Overhead cost encompasses all ongoing business expenses not directly tied to a specific product or service, such as rent, utilities, and administrative salaries. Proper management of these costs is essential to maintain profitability and allocate resources efficiently in your company. Explore the article to uncover practical strategies for controlling and reducing overhead expenses.

Table of Comparison

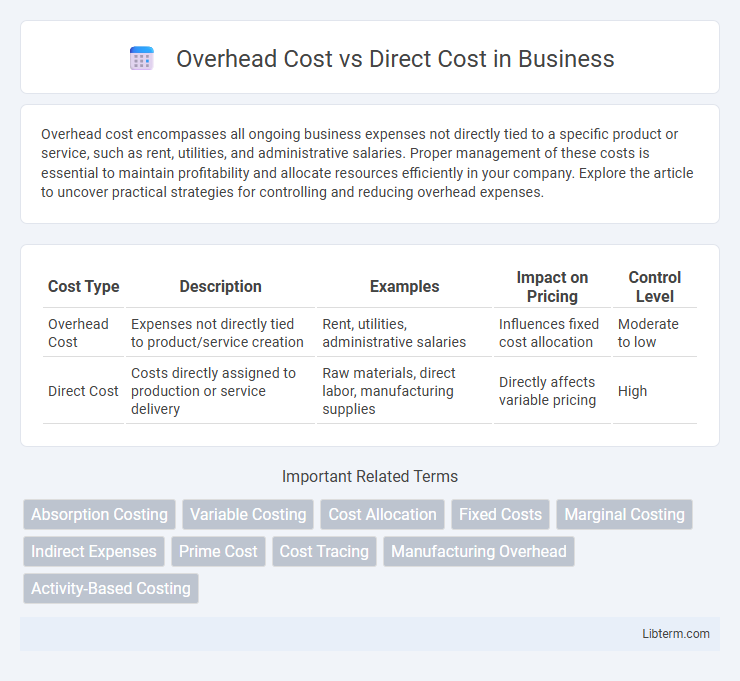

| Cost Type | Description | Examples | Impact on Pricing | Control Level |

|---|---|---|---|---|

| Overhead Cost | Expenses not directly tied to product/service creation | Rent, utilities, administrative salaries | Influences fixed cost allocation | Moderate to low |

| Direct Cost | Costs directly assigned to production or service delivery | Raw materials, direct labor, manufacturing supplies | Directly affects variable pricing | High |

Introduction to Overhead Cost and Direct Cost

Overhead cost refers to indirect expenses necessary for running a business, such as rent, utilities, and administrative salaries, which cannot be traced directly to specific products or services. Direct cost includes expenses directly attributed to the production of goods or services, like raw materials and labor costs tied to manufacturing. Distinguishing between overhead and direct costs is crucial for accurate budgeting, cost control, and pricing strategies in business operations.

Defining Overhead Costs

Overhead costs refer to ongoing business expenses that are not directly tied to product creation or service delivery but are necessary for general operations, such as rent, utilities, and salaries of administrative staff. These costs differ from direct costs, which include raw materials and labor directly involved in production. Accurate identification and allocation of overhead costs are essential for budgeting, pricing strategies, and financial analysis within companies, especially in manufacturing and service industries.

Understanding Direct Costs

Direct costs are expenses that can be directly attributed to the production of goods or services, such as raw materials, labor, and manufacturing supplies. These costs vary directly with the level of production, making them essential for calculating product pricing and profitability. Accurate tracking of direct costs enables businesses to optimize budgeting and cost control strategies, improving overall financial performance.

Key Differences Between Overhead and Direct Costs

Overhead costs are indirect expenses that support overall business operations, such as rent, utilities, and administrative salaries, while direct costs are expenses directly attributable to production, like raw materials and labor used in manufacturing. Overhead expenses cannot be traced to a single product, whereas direct costs are clearly linked to specific items or projects. Understanding the distinction between overhead and direct costs is crucial for accurate cost allocation, pricing strategies, and financial reporting.

Examples of Overhead Costs in Business

Overhead costs in business refer to expenses not directly tied to production, such as rent, utilities, and administrative salaries, which are essential for operations but cannot be traced to a specific product. Examples include office rent, electricity bills, and payroll for support staff like accountants and human resources. These costs contrast with direct costs like raw materials and labor used directly in manufacturing goods.

Examples of Direct Costs in Business

Direct costs in business typically include expenses directly attributable to the production of goods or services, such as raw materials, labor wages for production staff, and manufacturing supplies. For example, in a furniture company, costs for wood, nails, and the salaries of carpenters are classified as direct costs. These expenditures are easily traceable to specific products, distinguishing them from overhead costs, which cover indirect expenses like rent and utilities.

Importance of Distinguishing Overhead and Direct Costs

Distinguishing overhead costs from direct costs is crucial for accurate financial analysis and pricing strategies in business operations. Overhead costs, such as rent and administrative salaries, cannot be directly traced to a specific product, while direct costs include materials and labor directly tied to production. Clear separation ensures precise budgeting, cost control, and profitability assessment, enabling better decision-making and resource allocation.

Impact of Overhead and Direct Costs on Pricing

Overhead costs, including rent, utilities, and administrative salaries, significantly influence product pricing by adding fixed expenses that must be covered regardless of production volume, thus affecting the baseline price. Direct costs, such as raw materials and labor directly involved in manufacturing, vary with production levels and directly impact variable pricing components. Accurate allocation of overhead and direct costs ensures competitive pricing strategies that reflect true production expenses and profit margins.

Methods for Allocating Overhead Costs

Methods for allocating overhead costs include the traditional costing approach, which assigns overhead based on a single cost driver such as direct labor hours or machine hours, and activity-based costing (ABC), which allocates overhead according to multiple cost drivers reflecting actual activities. The traditional method's simplicity often leads to less accurate product costing, while ABC improves precision by tracing overhead expenses to specific activities like setup, inspection, or material handling. Firms choose the allocation method based on the complexity of production processes and the need for detailed cost information to improve pricing and profitability analysis.

Overhead Cost vs Direct Cost: Strategic Business Implications

Overhead costs, such as rent, utilities, and administrative salaries, differ from direct costs like raw materials and labor directly tied to production, significantly influencing strategic business decisions. Accurately distinguishing and managing these costs enhances pricing strategies, budget allocation, and profitability analysis, enabling businesses to optimize operational efficiency. Effective control of overhead costs supports sustainable growth by reducing waste and improving financial forecasting, while precise tracking of direct costs ensures competitive product pricing and resource management.

Overhead Cost Infographic

libterm.com

libterm.com