Crown Jewels Defense is a strategic security approach designed to protect an organization's most critical assets from cyber threats and unauthorized access. By isolating and safeguarding these vital resources, businesses reduce the risk of significant damage during a security breach. Discover how implementing Crown Jewels Defense can strengthen your cybersecurity posture in the rest of this article.

Table of Comparison

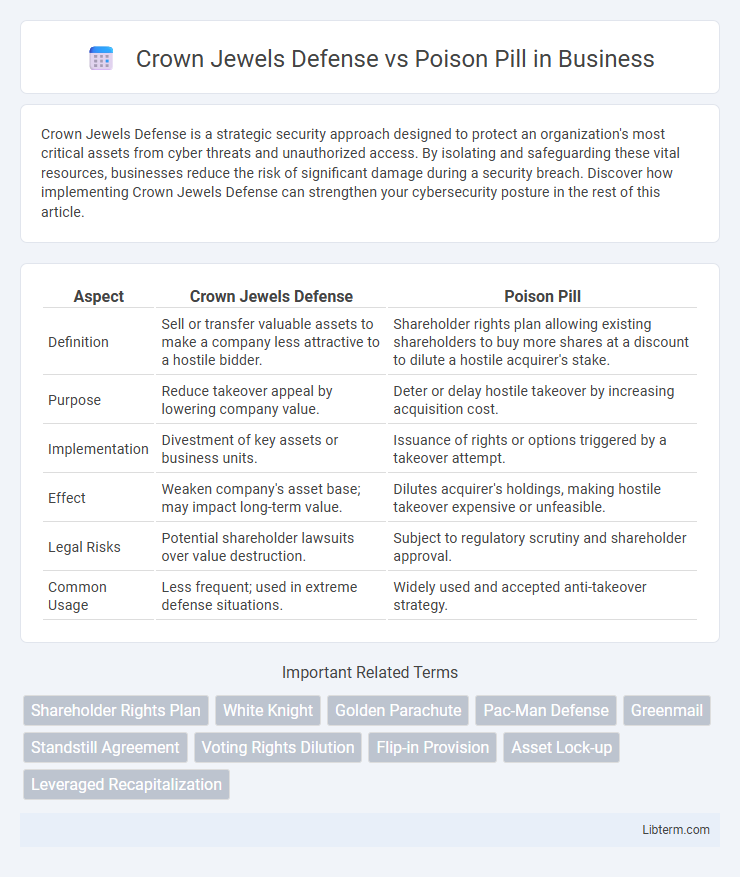

| Aspect | Crown Jewels Defense | Poison Pill |

|---|---|---|

| Definition | Sell or transfer valuable assets to make a company less attractive to a hostile bidder. | Shareholder rights plan allowing existing shareholders to buy more shares at a discount to dilute a hostile acquirer's stake. |

| Purpose | Reduce takeover appeal by lowering company value. | Deter or delay hostile takeover by increasing acquisition cost. |

| Implementation | Divestment of key assets or business units. | Issuance of rights or options triggered by a takeover attempt. |

| Effect | Weaken company's asset base; may impact long-term value. | Dilutes acquirer's holdings, making hostile takeover expensive or unfeasible. |

| Legal Risks | Potential shareholder lawsuits over value destruction. | Subject to regulatory scrutiny and shareholder approval. |

| Common Usage | Less frequent; used in extreme defense situations. | Widely used and accepted anti-takeover strategy. |

Introduction to Corporate Takeover Defenses

Corporate takeover defenses are strategic mechanisms employed by companies to prevent or deter hostile takeover attempts. Crown Jewels Defense involves selling or pledging the most valuable assets to make the company less attractive to the acquirer. Poison Pill, on the other hand, allows existing shareholders to purchase additional shares at a discount, diluting the potential acquirer's ownership and making the takeover more costly and difficult.

Understanding the Crown Jewels Defense

The Crown Jewels Defense involves a company selling or transferring its most valuable assets to prevent hostile takeover bidders from gaining control, effectively making the target less attractive. This strategic move contrasts with the Poison Pill, which typically dilutes shares or creates shareholder rights to frustrate the acquirer. Understanding the Crown Jewels Defense requires analyzing asset valuation and control leverage to ensure the company's long-term viability while deterring unwanted acquisitions.

Exploring the Poison Pill Strategy

The Poison Pill strategy, also known as a shareholder rights plan, aims to prevent hostile takeovers by diluting the value of shares once an acquiring entity surpasses a specified ownership threshold. This defense mechanism allows existing shareholders to purchase additional shares at a discount, making the takeover prohibitively expensive and less attractive to the potential acquirer. Unlike the Crown Jewels Defense, which involves selling valuable assets to reduce the company's appeal, the Poison Pill maintains company assets while directly targeting the economics of the acquisition attempt.

Key Differences Between Crown Jewels and Poison Pill

The Crown Jewels Defense involves a company selling or transferring its most valuable assets to prevent a hostile takeover, making the target less attractive to acquirers. In contrast, the Poison Pill strategy allows existing shareholders to purchase additional shares at a discount, diluting the ownership interest of a potential acquirer and making a takeover prohibitively expensive. While Crown Jewels Defense targets the company's critical assets, the Poison Pill focuses on shareholder equity structure to deter hostile bids.

Legal Framework Surrounding Both Strategies

The legal framework surrounding Crown Jewels Defense and Poison Pill strategies involves complex corporate governance and securities regulations aimed at protecting shareholder value and preventing hostile takeovers. Crown Jewels Defense, which entails selling or transferring key assets to deter acquirers, must comply with fiduciary duties and antitrust laws to avoid shareholder litigation. Poison Pill plans, structured as shareholder rights offerings, are governed by SEC rules and state corporate laws, requiring board approval and shareholder disclosure to ensure legality and prevent abuse.

Advantages of Crown Jewels Defense

The Crown Jewels Defense protects a company by selling or transferring its most valuable assets, making it less attractive to hostile bidders and preserving essential resources for long-term growth. This strategy allows the target to maintain control over core business units while deterring unwanted acquisitions without severely harming overall operational integrity. Compared to the Poison Pill, which can dilute shareholder value and create legal complexities, the Crown Jewels Defense offers a more straightforward and asset-focused approach to safeguarding corporate value.

Benefits and Risks of Implementing a Poison Pill

Implementing a Poison Pill defense in corporate mergers provides a strategic mechanism to deter hostile takeovers by diluting shareholder value through issuing additional shares to existing shareholders, thereby making acquisition prohibitively expensive. This tactic benefits companies by maintaining control and bargaining power during merger negotiations, while potentially increasing market confidence by signaling strong board commitment to shareholder interests. However, risks include possible shareholder dilution, negative impact on stock price, and potential legal challenges, which can harm long-term investor relations and restrict future strategic transactions.

Case Studies: Notable Examples in Mergers and Acquisitions

The Crown Jewels Defense involves selling or threatening to sell the most valuable assets of a company to make a hostile takeover less attractive, exemplified by Gulf Oil's defense against T. Boone Pickens in the 1980s. The Poison Pill strategy issues new shares to existing shareholders at a discount to dilute the potential acquirer's stake, prominently used by Netflix in its 2012 defense against Carl Icahn. Both tactics have been pivotal in notable mergers and acquisitions, shaping corporate control battles and influencing bidder strategies.

Choosing the Right Defense for Your Company

Choosing the right defense for your company involves evaluating the Crown Jewels Defense, which safeguards key assets by making them less attractive to hostile bidders, against the Poison Pill strategy that dilutes shareholder value to deter takeovers. Crown Jewels Defense is ideal for protecting irreplaceable intellectual property or critical business units, while Poison Pill effectively prevents hostile acquisition by enabling existing shareholders to purchase additional shares at a discount. Assessing company-specific factors such as asset value, corporate structure, and shareholder interests ensures the selection of a tailored, strategic defense mechanism.

Future Trends in Anti-Takeover Mechanisms

Future trends in anti-takeover mechanisms emphasize integrating Crown Jewels Defense and Poison Pill strategies with advanced corporate governance frameworks to enhance shareholder rights while deterring hostile bids. Emerging techniques leverage data analytics and AI-driven monitoring to dynamically adjust defense triggers, increasing effectiveness and regulatory compliance. Growing emphasis on transparency and shareholder engagement shapes the evolution of these defenses, balancing corporate control protection with investor interests.

Crown Jewels Defense Infographic

libterm.com

libterm.com