Accrued expenses represent liabilities for goods or services that have been received but not yet paid for, reflecting your company's financial obligations in the accounting period. Properly tracking these expenses ensures accurate financial statements and compliance with accounting principles. Explore the article to understand how managing accrued expenses impacts your business's financial health.

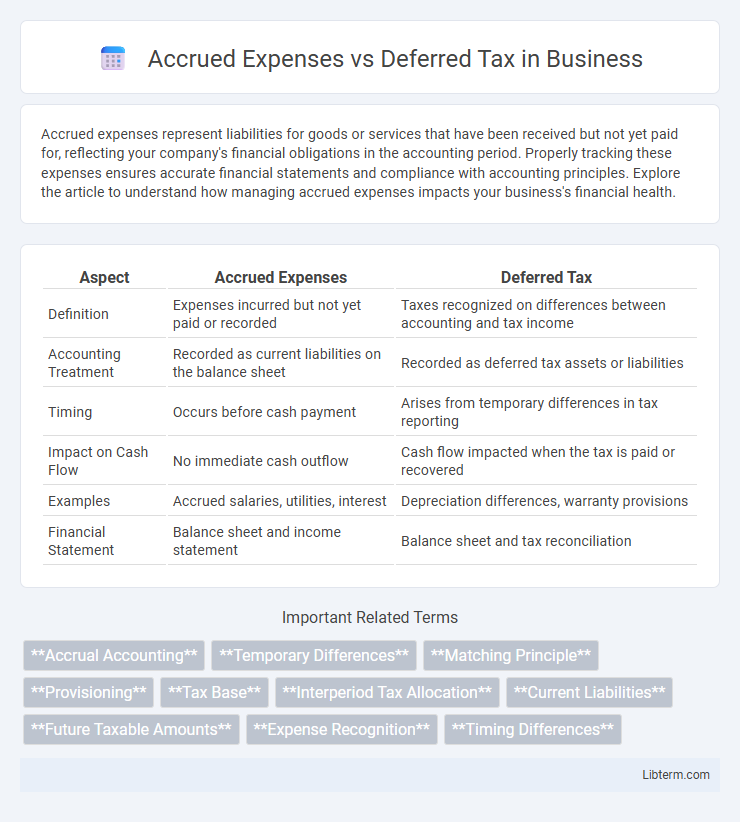

Table of Comparison

| Aspect | Accrued Expenses | Deferred Tax |

|---|---|---|

| Definition | Expenses incurred but not yet paid or recorded | Taxes recognized on differences between accounting and tax income |

| Accounting Treatment | Recorded as current liabilities on the balance sheet | Recorded as deferred tax assets or liabilities |

| Timing | Occurs before cash payment | Arises from temporary differences in tax reporting |

| Impact on Cash Flow | No immediate cash outflow | Cash flow impacted when the tax is paid or recovered |

| Examples | Accrued salaries, utilities, interest | Depreciation differences, warranty provisions |

| Financial Statement | Balance sheet and income statement | Balance sheet and tax reconciliation |

Introduction to Accrued Expenses and Deferred Tax

Accrued expenses are accounting liabilities representing expenses that have been incurred but not yet paid or recorded, such as wages, interest, and utilities, ensuring accurate matching of expenses to the period they relate to. Deferred tax arises from temporary differences between accounting income and taxable income, creating deferred tax assets or liabilities that reflect future tax consequences of current transactions. Understanding accrued expenses and deferred tax is essential for accurate financial reporting and tax compliance.

Defining Accrued Expenses

Accrued expenses represent liabilities for costs that a company has incurred but has not yet paid, such as wages, utilities, and interest. These expenses are recorded in the financial statements to accurately reflect the company's financial position during an accounting period. Unlike deferred tax, which deals with timing differences in tax payments, accrued expenses relate directly to operational costs pending settlement.

Understanding Deferred Tax

Deferred tax arises from temporary differences between accounting income and taxable income, leading to future tax liabilities or assets on the balance sheet. It reflects taxes payable or recoverable in future periods due to timing differences in revenue recognition or expense deduction. Proper understanding of deferred tax is crucial for accurate financial reporting and tax planning strategies.

Key Differences Between Accrued Expenses and Deferred Tax

Accrued expenses represent liabilities for services or goods received but not yet paid, reflecting current period expenses that impact financial statements immediately. Deferred tax arises from temporary differences between accounting income and taxable income, leading to future tax payments or benefits recognized as assets or liabilities on the balance sheet. Key differences include their origin--accrued expenses relate to operational costs, while deferred tax stems from tax timing differences--and their impact timing, with accrued expenses affecting current cash flows and deferred taxes affecting future tax obligations.

Recognition Criteria in Financial Statements

Accrued expenses are recognized in financial statements when a company incurs an obligation for goods or services received but not yet paid, reflecting liabilities based on the matching principle in accounting. Deferred tax arises from temporary differences between accounting income and taxable income, recognized according to the timing differences in tax reporting under IAS 12 or ASC 740 standards. Accurate recognition criteria for accrued expenses and deferred taxes ensure proper matching of expenses and revenues, enhancing the reliability of financial position and performance reporting.

Impact on Profit and Loss Statements

Accrued expenses increase liabilities and reduce net income on the profit and loss statement by recognizing expenses incurred but not yet paid, ensuring expenses match the period they relate to. Deferred tax impacts profit and loss by reflecting future tax liabilities or assets arising from temporary differences between accounting income and taxable income, causing fluctuations in tax expense reported. Both accrued expenses and deferred tax adjustments influence earnings accuracy and provide a clearer view of financial performance.

Examples of Accrued Expenses

Accrued expenses are liabilities representing costs that a company has incurred but not yet paid, such as wages payable, interest payable, and utilities expenses accrued at the end of an accounting period. Examples include salaries earned by employees but unpaid, interest on loans accrued but not disbursed, and utility bills for electricity or water services used but not yet invoiced. Differently, deferred tax arises from timing differences between accounting income and taxable income, impacting future tax payments rather than recording immediate operational costs.

Examples of Deferred Tax

Deferred tax commonly arises from temporary differences such as depreciation methods causing discrepancies between accounting income and taxable income. Examples include tax deductions on accelerated depreciation exceeding book depreciation, creating deferred tax liabilities, and warranty expenses recognized in accounting but deductible for tax only when paid, generating deferred tax assets. These timing differences affect future tax payments and are essential for accurate financial reporting.

Importance in Financial Reporting and Compliance

Accrued expenses represent liabilities for services or goods received but not yet paid, crucial for accurately matching expenses to the period incurred, ensuring precise profit measurement and compliance with accounting standards like GAAP or IFRS. Deferred tax arises from timing differences between accounting income and taxable income, reflecting future tax obligations or benefits that must be disclosed to provide a transparent view of a company's financial position and tax strategy. Proper recognition and disclosure of accrued expenses and deferred tax enhance financial reporting reliability, support regulatory compliance, and facilitate informed decision-making by stakeholders.

Best Practices for Accurate Accounting

Accrued expenses require precise estimation and timely recognition to ensure liabilities are recorded in the correct accounting periods, following the matching principle and GAAP guidelines. Deferred tax accounting demands accurate tracking of temporary differences between financial reporting and tax bases, supported by robust documentation and regularly updated tax rate assumptions to prevent misstatements. Implementing regular reconciliations and leveraging accounting software automation improves accuracy and compliance for both accrued expenses and deferred tax reporting.

Accrued Expenses Infographic

libterm.com

libterm.com