A revenue center focuses exclusively on generating income through sales or services without direct responsibility for controlling costs. It allows businesses to evaluate the performance of specific departments based on their ability to maximize revenue. Discover how optimizing your revenue center can significantly impact overall financial success in the full article.

Table of Comparison

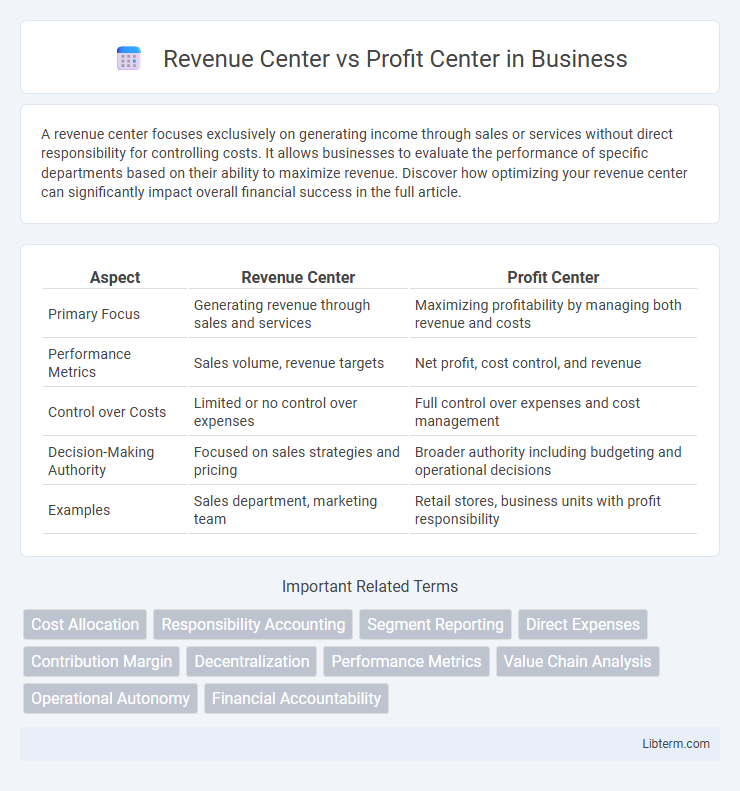

| Aspect | Revenue Center | Profit Center |

|---|---|---|

| Primary Focus | Generating revenue through sales and services | Maximizing profitability by managing both revenue and costs |

| Performance Metrics | Sales volume, revenue targets | Net profit, cost control, and revenue |

| Control over Costs | Limited or no control over expenses | Full control over expenses and cost management |

| Decision-Making Authority | Focused on sales strategies and pricing | Broader authority including budgeting and operational decisions |

| Examples | Sales department, marketing team | Retail stores, business units with profit responsibility |

Introduction to Revenue Centers and Profit Centers

Revenue centers are business units primarily responsible for generating sales revenue without direct control over costs, focusing on maximizing income through effective sales strategies. Profit centers manage both revenue generation and cost control, aiming to optimize overall profitability by balancing income with expenses. Understanding these distinctions helps organizations allocate resources, measure performance, and implement targeted financial strategies.

Definition of a Revenue Center

A Revenue Center is a business unit or department primarily responsible for generating sales or income without direct control over costs or expenses. Its main objective is to maximize revenue by focusing on activities like sales, marketing, or client acquisition. Unlike a Profit Center, a Revenue Center does not manage profitability but contributes to the organization's top-line growth.

Definition of a Profit Center

A Profit Center is a business unit or department responsible for generating revenue while controlling its own costs, thereby directly contributing to the company's overall profitability. Unlike a Revenue Center, which focuses solely on sales and revenue generation without considering expenses, a Profit Center evaluates both income and expenditures to determine net profit. This dual accountability enables organizations to assess financial performance more accurately and make strategic decisions based on profit margins.

Key Differences between Revenue Centers and Profit Centers

Revenue centers focus exclusively on generating sales and income, tracking revenue without accounting for associated costs or expenses. Profit centers measure both revenue and costs, allowing businesses to evaluate overall profitability and operational efficiency. The key difference lies in revenue centers emphasizing top-line performance, whereas profit centers provide a comprehensive view of financial performance by considering both income and expenses.

Roles and Responsibilities in Revenue Centers

Revenue centers focus primarily on generating sales and increasing top-line income, with roles centered around marketing, sales, and customer relationship management. Responsibilities include driving revenue growth, meeting sales targets, and implementing pricing strategies while minimizing cost control. Unlike profit centers, revenue centers do not manage expenses extensively or focus on overall profitability, as those tasks are typically handled by other organizational units.

Roles and Responsibilities in Profit Centers

Profit centers are business units responsible for generating revenue and managing expenses to achieve profitability, requiring roles that focus on both sales performance and cost control. Managers in profit centers analyze financial statements, make strategic decisions to enhance profit margins, and oversee operational efficiency to drive sustainable growth. Their responsibilities include budgeting, forecasting, and motivating teams to meet profit targets while ensuring resource allocation aligns with business goals.

Metrics for Measuring Performance

Revenue centers primarily measure performance using total sales, revenue growth rate, and customer acquisition metrics, emphasizing top-line results without accounting for costs. Profit centers evaluate performance based on net profit, profit margin, return on investment (ROI), and cost control efficiency, reflecting both revenue generation and expense management. Key performance indicators (KPIs) for revenue centers highlight sales volume and market share, while profit centers focus on profitability and financial sustainability.

Advantages and Disadvantages of Each Center

Revenue centers focus primarily on generating sales and increasing income without direct responsibility for costs, enabling businesses to measure and incentivize sales performance effectively. However, they may overlook cost control, leading to potential inefficiencies and reduced overall profitability. Profit centers manage both revenues and expenses, offering a comprehensive view of financial performance and encouraging accountability for profitability, but they require sophisticated management controls and can create internal conflicts over cost allocations.

Real-World Examples of Revenue and Profit Centers

Amazon Web Services (AWS) serves as a prime example of a profit center by generating significant earnings through its cloud computing services, directly impacting Amazon's overall profitability. In contrast, the marketing department of a retail brand functions as a revenue center by driving sales without directly bearing profit responsibility. Car manufacturers like Tesla treat their individual vehicle production plants as profit centers, where both revenues and expenses are managed to maximize profit margins.

Choosing the Right Structure for Your Business

Choosing the right structure between a Revenue Center and a Profit Center depends on your business goals and management focus. A Revenue Center emphasizes sales and top-line growth, ideal for divisions primarily responsible for generating income without direct cost accountability. In contrast, a Profit Center manages both revenues and expenses, providing a clearer picture of profitability and efficiency, which aids in strategic decision-making and resource allocation.

Revenue Center Infographic

libterm.com

libterm.com