Equity partners hold ownership stakes in a firm, sharing profits, losses, and decision-making authority. These partners typically invest capital and contribute to the firm's growth and strategic direction. Discover how becoming an equity partner can impact your career and financial future in this comprehensive guide.

Table of Comparison

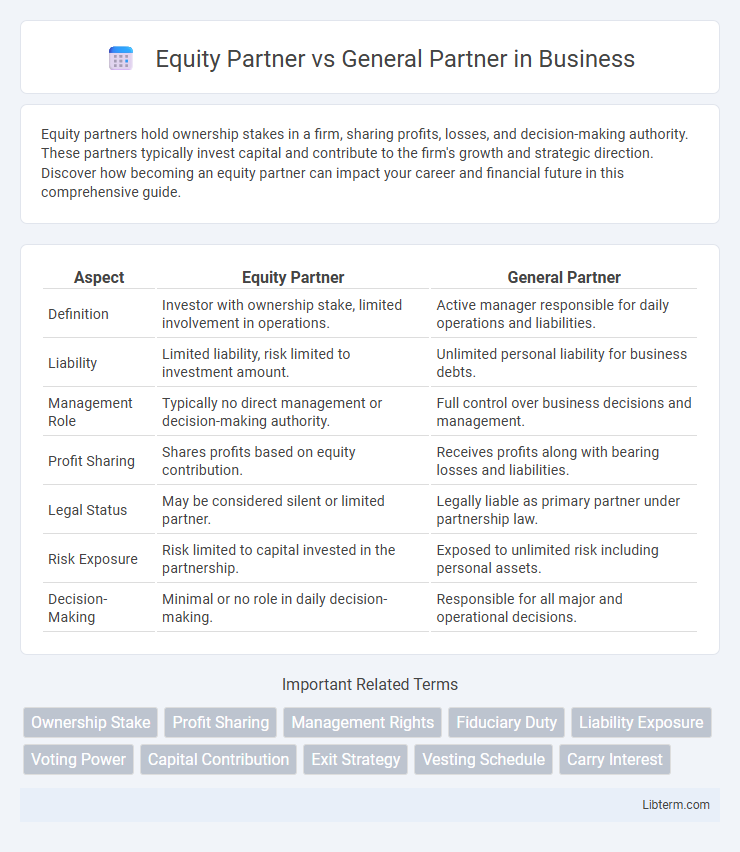

| Aspect | Equity Partner | General Partner |

|---|---|---|

| Definition | Investor with ownership stake, limited involvement in operations. | Active manager responsible for daily operations and liabilities. |

| Liability | Limited liability, risk limited to investment amount. | Unlimited personal liability for business debts. |

| Management Role | Typically no direct management or decision-making authority. | Full control over business decisions and management. |

| Profit Sharing | Shares profits based on equity contribution. | Receives profits along with bearing losses and liabilities. |

| Legal Status | May be considered silent or limited partner. | Legally liable as primary partner under partnership law. |

| Risk Exposure | Risk limited to capital invested in the partnership. | Exposed to unlimited risk including personal assets. |

| Decision-Making | Minimal or no role in daily decision-making. | Responsible for all major and operational decisions. |

Understanding Equity Partners: Definition and Role

Equity partners are investors who hold ownership stakes in a firm, sharing in profits, losses, and decision-making responsibilities based on their equity contribution. They play a crucial role in providing capital, influencing strategic direction, and bearing financial risks proportional to their investment. Unlike general partners, equity partners may have limited liability, depending on the firm's structure, impacting their legal and financial obligations.

Who Is a General Partner? Key Responsibilities

A General Partner in a partnership holds unlimited liability and actively manages the business operations, making key decisions that affect the firm's direction and financial health. Their responsibilities include overseeing daily management, assuming full responsibility for debts and obligations, and representing the partnership in legal matters. Unlike Equity Partners, General Partners are directly involved in operational control and bear greater personal risk.

Equity Partner vs General Partner: Core Differences

Equity partners hold ownership stakes in a firm, sharing in its profits, losses, and decision-making, whereas general partners assume full managerial responsibility and unlimited personal liability for the firm's obligations. Equity partners typically invest capital and gain residual returns, while general partners actively manage daily operations and bear fiduciary duties to creditors and partners. The core differences lie in financial risk exposure, governance roles, and profit distribution rights within the partnership structure.

Legal Structure: Equity vs General Partnerships

Equity partners hold ownership stakes in a firm, sharing profits and losses based on their capital contributions, while general partners actively manage the business and bear unlimited personal liability. In equity partnerships, liability is often limited to the invested capital, contrasting with general partnerships where all partners have joint and several liability for the firm's obligations. This distinction in legal structure affects decision-making authority, financial risk, and the distribution of profits within the partnership.

Compensation Models: Profit Sharing and Salaries

Equity partners typically receive compensation through profit sharing, where their earnings are tied to the firm's overall profitability and equity stake, aligning their financial rewards with long-term business performance. General partners often combine fixed salaries with profit shares, reflecting their active management roles and operational responsibilities within the partnership. This dual compensation model balances stable income with incentives linked to firm success, differentiating their payment structures from non-equity or salaried partners.

Decision-Making Power: Authority and Influence

Equity Partners hold significant decision-making power through their ownership stakes, granting them authority over major business strategies and profit distribution. General Partners possess broad managerial control and legal authority, often responsible for day-to-day operations and binding the partnership contractually. The balance of influence depends on the partnership structure, where Equity Partners may influence long-term decisions, while General Partners manage operational execution.

Investment Requirements: Capital Commitments Compared

Equity partners typically make larger capital commitments compared to general partners, reflecting their ownership stake and investment risk in the business. General partners contribute capital as well but often have responsibilities beyond financial input, including management and liability for debts. The difference in capital commitments influences the distribution of profits and decision-making authority within the partnership.

Risks and Liabilities: Exposure Analysis

Equity partners typically face limited liability risks, as their exposure is confined to their capital investment in the firm, protecting personal assets from business debts and legal claims. General partners, however, assume unlimited liability, bearing full responsibility for all partnership debts and obligations, which can extend to personal assets beyond their initial investment. Risk exposure for general partners is significantly higher due to this unlimited liability, making thorough risk assessment and liability management crucial for these stakeholders.

Career Path: Becoming an Equity or General Partner

Becoming an equity partner typically requires years of demonstrated leadership, business development skills, and a track record of generating substantial firm revenue, often culminating after 8 to 12 years at a firm. General partners usually advance through a combination of legal expertise and management responsibilities, with a focus on firm governance and operational decision-making roles. Both career paths involve gaining client trust, building networks, and contributing to the firm's long-term profitability, but equity partners hold ownership stakes while general partners may have broader managerial duties without necessarily holding equity.

Choosing the Right Partnership Model for Your Firm

Equity partners hold ownership stakes and share profits based on their investment and contributions, making them ideal for firms seeking long-term growth and shared financial risk. General partners carry unlimited liability and actively manage the business, suited for firms prioritizing control and operational involvement. Selecting the right partnership model depends on your firm's goals for liability exposure, profit sharing, and management responsibilities to align with strategic growth and risk tolerance.

Equity Partner Infographic

libterm.com

libterm.com