Recoupment is a legal mechanism allowing a party to recover funds by offsetting what is owed against amounts previously paid, often in contract or insurance disputes. It differs from counterclaims by focusing on related obligations within the same transaction rather than separate claims. Explore the article to understand how recoupment can impact your financial rights and obligations.

Table of Comparison

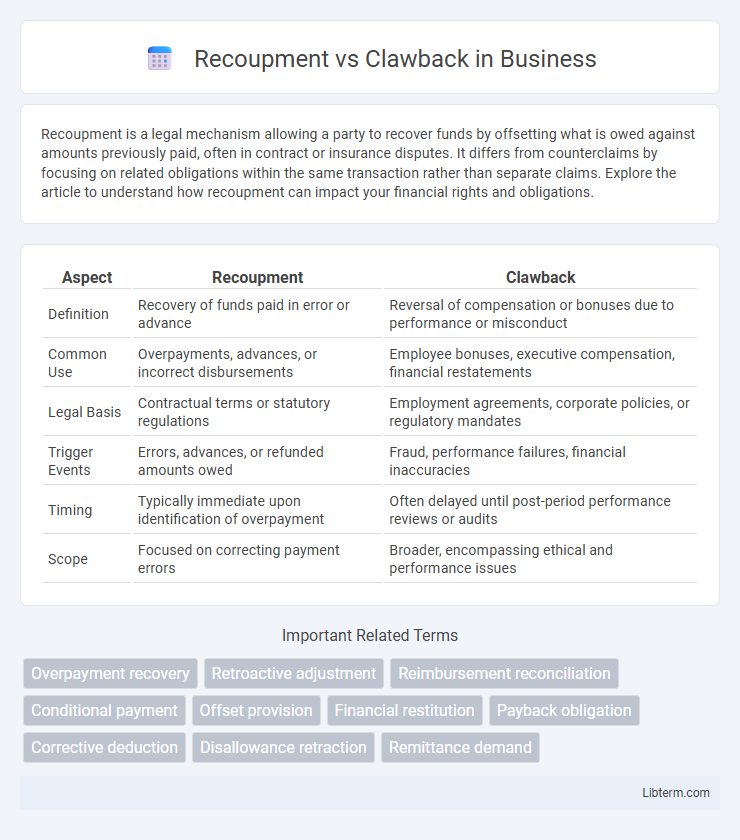

| Aspect | Recoupment | Clawback |

|---|---|---|

| Definition | Recovery of funds paid in error or advance | Reversal of compensation or bonuses due to performance or misconduct |

| Common Use | Overpayments, advances, or incorrect disbursements | Employee bonuses, executive compensation, financial restatements |

| Legal Basis | Contractual terms or statutory regulations | Employment agreements, corporate policies, or regulatory mandates |

| Trigger Events | Errors, advances, or refunded amounts owed | Fraud, performance failures, financial inaccuracies |

| Timing | Typically immediate upon identification of overpayment | Often delayed until post-period performance reviews or audits |

| Scope | Focused on correcting payment errors | Broader, encompassing ethical and performance issues |

Introduction to Recoupment and Clawback

Recoupment and clawback are financial mechanisms used to recover funds or benefits mistakenly or improperly paid. Recoupment typically involves offsetting future payments against overpaid amounts without requiring formal legal action. Clawback refers to the contractual provision that mandates repayment of money already disbursed, often triggered by breaches or failure to meet specific conditions.

Defining Recoupment: Key Concepts

Recoupment refers to the process by which a party recovers funds or expenses previously paid out, typically due to an error, overpayment, or breach of contract. It is a legal mechanism that allows a defendant to offset amounts owed to a plaintiff against any debts or claims arising from the same transaction or agreement. This concept is widely used in industries such as insurance, finance, and employment law to ensure fair adjustment of payments and prevent unjust enrichment.

Understanding Clawback: Core Principles

Clawback refers to the contractual provision allowing an employer or payer to reclaim previously disbursed funds due to specific conditions such as misconduct, financial restatements, or breach of agreement. It serves as a risk management tool ensuring accountability by reversing compensation or bonuses that were improperly awarded or earned under false pretenses. The core principle of clawback lies in maintaining financial integrity and protecting stakeholders from losses caused by erroneous payments or unethical behavior.

Legal Foundations of Recoupment

Recoupment is grounded in contract law principles allowing a debtor to withhold funds owed to a creditor to offset claims arising from the same transaction, thereby avoiding litigation. Its legal foundation hinges on the concept of mutuality of obligations, enabling parties to reduce the amount payable without breaching the contract. Unlike clawback, which often involves recovering funds after payment due to fraud or error, recoupment operates as an affirmative defense within ongoing obligations between the parties.

Legal Basis for Clawback Provisions

Clawback provisions are legally grounded in contracts, statutes, or regulatory rules that mandate the return of funds under specific conditions, such as misconduct or financial restatements. These provisions often arise from corporate governance standards and securities laws designed to protect shareholders and ensure executive accountability. Legal frameworks like the Sarbanes-Oxley Act and Dodd-Frank Act provide explicit authority for enforcing clawbacks in publicly traded companies, reinforcing compliance and ethical financial practices.

Differences Between Recoupment and Clawback

Recoupment refers to the process by which an employer or payer retrieves funds previously disbursed, typically under a contract or agreement, due to errors or overpayments, often without requiring legal action. Clawback involves the recovery of bonuses, incentives, or profits after they have been paid out, especially if the recipient violates terms or if financial results are restated, and may include legal enforcement. The key difference lies in recoupment being a preventive correction of payments usually embedded in agreements, while clawback often addresses misconduct or misstated results requiring formal reclamation.

Common Scenarios for Recoupment

Common scenarios for recoupment include employee overpayments, insurance claim reimbursements, and welfare benefits corrections. Employers frequently recoup salaries or bonuses when errors or policy violations occur, ensuring financial accuracy. Health insurers also invoke recoupment to recover funds from providers for denied or overpaid claims.

Typical Applications of Clawback Clauses

Clawback clauses are typically applied in executive compensation agreements, where bonuses or stock options are recovered if financial results are restated due to misconduct or errors. These clauses are common in employment contracts to ensure accountability and align incentives with long-term company performance. They also appear in government grants and incentive programs to reclaim funds if recipients fail to meet specific conditions or violate terms.

Implications for Businesses and Employees

Recoupment and clawback provisions directly impact business financial strategies and employee compensation structures by mandating the return of funds under specific circumstances such as misconduct or financial restatements. Businesses face increased administrative costs and legal complexities in implementing these policies, while employees may experience heightened job insecurity and altered incentives, influencing retention and performance. Clear communication and well-defined contractual terms are essential to balance operational risk and employee morale effectively.

Best Practices for Managing Recoupment and Clawback

Effective management of recoupment and clawback processes requires transparent contract terms clearly defining conditions for repayment to minimize disputes. Implementing automated tracking systems ensures accurate monitoring of payments and timely identification of overpayments for efficient recovery. Regular audits combined with proactive communication with stakeholders enhance compliance and reduce financial risks associated with recoupments and clawbacks.

Recoupment Infographic

libterm.com

libterm.com