Emission allowances represent tradable permits that enable companies to emit a specified amount of greenhouse gases, supporting regulatory efforts to reduce environmental impact. Companies must strategically manage their emission allowances to balance operational needs while complying with environmental regulations and avoiding penalties. Explore the full article to understand how emission allowances can influence your business decisions and the environment.

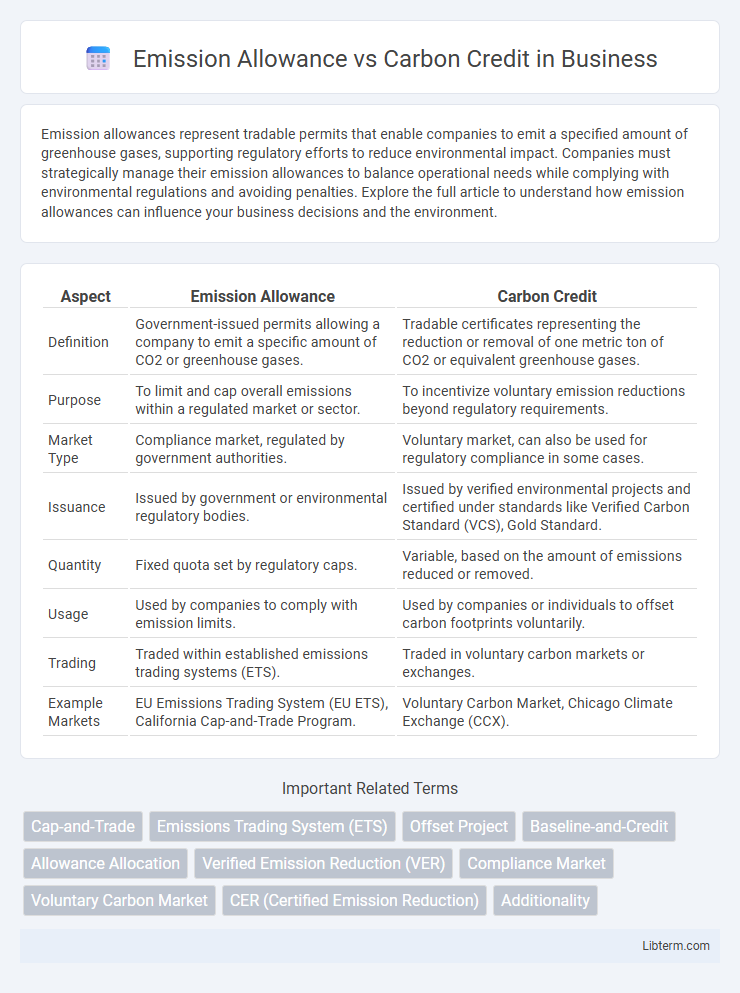

Table of Comparison

| Aspect | Emission Allowance | Carbon Credit |

|---|---|---|

| Definition | Government-issued permits allowing a company to emit a specific amount of CO2 or greenhouse gases. | Tradable certificates representing the reduction or removal of one metric ton of CO2 or equivalent greenhouse gases. |

| Purpose | To limit and cap overall emissions within a regulated market or sector. | To incentivize voluntary emission reductions beyond regulatory requirements. |

| Market Type | Compliance market, regulated by government authorities. | Voluntary market, can also be used for regulatory compliance in some cases. |

| Issuance | Issued by government or environmental regulatory bodies. | Issued by verified environmental projects and certified under standards like Verified Carbon Standard (VCS), Gold Standard. |

| Quantity | Fixed quota set by regulatory caps. | Variable, based on the amount of emissions reduced or removed. |

| Usage | Used by companies to comply with emission limits. | Used by companies or individuals to offset carbon footprints voluntarily. |

| Trading | Traded within established emissions trading systems (ETS). | Traded in voluntary carbon markets or exchanges. |

| Example Markets | EU Emissions Trading System (EU ETS), California Cap-and-Trade Program. | Voluntary Carbon Market, Chicago Climate Exchange (CCX). |

Introduction to Emission Allowances and Carbon Credits

Emission allowances represent the legal permits that grant companies the right to emit a specified amount of greenhouse gases, playing a critical role in cap-and-trade systems designed to limit overall emissions. Carbon credits function as tradable certificates certifying the reduction or removal of one metric ton of carbon dioxide or its equivalent, enabling organizations to offset their emissions voluntarily or comply with regulatory frameworks. Differentiating these tools is essential for understanding environmental market mechanisms aimed at mitigating climate change.

Defining Emission Allowances

Emission allowances are government-issued permits that grant the holder the right to emit a specific amount of greenhouse gases, typically measured in metric tons of CO2 equivalent, within a regulated cap-and-trade system. These tradable permits are designed to limit total emissions by capping the aggregate allowance available, encouraging companies to reduce their carbon footprint or buy additional allowances if needed. Emission allowances function as a central tool in environmental policy, providing economic incentives for pollution reduction and compliance with climate targets.

What Are Carbon Credits?

Carbon credits are tradable certificates representing the right to emit one metric ton of carbon dioxide or an equivalent amount of other greenhouse gases. They function as market-based instruments to incentivize pollution reduction by allowing entities to buy or sell emission allowances. Carbon credits support global efforts to mitigate climate change by promoting investment in sustainable projects and technologies that reduce or offset harmful emissions.

Key Differences Between Emission Allowances and Carbon Credits

Emission allowances are government-issued permits that cap the total amount of greenhouse gases a company can emit, typically under a cap-and-trade system, while carbon credits represent a quantifiable emission reduction or removal, often generated from specific projects like reforestation or renewable energy. Emission allowances are primarily regulatory compliance tools that allocate emission limits, whereas carbon credits are market-based instruments that can be bought, sold, or retired to offset emissions beyond regulatory requirements. The key difference lies in their origin and function: allowances set a legal emission ceiling, while credits provide a voluntary or supplementary mechanism for reducing atmospheric carbon dioxide.

Regulatory Frameworks: Cap-and-Trade vs. Voluntary Markets

Emission allowances operate within regulatory cap-and-trade systems where governments set a maximum limit on emissions and distribute allowances accordingly, enabling entities to buy or sell permits to comply with legal requirements. Carbon credits typically emerge from voluntary markets where companies and individuals invest in verified projects that reduce or remove greenhouse gases, without binding regulatory mandates. Understanding these frameworks is crucial for distinguishing the legally enforceable nature of emission allowances from the market-driven flexibility of voluntary carbon credits.

How Emission Allowances Work

Emission allowances function as government-issued permits that cap the total amount of greenhouse gases a company can emit within a specific period, enabling a controlled carbon market. Each allowance typically permits the holder to emit one metric ton of CO2 or its equivalent, creating a binding limit that drives companies to innovate or purchase additional allowances if they exceed their allotment. This system incentivizes emission reductions by putting a financial value on excess emissions, encouraging industries to lower their carbon footprint.

The Role of Carbon Credits in Offsetting Emissions

Carbon credits serve as tradable certificates representing the reduction of one metric ton of CO2 or its equivalent in greenhouse gases, enabling organizations to offset emissions they cannot eliminate internally. Emission allowances, issued by regulatory bodies under cap-and-trade systems, set a legal limit on the total emissions allowed for specific sectors or companies, with allowances being bought and sold to comply with these caps. Carbon credits complement emission allowances by funding projects like reforestation or renewable energy that absorb or prevent emissions, thus balancing out residual carbon footprints beyond regulatory limits.

Benefits and Limitations of Each System

Emission allowances provide a regulatory cap on greenhouse gas emissions, creating a market-driven incentive for companies to reduce their carbon footprint through tradable permits, but they can lead to market volatility and potential overallocation. Carbon credits represent emissions reductions from verified projects outside regulatory caps, offering flexibility and encouraging investment in sustainable practices, though they face challenges in verifying authenticity and avoiding double counting. Both systems aim to lower emissions but differ in scope, with emission allowances driving systemic change in capped sectors and carbon credits supporting voluntary or supplementary emission reductions.

Global Examples and Case Studies

Emission allowances, often government-issued under cap-and-trade schemes like the EU Emissions Trading System (EU ETS), set a legal limit on greenhouse gas emissions for industries, requiring companies to hold enough allowances to cover their emissions. Carbon credits, exemplified by voluntary markets such as the Verified Carbon Standard (VCS), enable entities to offset emissions through projects that reduce or remove CO2, like reforestation initiatives in Brazil or renewable energy projects in India. Case studies from California's cap-and-trade program and REDD+ projects in the Amazon provide insights into the effectiveness of emission allowances and carbon credits in reducing global carbon footprints and incentivizing sustainable practices.

Future Trends in Carbon Markets

Future trends in carbon markets indicate a convergence between emission allowances and carbon credits as regulatory frameworks expand globally to meet stricter climate targets. Advances in blockchain technology and real-time monitoring systems enhance transparency and traceability, driving market liquidity and investor confidence. Increasing corporate commitments to net-zero emissions stimulate demand for both compliance-based emission allowances and voluntary carbon credits, fostering innovation in sustainable practices and carbon reduction projects.

Emission Allowance Infographic

libterm.com

libterm.com