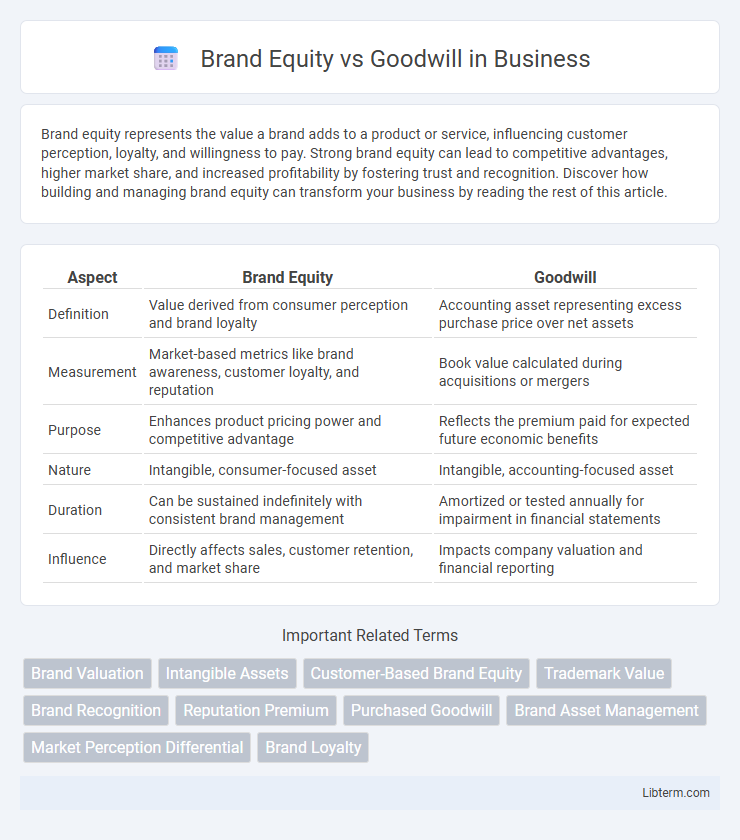

Brand equity represents the value a brand adds to a product or service, influencing customer perception, loyalty, and willingness to pay. Strong brand equity can lead to competitive advantages, higher market share, and increased profitability by fostering trust and recognition. Discover how building and managing brand equity can transform your business by reading the rest of this article.

Table of Comparison

| Aspect | Brand Equity | Goodwill |

|---|---|---|

| Definition | Value derived from consumer perception and brand loyalty | Accounting asset representing excess purchase price over net assets |

| Measurement | Market-based metrics like brand awareness, customer loyalty, and reputation | Book value calculated during acquisitions or mergers |

| Purpose | Enhances product pricing power and competitive advantage | Reflects the premium paid for expected future economic benefits |

| Nature | Intangible, consumer-focused asset | Intangible, accounting-focused asset |

| Duration | Can be sustained indefinitely with consistent brand management | Amortized or tested annually for impairment in financial statements |

| Influence | Directly affects sales, customer retention, and market share | Impacts company valuation and financial reporting |

Understanding Brand Equity: Definition and Components

Brand equity represents the intangible value derived from consumers' perception, recognition, and loyalty toward a brand, encompassing elements such as brand awareness, brand associations, perceived quality, and brand loyalty. It quantifies how a brand influences customer choice and willingness to pay premium prices, contributing to long-term competitive advantage. Goodwill, in contrast, is an accounting term reflecting the excess purchase price over net assets during acquisitions, incorporating brand equity alongside other intangibles like customer relationships and intellectual property.

What is Goodwill? Meaning and Importance

Goodwill represents the intangible asset arising when a company acquires another for a price higher than the fair market value of its net identifiable assets, reflecting elements like brand reputation, customer loyalty, and intellectual property. It is crucial for financial reporting and mergers, as it captures non-physical value that contributes to future earnings potential. Proper valuation of goodwill impacts balance sheets and investment decisions, highlighting its importance in understanding a business's true worth beyond tangible assets.

Key Differences Between Brand Equity and Goodwill

Brand equity refers to the value and strength of a brand's reputation, recognition, and customer loyalty, quantifiable through metrics like brand awareness and perceived quality. Goodwill represents the intangible asset arising from business acquisitions, reflecting customer relationships, intellectual property, and reputation beyond identifiable net assets. Key differences include brand equity being market-driven and measurable independently, while goodwill is an accounting concept recorded only during acquisitions.

How Brand Equity is Built and Measured

Brand equity is built through consistent brand messaging, quality product delivery, and positive customer experiences that foster trust and loyalty. It is measured using metrics such as brand awareness, perceived quality, brand associations, and customer loyalty indexes. Unlike goodwill, which arises from accounting practices and acquisition premiums, brand equity reflects the tangible and intangible value derived from customer perception and market position.

Types of Goodwill in Business Transactions

Goodwill in business transactions is classified into various types including purchased goodwill, arising when a company acquires another for more than its fair market value, and inherent goodwill, which exists internally due to a company's reputation and customer loyalty. Other types are personal goodwill, tied to the individual skills and relationships of the owners, and institutional goodwill, related to the overall brand and operational strengths of a business. Understanding these distinctions is crucial in valuing business acquisitions and differentiating goodwill from brand equity, which primarily reflects consumer perceptions and market position.

The Role of Brand Equity in Consumer Perception

Brand equity plays a crucial role in shaping consumer perception by establishing a brand's value through recognition, trust, and emotional connection, which directly influences purchasing decisions. Unlike goodwill, which is an accounting measure reflecting intangible assets acquired during mergers, brand equity represents the market-driven strength of a brand in the minds of consumers. High brand equity enhances customer loyalty and justifies premium pricing, reinforcing the brand's competitive advantage.

Goodwill in Financial Statements and Accounting

Goodwill on financial statements represents an intangible asset arising from the acquisition of one company by another, reflecting the excess of purchase price over the fair value of identifiable net assets. It is recorded only during business combinations and must be tested annually for impairment, as opposed to brand equity which pertains to consumer perception and brand strength. Accounting standards like IFRS and GAAP require disclosure of goodwill separately from other intangible assets to provide transparency in a company's financial health.

Impact of Brand Equity on Business Valuation

Brand equity significantly enhances business valuation by reflecting customer loyalty, brand recognition, and market positioning, which directly influence revenue potential and profitability. Unlike goodwill, which is an accounting measure of intangible assets acquired during a merger or acquisition, brand equity represents the intrinsic value derived from consumer perception and emotional connection to the brand. High brand equity drives premium pricing, market share growth, and sustainable competitive advantage, making it a crucial factor in investor confidence and overall company worth.

Goodwill vs Brand Equity: Implications for Mergers and Acquisitions

Goodwill represents the intangible value arising from a company's reputation, customer relationships, and intellectual property beyond its identifiable assets during mergers and acquisitions. Brand equity specifically captures the premium value attached to a brand name and its market recognition, influencing customer loyalty and sales potential. Differentiating goodwill from brand equity is critical in M&A due diligence, as goodwill encapsulates synergies and unidentifiable assets post-acquisition, while brand equity can be separately assessed for strategic valuation and growth forecasting.

Strategies to Enhance Brand Equity and Goodwill

Brands enhance brand equity by consistently delivering superior product quality, fostering emotional customer connections, and maintaining strong visual and verbal identity elements that reinforce recognition and trust. Goodwill is strengthened through exceptional customer service, ethical business practices, and long-term stakeholder relationships that generate positive community perception and loyalty. Strategic investments in marketing, corporate social responsibility, and transparent communication amplify both brand equity and goodwill, creating sustainable competitive advantages.

Brand Equity Infographic

libterm.com

libterm.com