An Initial Public Offering (IPO) marks a company's debut in the stock market, offering shares to public investors for the first time and creating pathways for capital growth and increased market visibility. Understanding the IPO process, from preparation to pricing and regulatory compliance, is crucial for both companies and investors aiming to maximize potential returns. Explore the rest of this article to learn how an IPO can transform your investment strategy and empower informed financial decisions.

Table of Comparison

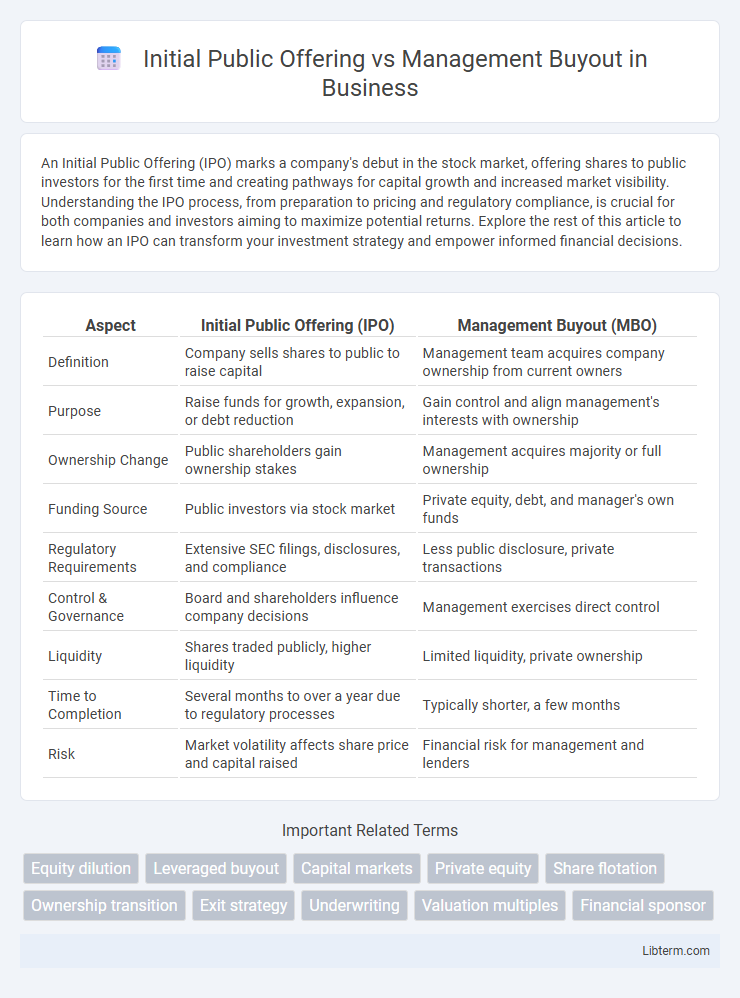

| Aspect | Initial Public Offering (IPO) | Management Buyout (MBO) |

|---|---|---|

| Definition | Company sells shares to public to raise capital | Management team acquires company ownership from current owners |

| Purpose | Raise funds for growth, expansion, or debt reduction | Gain control and align management's interests with ownership |

| Ownership Change | Public shareholders gain ownership stakes | Management acquires majority or full ownership |

| Funding Source | Public investors via stock market | Private equity, debt, and manager's own funds |

| Regulatory Requirements | Extensive SEC filings, disclosures, and compliance | Less public disclosure, private transactions |

| Control & Governance | Board and shareholders influence company decisions | Management exercises direct control |

| Liquidity | Shares traded publicly, higher liquidity | Limited liquidity, private ownership |

| Time to Completion | Several months to over a year due to regulatory processes | Typically shorter, a few months |

| Risk | Market volatility affects share price and capital raised | Financial risk for management and lenders |

Introduction to IPOs and MBOs

An Initial Public Offering (IPO) involves a private company offering shares to the public for the first time, facilitating access to capital markets and enhancing shareholder liquidity. A Management Buyout (MBO) occurs when a company's existing management team purchases the business, often using significant debt financing to fund the acquisition. Both IPOs and MBOs serve strategic goals--IPOs for raising external equity and MBOs for consolidating ownership under current management.

Key Definitions: IPO vs Management Buyout

An Initial Public Offering (IPO) is a process where a private company offers its shares to the public for the first time, enabling capital raising through stock market listing. A Management Buyout (MBO) occurs when a company's existing management team purchases a significant portion or all of the business, often with external financing, to gain ownership control. Both IPOs and MBOs represent strategic ownership transitions but differ fundamentally in their investor base and capital acquisition methods.

Core Objectives of IPOs and MBOs

Initial Public Offerings (IPOs) primarily aim to raise capital by offering shares to the public, enhancing liquidity and market visibility for the company. Management Buyouts (MBOs) focus on transferring ownership from existing shareholders to current management, often to improve operational control and strategic direction. While IPOs seek external funding for growth, MBOs emphasize consolidating internal leadership and long-term value creation.

Process Overview: How IPOs Work

An Initial Public Offering (IPO) involves a private company offering its shares to the public for the first time, typically facilitated by investment banks that underwrite the stock issuance and set the offering price. The IPO process includes due diligence, regulatory filings with the Securities and Exchange Commission (SEC), roadshows to attract investors, and ultimately listing on a stock exchange such as the NYSE or NASDAQ. This process enables companies to raise capital from public investors, improve liquidity, and increase visibility, contrasting with a Management Buyout (MBO), where existing management acquires the company, usually through private financing.

Step-by-Step Guide to Management Buyouts

Management buyouts (MBOs) involve a systematic process starting with identifying key management team members interested in acquiring the company, followed by conducting thorough due diligence on financial, legal, and operational aspects. Securing financing is crucial, typically through a combination of equity, debt, and seller financing, before negotiating purchase terms and drafting legal agreements. Final steps include obtaining board and shareholder approvals, closing the transaction, and implementing a post-buyout integration plan to ensure smooth operational transition.

Advantages of Launching an IPO

Launching an Initial Public Offering (IPO) provides companies with substantial capital infusion, enhancing financial flexibility to fund expansion, research, and debt reduction. An IPO also increases public visibility and credibility, attracting potential customers, partners, and skilled talent. Unlike a Management Buyout, an IPO offers shareholders liquidity through the public markets and the possibility of higher valuation driven by market demand.

Benefits of Choosing a Management Buyout

A Management Buyout (MBO) allows existing management to maintain operational control and align company strategy with insider expertise, often leading to enhanced decision-making and stability. Unlike Initial Public Offerings (IPOs), MBOs avoid public market pressures, regulatory scrutiny, and ongoing disclosure requirements, preserving confidentiality and reducing administrative costs. MBOs also offer a quicker, more flexible exit strategy for shareholders while fostering a stronger incentive structure for management to drive long-term company growth.

Risks and Challenges: IPOs vs MBOs

Initial Public Offerings (IPOs) expose companies to market volatility and regulatory scrutiny, increasing the risk of share price fluctuations and compliance costs. Management Buyouts (MBOs) face challenges related to financing complexity and potential conflicts of interest within existing management teams. Both IPOs and MBOs carry significant operational risks, with IPOs emphasizing external market pressures and MBOs focusing on internal governance and capital structure stability.

Financial Implications for Stakeholders

An Initial Public Offering (IPO) can generate substantial capital by offering shares to public investors, potentially diluting ownership but increasing liquidity and market visibility for existing stakeholders. In contrast, a Management Buyout (MBO) typically involves internal management acquiring the company using debt financing, intensifying financial risk for managers but preserving ownership control and potentially higher future returns. Both structures impact stakeholder value differently, with IPOs offering broader equity distribution and MBOs focusing on concentrated, active ownership and financial leverage.

Which Option is Right? Factors to Consider

Choosing between an Initial Public Offering (IPO) and a Management Buyout (MBO) depends on factors such as company growth objectives, control preferences, and financing needs. IPOs offer access to capital markets for expansive growth and increased public visibility, while MBOs focus on retaining control within the existing management team and often involve leveraged financing. Evaluating market conditions, shareholder expectations, and long-term strategic goals is crucial in determining the optimal route for raising capital and business transition.

Initial Public Offering Infographic

libterm.com

libterm.com