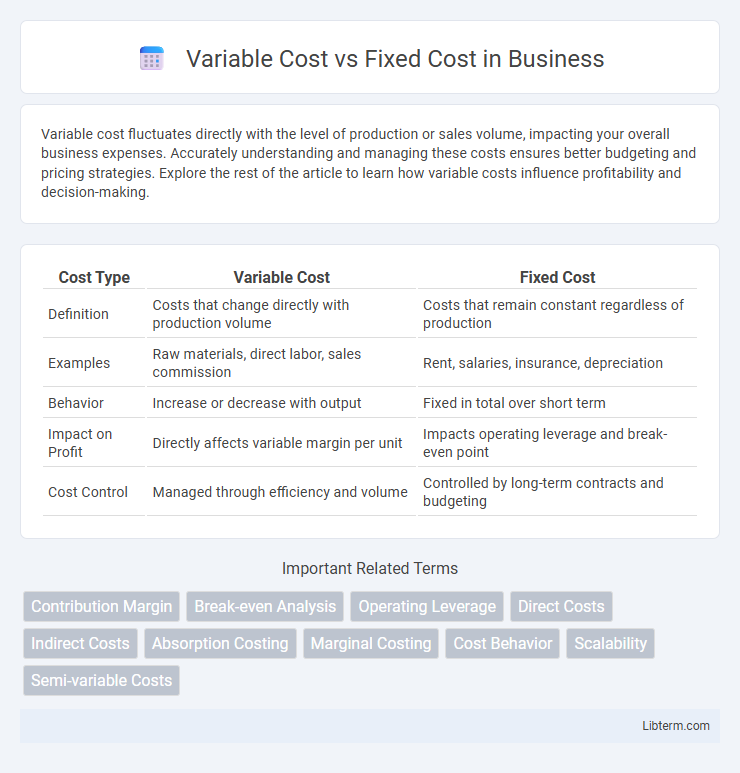

Variable cost fluctuates directly with the level of production or sales volume, impacting your overall business expenses. Accurately understanding and managing these costs ensures better budgeting and pricing strategies. Explore the rest of the article to learn how variable costs influence profitability and decision-making.

Table of Comparison

| Cost Type | Variable Cost | Fixed Cost |

|---|---|---|

| Definition | Costs that change directly with production volume | Costs that remain constant regardless of production |

| Examples | Raw materials, direct labor, sales commission | Rent, salaries, insurance, depreciation |

| Behavior | Increase or decrease with output | Fixed in total over short term |

| Impact on Profit | Directly affects variable margin per unit | Impacts operating leverage and break-even point |

| Cost Control | Managed through efficiency and volume | Controlled by long-term contracts and budgeting |

Introduction to Variable and Fixed Costs

Variable costs fluctuate directly with production volume, such as raw materials and direct labor, impacting overall expenses as output changes. Fixed costs remain constant regardless of production levels, including rent, salaries, and insurance, providing stability in budgeting. Understanding the distinction between variable and fixed costs is essential for accurate cost control, pricing strategies, and profitability analysis.

Definition of Variable Costs

Variable costs refer to expenses that fluctuate directly with the level of production or sales volume, such as raw materials, direct labor, and utility costs connected to manufacturing. Unlike fixed costs, which remain constant regardless of output, variable costs increase as production scales up and decrease when output declines. Understanding variable costs is essential for businesses to accurately calculate the contribution margin and make informed decisions on pricing, budgeting, and operational efficiency.

Definition of Fixed Costs

Fixed costs are business expenses that remain constant regardless of production levels, such as rent, salaries, and insurance premiums. Unlike variable costs, which fluctuate with output volume, fixed costs do not change in the short term, providing a predictable baseline for budgeting and financial planning. Understanding fixed costs is crucial for calculating a company's break-even point and assessing operational leverage.

Key Differences Between Variable and Fixed Costs

Variable costs fluctuate directly with production volume, such as raw materials and direct labor, while fixed costs remain constant regardless of output, including rent and salaried wages. Variable costs increase proportionally with each unit produced, contrasting with fixed costs that are incurred even when production is zero. Understanding these differences is crucial for budgeting, pricing strategies, and break-even analysis in business management.

Examples of Variable Costs in Business

Variable costs in business fluctuate directly with production volume and include expenses such as raw materials, direct labor, and utility costs tied to manufacturing processes. Examples of variable costs are the cost of fabric for a clothing manufacturer, commissions paid to sales staff, and shipping fees based on order quantities. Understanding these costs is crucial for pricing strategies and managing profit margins effectively.

Examples of Fixed Costs in Business

Fixed costs in business include expenses such as rent for office or manufacturing space, salaries of permanent employees, and insurance premiums that remain constant regardless of production levels. These costs contrast with variable costs like raw materials or utility expenses, which fluctuate with operational output. Understanding fixed costs is essential for budgeting and profitability analysis, as they must be covered even when sales volume is low.

Impact of Variable and Fixed Costs on Profitability

Variable costs fluctuate directly with production volume, impacting profitability by increasing total expenses as output rises, which can reduce profit margins if sales prices remain constant. Fixed costs remain constant regardless of production levels, affecting profitability through higher break-even points but allowing greater profit leverage once sales exceed those costs. Efficient management of both cost types is crucial for optimizing profit margins and sustaining financial health in variable market conditions.

How to Calculate Variable and Fixed Costs

Variable costs are calculated by multiplying the cost per unit of activity by the total units produced or consumed, such as direct materials and labor expenses that fluctuate with production volume. Fixed costs remain constant regardless of output levels and are determined by summing expenses like rent, salaries, and insurance over a specific period. Accurately separating and calculating these costs is essential for budgeting, forecasting, and break-even analysis in financial management.

Role of Cost Structure in Decision Making

Variable costs fluctuate directly with production volume, making them crucial for short-term operational decisions and pricing strategies, while fixed costs remain constant regardless of output, influencing long-term financial planning and investment choices. Understanding the proportion of variable to fixed costs helps managers assess break-even points, evaluate scalability, and optimize resource allocation to maintain profitability under different market conditions. Accurate cost structure analysis supports strategic decision-making by highlighting financial flexibility, risk exposure, and potential leverage in pricing or capacity adjustments.

Strategies for Managing Variable and Fixed Costs

Implementing flexible budgeting allows businesses to adjust spending based on variable costs such as raw materials and direct labor, enhancing cost control during demand fluctuations. Fixed costs require strategies like long-term contracts or outsourcing to stabilize expenses tied to rent, salaries, and depreciation, ensuring predictable financial planning. Utilizing activity-based costing provides detailed insights into how different activities impact both variable and fixed costs, enabling more informed decision-making and resource allocation.

Variable Cost Infographic

libterm.com

libterm.com