An Initial Public Offering (IPO) marks the first time a company offers its shares to the public, enabling it to raise capital from a broad investor base. This process can transform your business by providing increased liquidity, public visibility, and access to funds for expansion or debt reduction. Discover how an IPO can impact your financial strategy and what steps are involved by reading the full article.

Table of Comparison

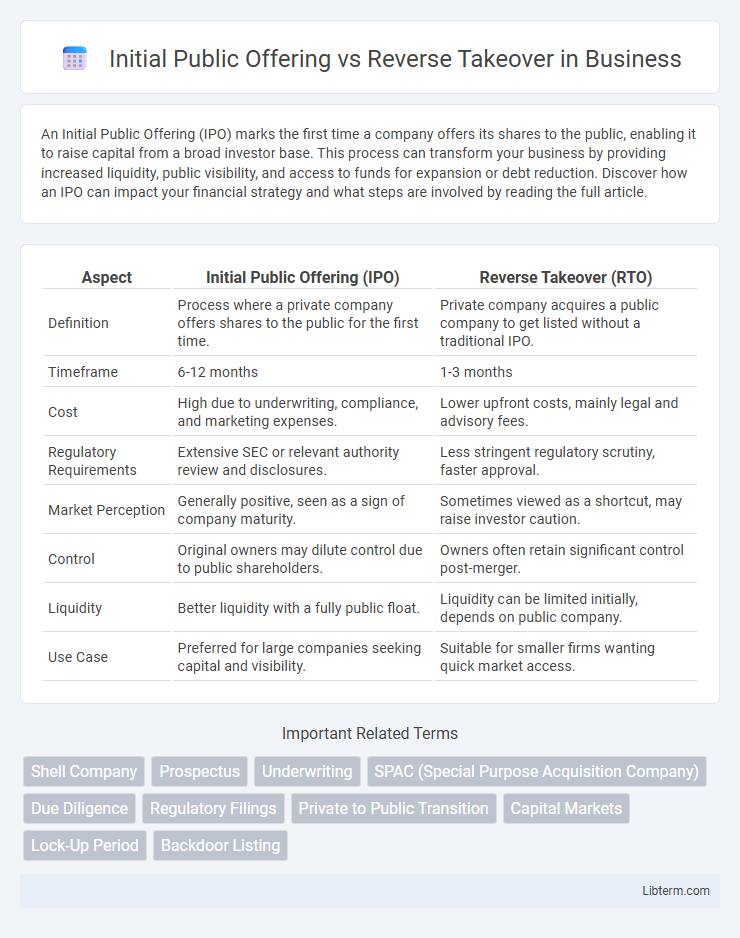

| Aspect | Initial Public Offering (IPO) | Reverse Takeover (RTO) |

|---|---|---|

| Definition | Process where a private company offers shares to the public for the first time. | Private company acquires a public company to get listed without a traditional IPO. |

| Timeframe | 6-12 months | 1-3 months |

| Cost | High due to underwriting, compliance, and marketing expenses. | Lower upfront costs, mainly legal and advisory fees. |

| Regulatory Requirements | Extensive SEC or relevant authority review and disclosures. | Less stringent regulatory scrutiny, faster approval. |

| Market Perception | Generally positive, seen as a sign of company maturity. | Sometimes viewed as a shortcut, may raise investor caution. |

| Control | Original owners may dilute control due to public shareholders. | Owners often retain significant control post-merger. |

| Liquidity | Better liquidity with a fully public float. | Liquidity can be limited initially, depends on public company. |

| Use Case | Preferred for large companies seeking capital and visibility. | Suitable for smaller firms wanting quick market access. |

Introduction to IPOs and Reverse Takeovers

An Initial Public Offering (IPO) is a process where a private company offers its shares to the public for the first time to raise capital and gain market visibility. A Reverse Takeover (RTO) occurs when a private company acquires a publicly listed shell company to achieve a faster and often less expensive route to public trading. Both methods provide access to public markets, but IPOs involve regulatory scrutiny and underwriting, while RTOs offer a quicker path with potentially fewer disclosure requirements.

Key Definitions: IPO vs Reverse Takeover

An Initial Public Offering (IPO) is the process where a private company offers shares to the public for the first time to raise capital and gain market exposure. A Reverse Takeover (RTO) occurs when a private company acquires a publicly listed shell company to bypass the lengthy IPO process and achieve a public listing quickly. IPOs typically involve regulatory scrutiny and investor roadshows, while RTOs provide faster market entry with fewer immediate regulatory burdens.

The Process: How IPOs Work

Initial Public Offerings (IPOs) begin with a company collaborating closely with investment banks to underwrite the share issuance and register with regulatory bodies like the SEC. The process involves drafting a prospectus, conducting due diligence, pricing shares based on market conditions, and launching a roadshow to attract investors. Upon approval and successful subscription, the company's shares list on a public exchange, providing capital infusion and enhanced market visibility.

The Process: How Reverse Takeovers Work

A Reverse Takeover (RTO) involves a private company acquiring a publicly listed shell company to bypass the lengthy Initial Public Offering (IPO) process, enabling faster access to public markets. The private company's shareholders exchange their shares for a majority stake in the public entity, effectively gaining control without undergoing a traditional IPO. This streamlined process reduces regulatory hurdles and capital market requirements, making it an attractive alternative for companies seeking rapid public listing.

Timeframes and Regulatory Requirements

An Initial Public Offering (IPO) typically requires 6 to 12 months involving extensive regulatory filings, including a prospectus reviewed by the Securities and Exchange Commission (SEC) and approval from stock exchanges. In contrast, a Reverse Takeover (RTO) is often completed within 3 to 6 months by acquiring an existing public company, bypassing many traditional registration processes. Regulatory requirements for IPOs are more stringent, demanding thorough financial disclosure and investor scrutiny, while RTOs face fewer upfront regulatory hurdles but still comply with ongoing public company reporting standards.

Costs and Financial Considerations

Initial Public Offerings (IPOs) involve higher upfront costs, including underwriting fees, regulatory compliance expenses, and extensive marketing, often reaching 7-10% of the capital raised. Reverse Takeovers (RTOs) offer a more cost-effective alternative, bypassing many traditional IPO fees and reducing time to public listing by merging with an existing public company. Financial considerations for RTOs include potential hidden liabilities of the target company and the need for extensive due diligence to avoid future financial risks.

Advantages and Disadvantages of IPOs

Initial Public Offerings (IPOs) provide companies with access to substantial capital and increased public visibility, essential for growth and expansion, while offering liquidity to early investors. However, IPOs involve extensive regulatory compliance, high underwriting fees, and market volatility risks that can impact valuation and timing. Despite these challenges, IPOs remain a preferred method for companies aiming to build long-term credibility and attract institutional investors.

Advantages and Disadvantages of Reverse Takeovers

Reverse takeovers (RTOs) offer the advantage of faster access to public markets compared to the lengthy Initial Public Offering (IPO) process, often reducing costs and avoiding extensive regulatory hurdles. However, RTOs may carry hidden liabilities from the acquired shell company, posing risks to investors and management. While RTOs enable private companies to bypass some IPO scrutiny, the lack of comprehensive due diligence can lead to lower market confidence and liquidity challenges.

Suitability: Which Companies Should Choose Which Route?

Companies with strong financials, solid growth prospects, and comprehensive regulatory compliance typically suit Initial Public Offerings (IPOs), as they benefit from increased market visibility and capital influx. Conversely, firms seeking faster access to public markets with lower upfront costs and less stringent disclosure requirements may prefer Reverse Takeovers (RTOs), especially smaller or turnaround companies aiming to leverage existing public listings. Each method aligns differently with company size, financial health, and urgency for capital, influencing the optimal route for going public based on strategic goals and market conditions.

Case Studies and Real-World Examples

Case studies reveal that Initial Public Offerings (IPOs), such as Facebook's 2012 IPO raising $16 billion, demonstrate the traditional route to public markets with extensive regulatory scrutiny and market visibility. Conversely, Reverse Takeovers (RTOs), exemplified by Virgin Galactic's 2019 RTO with Social Capital Hedosophia, offer faster market access by merging private firms with shell companies, often bypassing lengthy IPO processes. Real-world examples highlight the trade-offs between IPOs' capital raising potential and RTOs' expedited public listings, influencing corporate strategy depending on market conditions and operational needs.

Initial Public Offering Infographic

libterm.com

libterm.com