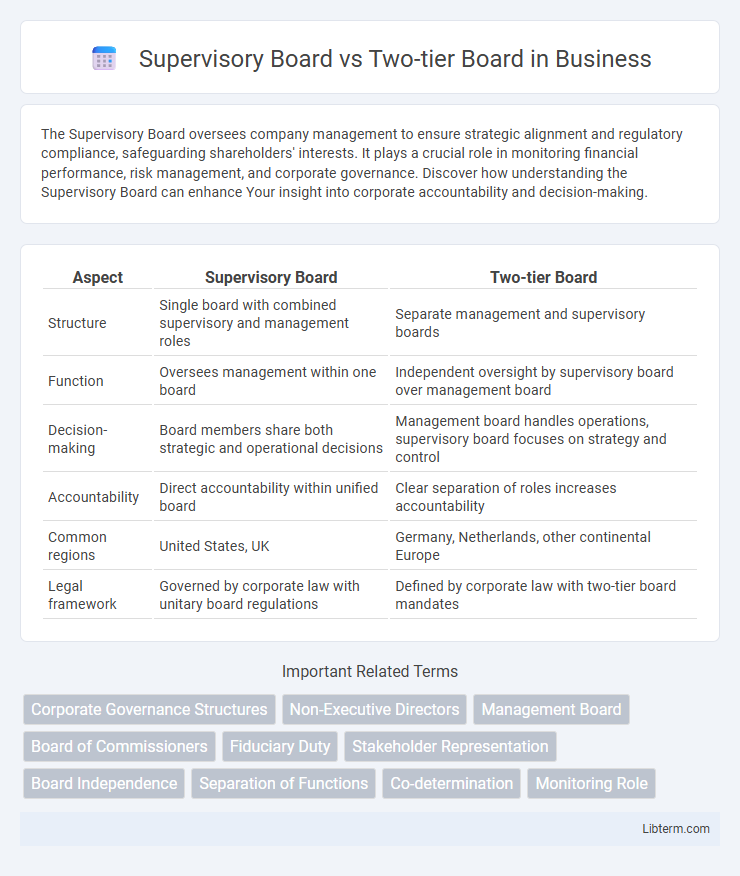

The Supervisory Board oversees company management to ensure strategic alignment and regulatory compliance, safeguarding shareholders' interests. It plays a crucial role in monitoring financial performance, risk management, and corporate governance. Discover how understanding the Supervisory Board can enhance Your insight into corporate accountability and decision-making.

Table of Comparison

| Aspect | Supervisory Board | Two-tier Board |

|---|---|---|

| Structure | Single board with combined supervisory and management roles | Separate management and supervisory boards |

| Function | Oversees management within one board | Independent oversight by supervisory board over management board |

| Decision-making | Board members share both strategic and operational decisions | Management board handles operations, supervisory board focuses on strategy and control |

| Accountability | Direct accountability within unified board | Clear separation of roles increases accountability |

| Common regions | United States, UK | Germany, Netherlands, other continental Europe |

| Legal framework | Governed by corporate law with unitary board regulations | Defined by corporate law with two-tier board mandates |

Introduction to Corporate Governance Structures

The Supervisory Board, a key component of the two-tier board system, oversees the management board and provides strategic guidance without engaging in day-to-day operations. In contrast, the single-tier board combines executive and non-executive directors within one body responsible for both management and supervision. Understanding these corporate governance structures is essential for compliance, transparency, and effective oversight in diverse regulatory environments.

Defining the Supervisory Board

The Supervisory Board is a key component of the two-tier board system, primarily responsible for overseeing the management board and ensuring corporate governance compliance. It acts independently from the executive management, providing strategic guidance, monitoring performance, and representing shareholders' interests. This structure enhances transparency and accountability by separating supervisory functions from day-to-day operations in corporate governance.

Overview of the Two-tier Board System

The two-tier board system separates management and supervision through distinct entities: the Management Board and the Supervisory Board, enhancing checks and balances within corporate governance. The Supervisory Board primarily oversees the Management Board's activities and strategic direction, ensuring accountability and protecting shareholders' interests. Common in countries like Germany and the Netherlands, this structure facilitates stakeholder representation and clearer delineation of duties compared to single-tier boards.

Key Differences Between Supervisory and Two-tier Boards

The Supervisory Board is a component of the two-tier board system, primarily responsible for overseeing the management board without engaging in daily operations, ensuring compliance and strategic alignment. Two-tier boards comprise both a Supervisory Board and a separate Management Board, creating a clear division between oversight and executive functions, which enhances corporate governance transparency. Key differences include the structure, with the Supervisory Board acting solely as an oversight body, while the two-tier board system incorporates a dual board mechanism to separate control and management roles distinctly.

Roles and Responsibilities of a Supervisory Board

A Supervisory Board primarily oversees the management board, ensuring compliance with laws and company policies while safeguarding shareholders' interests through regular audits and strategic monitoring. It appoints and dismisses members of the management board, evaluates their performance, and approves major corporate decisions such as mergers or capital investments. Its roles emphasize transparency, accountability, and long-term value creation within a two-tier board system prevalent in European corporate governance.

Composition and Appointment in Both Board Systems

The Supervisory Board typically consists of non-executive members appointed by shareholders or employees, ensuring independent oversight separate from management. In the Two-tier Board system, the Supervisory Board is distinctly separate from the Management Board, with members often appointed by shareholders, employees, or government entities depending on jurisdictional regulations. This clear separation in composition and appointment processes enhances governance transparency and accountability in both board systems.

Advantages of the Supervisory Board Model

The Supervisory Board model offers clear separation between management and oversight, enhancing corporate governance by reducing conflicts of interest and improving accountability. It allows independent directors to focus solely on monitoring executive decisions, which fosters transparency and long-term strategic alignment. This structure is particularly advantageous in complex organizations or jurisdictions emphasizing stringent oversight and stakeholder protection.

Benefits of the Two-tier Board System

The two-tier board system enhances corporate governance by clearly separating management and oversight functions through distinct management and supervisory boards, reducing conflicts of interest. It offers increased transparency and accountability, enabling the supervisory board to rigorously monitor executive decisions and safeguard shareholder interests effectively. This structure also fosters long-term strategic planning and sustainable growth by encouraging continuous dialogue between management and supervisory directors.

Global Adoption and Legal Frameworks

Supervisory Boards are predominantly adopted in Germanic and Continental European countries, where dual board systems are mandated by law, separating management and oversight roles to enhance corporate governance. The two-tier board structure, characterized by an elected Supervisory Board overseeing a Management Board, aligns with legal frameworks such as Germany's Aktiengesetz and the Netherlands' Corporate Governance Code, enforcing transparency and accountability. In contrast, common law countries like the UK and US favor unitary boards but have seen growing interest in two-tier systems for aligning with international best practices in stakeholder engagement and regulatory compliance.

Choosing the Right Board Structure for Your Organization

Choosing the right board structure depends on your organization's size, complexity, and regulatory environment. A supervisory board, common in two-tier systems, provides independent oversight by separating management and supervision roles, enhancing accountability in larger or publicly traded companies. In contrast, a single-tier board integrates executive and non-executive directors, facilitating quicker decision-making ideal for smaller or privately held organizations.

Supervisory Board Infographic

libterm.com

libterm.com