

Table of Comparison

| Feature | Limit Order | Stop Loss |

|---|---|---|

| Purpose | Buy or sell at a specified price or better | Automatically sell to limit losses or buy to limit risks |

| Execution Price | Set limit price or better | Triggered at stop price, executed at market price |

| Use Case | Enter or exit positions with price control | Protect profits or minimize losses |

| Risk Management | Allows price precision, no guarantee of execution | Ensures exit after trigger, may execute at unfavorable price |

| Order Type | Limit Order | Stop Order |

| Best For | Traders wanting controlled price entry/exit | Investors wanting automatic loss limitation |

Introduction to Limit Orders and Stop Loss

Limit orders allow traders to buy or sell an asset at a specified price or better, ensuring control over the execution price but not guaranteeing the order will fill. Stop loss orders automatically trigger a market sell or buy once the asset price reaches a predetermined level, designed to limit potential losses or protect profits. Both tools are essential for risk management and precise trade execution in volatile markets.

Key Differences Between Limit Orders and Stop Loss

Limit orders specify the exact price at which a trader wants to buy or sell an asset, ensuring execution only at the designated price or better. Stop loss orders activate a market order once a predetermined price level is reached to minimize potential losses or protect profits. The key difference lies in limit orders controlling trade entry or exit price, while stop loss orders primarily function as risk management tools to prevent further losses.

How Limit Orders Work in Trading

Limit orders allow traders to specify the exact price at which they want to buy or sell an asset, ensuring execution only at that price or better. This control helps manage entry and exit points by locking in a desired price, preventing trades from occurring at unfavorable market prices. Limit orders remain active until executed or canceled, providing traders with price certainty but not guaranteed execution.

Understanding Stop Loss Orders

Stop loss orders are designed to automatically sell a security when its price drops to a predetermined level, minimizing potential losses in volatile markets. Unlike limit orders that execute trades at a specific price or better, stop loss orders protect investors by triggering a market order once the stop price is reached. Effective use of stop loss orders helps manage risk by preventing substantial losses during sudden price declines.

Advantages of Using Limit Orders

Limit orders allow traders to specify the exact price at which they want to buy or sell an asset, ensuring control over entry and exit points. This precision helps minimize slippage and protects against unfavorable price movements often seen with market orders. Using limit orders can improve trade execution efficiency and enhance risk management by locking in desired prices before market fluctuations occur.

Benefits of Stop Loss Orders

Stop loss orders provide essential risk management by automatically triggering a sale when an asset's price falls to a predetermined level, helping investors minimize potential losses. They protect portfolios from significant downturns without requiring constant market monitoring, ensuring disciplined exit strategies. This automated approach enhances emotional control during volatile markets, preserving capital and supporting long-term investment goals.

When to Use Limit Orders vs Stop Loss

Limit orders are ideal when aiming to buy or sell an asset at a specific price or better, ensuring control over entry or exit points in a fluctuating market. Stop loss orders are essential for risk management, automatically triggering a sale to prevent significant losses once the price hits a predetermined threshold. Use limit orders when targeting optimal trade execution prices, while stop loss orders are best for protecting capital against adverse market movements.

Common Mistakes with Limit and Stop Loss Orders

Common mistakes with limit and stop loss orders include setting limit prices too close to the current market price, resulting in missed executions or partial fills, and placing stop loss orders without considering market volatility, which can trigger premature exits during normal price fluctuations. Traders often confuse limit orders with stop orders, leading to unintended trade executions or missed opportunities. Failure to regularly adjust stop loss levels in response to changing market conditions can result in either excessive losses or premature closure of profitable positions.

Tips for Effective Order Placement

Using limit orders ensures you buy or sell assets at your specified price or better, enhancing control over trade execution and risk management. Setting stop loss orders helps protect your investments by automatically triggering a sale at a predefined price, minimizing potential losses during market volatility. Combining both strategies with regular market analysis and clear risk tolerance levels improves overall trading efficiency and capital preservation.

Final Thoughts on Limit Orders and Stop Loss Orders

Limit orders provide precise control over trade entry and exit prices, minimizing slippage in volatile markets. Stop loss orders are essential for risk management, automatically limiting losses by triggering market or limit orders once a specified price is reached. Combining limit orders and stop loss orders optimizes trade execution by balancing profit objectives with risk mitigation strategies.

Limit Order Infographic

libterm.com

libterm.com