Commercial paper is a short-term unsecured promissory note issued by corporations to meet immediate funding needs, typically with maturities ranging from a few days up to 270 days. This financial instrument offers lower interest rates compared to bank loans, making it an attractive option for companies seeking quick, cost-effective capital. Explore the rest of this article to understand how commercial paper can optimize your corporate financing strategy.

Table of Comparison

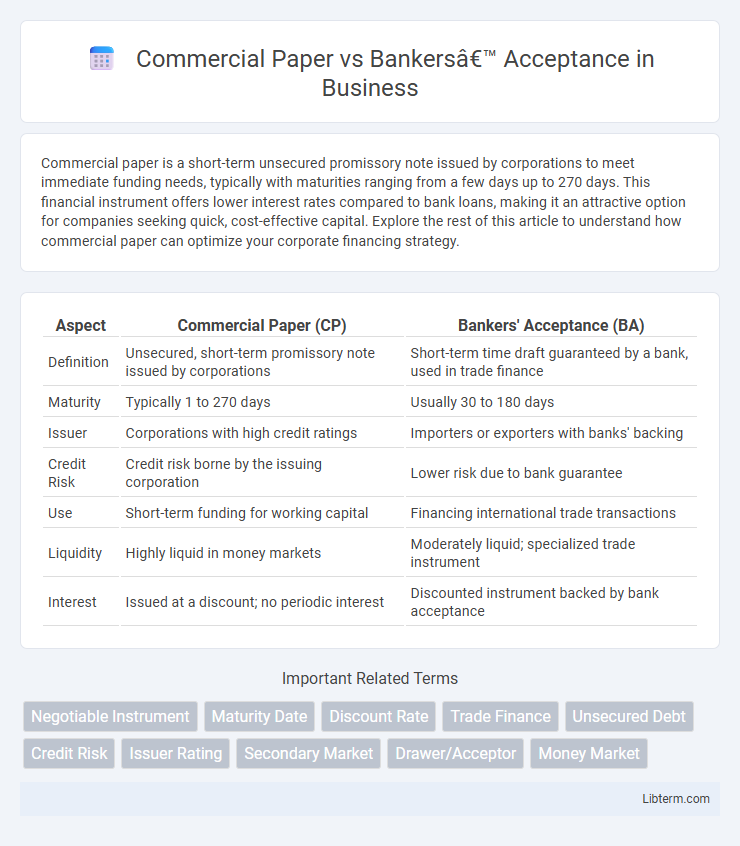

| Aspect | Commercial Paper (CP) | Bankers' Acceptance (BA) |

|---|---|---|

| Definition | Unsecured, short-term promissory note issued by corporations | Short-term time draft guaranteed by a bank, used in trade finance |

| Maturity | Typically 1 to 270 days | Usually 30 to 180 days |

| Issuer | Corporations with high credit ratings | Importers or exporters with banks' backing |

| Credit Risk | Credit risk borne by the issuing corporation | Lower risk due to bank guarantee |

| Use | Short-term funding for working capital | Financing international trade transactions |

| Liquidity | Highly liquid in money markets | Moderately liquid; specialized trade instrument |

| Interest | Issued at a discount; no periodic interest | Discounted instrument backed by bank acceptance |

Introduction to Commercial Paper and Bankers’ Acceptance

Commercial paper is a short-term, unsecured promissory note issued by corporations to raise funds for working capital and other immediate financial needs, typically with maturities ranging from a few days to 270 days. Bankers' acceptance is a short-term debt instrument guaranteed by a bank, used primarily in international trade to finance post-shipment periods, with maturities generally between 30 and 180 days. Both instruments offer liquidity and financing options but differ in security, issuance, and usage contexts, making them essential tools in corporate and trade finance.

Key Definitions and Concepts

Commercial Paper is an unsecured, short-term debt instrument issued by corporations to finance immediate liabilities, typically maturing within 270 days, while Bankers' Acceptance is a short-term negotiable instrument backed by a bank's guarantee, used primarily in international trade to facilitate payments. Commercial Paper relies on the issuer's creditworthiness without collateral, whereas Bankers' Acceptance involves a bank's acceptance, reducing credit risk and enhancing liquidity. Both serve as important money market instruments but differ in issuer, risk profile, and primary usage context.

Historical Development and Market Usage

Commercial paper emerged in the early 1900s as a short-term unsecured promissory note primarily issued by corporations to finance working capital, evolving into a vital instrument in money markets worldwide. Bankers' acceptances developed from trade finance in the late 19th century, enabling importers and exporters to mitigate credit risk by having a bank guarantee payment, thus facilitating international trade. Market usage shows commercial paper dominating corporate funding for liquidity needs in developed markets, while bankers' acceptances remain crucial in global trade finance, particularly in export-import transactions.

Structure and Issuance Process

Commercial paper is an unsecured short-term debt instrument issued directly by corporations to raise funds, typically with maturities up to 270 days, and sold at a discount through dealers or directly to investors. Bankers' acceptances are negotiable time drafts guaranteed by a bank, involving a three-party transaction where the bank accepts responsibility for payment, enhancing creditworthiness and often used in international trade finance. The issuance process for commercial paper is streamlined, relying on the issuer's credit rating, while bankers' acceptances require bank approval and acceptance, adding a layer of security and complexity to the transaction.

Credit Risk and Security Features

Commercial Paper typically carries higher credit risk due to its unsecured nature and reliance on the issuer's creditworthiness, whereas Bankers' Acceptance benefits from the bank's guarantee, significantly reducing credit risk. The security feature of Bankers' Acceptance includes a time draft endorsed by a bank, making it a more secure instrument compared to Commercial Paper, which lacks such guarantees. Investors favor Bankers' Acceptance for lower risk and automatic bank backing, while Commercial Paper offers higher yields compensating for its elevated risk profile.

Maturity Periods and Liquidity

Commercial paper typically has a maturity period ranging from 1 to 270 days, offering high liquidity in short-term funding markets. Bankers' acceptances generally have maturities between 30 and 180 days, providing moderate liquidity backed by a bank's guarantee. The shorter maturity and unsecured nature of commercial paper make it more liquid than bankers' acceptances, which serve as trade financing tools with relatively lower liquidity.

Regulatory Framework and Compliance

Commercial paper is regulated primarily under the Securities Act of 1933 in the U.S., requiring issuers to comply with disclosure and exemption provisions aimed at protecting investors. Bankers' acceptances fall under banking regulations enforced by agencies such as the Federal Reserve and the Office of the Comptroller of the Currency, emphasizing creditworthiness and risk management standards imposed on participating banks. Compliance for commercial paper centers on securities law adherence, while bankers' acceptances focus on banking regulatory frameworks and capital adequacy requirements.

Cost and Yield Comparison

Commercial paper typically offers higher yields than bankers' acceptances due to its slightly higher risk and shorter maturity, making it a cost-effective funding tool for corporations. Bankers' acceptances generally have lower yields because they carry the credit guarantee of a bank, reducing risk and cost for investors. Investors seeking higher returns may prefer commercial paper, while those prioritizing security and lower cost may opt for bankers' acceptances.

Suitability for Investors and Issuers

Commercial paper suits large, creditworthy corporations seeking short-term, unsecured funding with lower interest rates, appealing to institutional investors aiming for liquidity and moderate risk. Bankers' acceptances offer greater security through bank guarantees, making them ideal for exporters and importers requiring trade financing, attracting conservative investors prioritizing low credit risk and short maturities. Both instruments serve distinct needs: commercial paper favors issuers with strong credit ratings, while bankers' acceptances provide reliability for trade-related transactions and cautious investors.

Conclusion: Choosing Between Commercial Paper and Bankers’ Acceptance

Choosing between Commercial Paper and Bankers' Acceptance depends on factors such as credit risk tolerance, maturity preferences, and liquidity needs. Commercial Paper suits corporations seeking short-term, unsecured financing with typically higher yields, while Bankers' Acceptances offer lower risk backed by banks, ideal for trade-related financing. Assessing the trade-off between risk, cost, and market accessibility optimizes the decision in short-term funding strategies.

Commercial Paper Infographic

libterm.com

libterm.com