Understanding contribution margin is essential for assessing how much revenue remains after covering variable costs, which directly influences profitability. By calculating this metric, you can make informed decisions on pricing, cost control, and product focus to enhance your business's financial health. Explore the rest of the article to learn practical strategies for effectively managing your contribution margin.

Table of Comparison

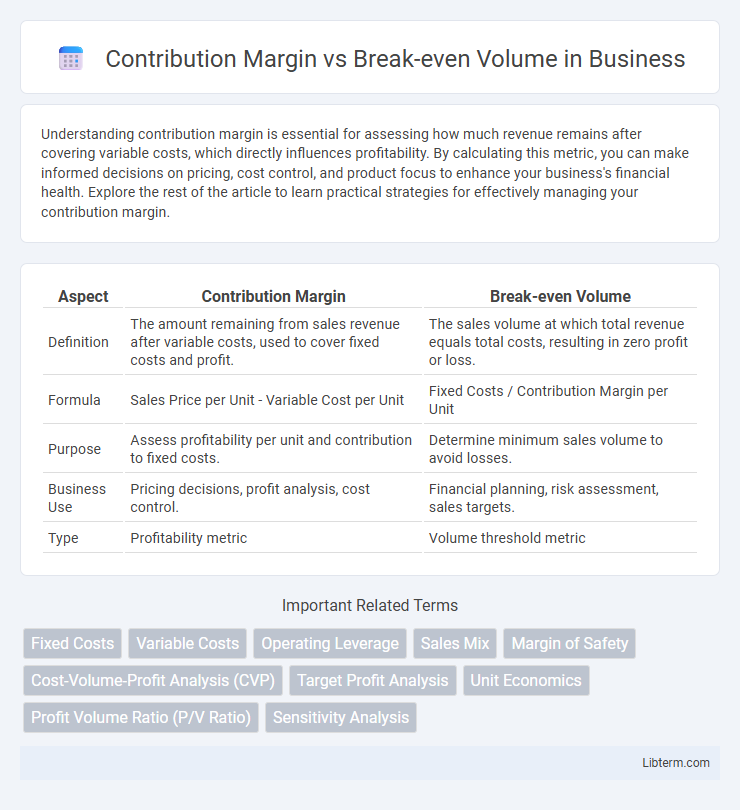

| Aspect | Contribution Margin | Break-even Volume |

|---|---|---|

| Definition | The amount remaining from sales revenue after variable costs, used to cover fixed costs and profit. | The sales volume at which total revenue equals total costs, resulting in zero profit or loss. |

| Formula | Sales Price per Unit - Variable Cost per Unit | Fixed Costs / Contribution Margin per Unit |

| Purpose | Assess profitability per unit and contribution to fixed costs. | Determine minimum sales volume to avoid losses. |

| Business Use | Pricing decisions, profit analysis, cost control. | Financial planning, risk assessment, sales targets. |

| Type | Profitability metric | Volume threshold metric |

Introduction to Contribution Margin and Break-even Volume

Contribution Margin represents the difference between sales revenue and variable costs, highlighting the amount available to cover fixed costs and generate profit. Break-even Volume is the sales quantity where total revenue equals total costs, resulting in zero profit or loss. Understanding Contribution Margin aids in determining the Break-even Volume by showing how many units must be sold to cover fixed expenses.

Understanding Contribution Margin: Definition and Importance

Contribution margin represents the difference between sales revenue and variable costs, indicating the amount available to cover fixed costs and generate profit. Understanding contribution margin is crucial for businesses to determine product profitability, make pricing decisions, and optimize sales mix. Break-even volume relies on contribution margin to calculate the number of units needed to cover all fixed and variable costs, ensuring no financial loss.

Calculating Contribution Margin: Step-by-Step Guide

Calculating contribution margin involves subtracting variable costs from total sales revenue, providing insight into profitability per unit sold. To determine the break-even volume, divide the total fixed costs by the contribution margin per unit, revealing the sales volume needed to cover all fixed expenses. This step-by-step approach aids businesses in setting sales targets and pricing strategies to achieve financial stability.

What is Break-even Volume? Key Concepts Explained

Break-even volume is the number of units a business must sell to cover all fixed and variable costs without making a profit or loss. It is calculated by dividing total fixed costs by the contribution margin per unit, which represents the revenue remaining after variable costs are deducted. Understanding break-even volume helps businesses determine the minimum sales needed to avoid losses and informs pricing, production, and sales strategies.

How to Calculate Break-even Volume Accurately

To calculate break-even volume accurately, divide total fixed costs by the contribution margin per unit, which is the selling price minus variable cost per unit. Understanding the contribution margin is essential as it reflects the portion of sales revenue that contributes to covering fixed costs and generating profit. This precise calculation allows businesses to determine the minimum sales volume required to avoid losses and achieve profitability.

Key Differences Between Contribution Margin and Break-even Volume

Contribution margin represents the per-unit profit after variable costs, essential for assessing product profitability, while break-even volume indicates the sales quantity needed to cover all fixed and variable costs, marking the point of zero profit. Contribution margin directly impacts break-even volume calculation; higher contribution margins reduce the break-even sales volume necessary. Understanding these differences enables businesses to optimize pricing strategies and production levels to achieve profitability efficiently.

The Role of Contribution Margin in Financial Decision-Making

Contribution margin represents the amount remaining from sales revenue after variable costs, playing a crucial role in determining the break-even volume, which is the sales level at which total revenues equal total costs. By analyzing contribution margin per unit, businesses can make informed decisions about pricing, product mix, and cost control to optimize profitability. Understanding this metric enables managers to assess the impact of changes in sales volume on net profit and strategically plan for financial sustainability.

The Importance of Break-even Analysis in Business Planning

Break-even analysis is crucial in business planning as it determines the exact sales volume needed to cover all fixed and variable costs, ensuring no loss occurs. By comparing contribution margin per unit to fixed costs, businesses identify the break-even volume, helping in pricing strategy, cost control, and profit forecasting. Understanding this relationship allows managers to make informed decisions on scaling operations and evaluating financial risk effectively.

Practical Examples: Applying Contribution Margin and Break-even Volume

Using the contribution margin, businesses calculate how much profit each unit generates after variable costs, which helps in setting the sales target to achieve profitability. For example, if a product's contribution margin is $25 per unit and fixed costs total $10,000, the break-even volume is 400 units ($10,000 / $25). Understanding this relationship enables companies to determine the minimum sales needed to cover costs and informs pricing and production decisions.

Conclusion: Optimizing Profitability with Contribution Margin and Break-even Analysis

Optimizing profitability requires understanding the relationship between contribution margin and break-even volume, where a higher contribution margin reduces the break-even sales volume needed to cover fixed costs. Accurate break-even analysis enables businesses to set sales targets that ensure profitability and make informed pricing decisions. Focusing on maximizing the contribution margin per unit drives efficiency and supports sustainable financial growth.

Contribution Margin Infographic

libterm.com

libterm.com