Beta testing is a crucial phase in product development that allows real users to evaluate software before its official release. By participating, you can provide valuable feedback that helps identify bugs and improve overall performance. Explore the rest of this article to discover how beta testing can enhance your product experience and streamline its launch.

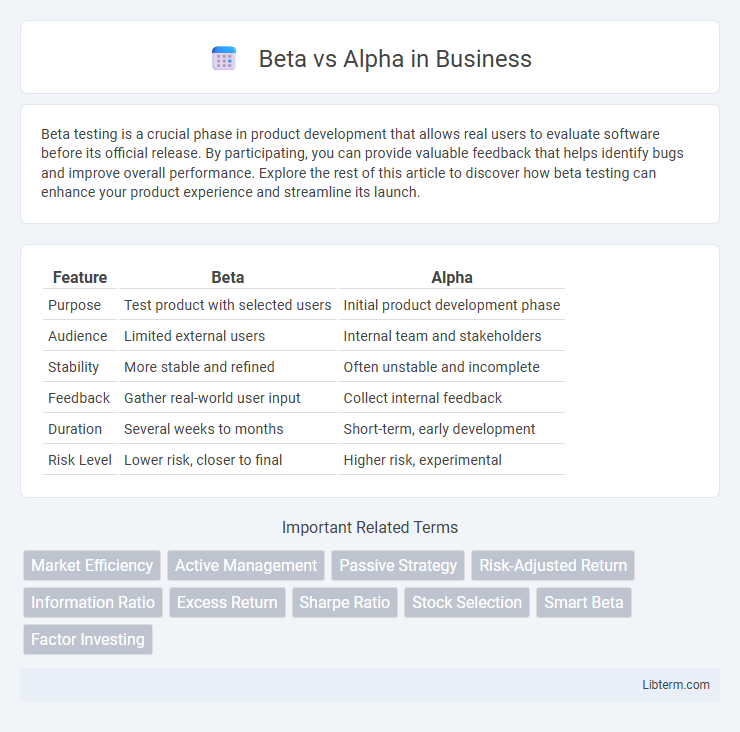

Table of Comparison

| Feature | Beta | Alpha |

|---|---|---|

| Purpose | Test product with selected users | Initial product development phase |

| Audience | Limited external users | Internal team and stakeholders |

| Stability | More stable and refined | Often unstable and incomplete |

| Feedback | Gather real-world user input | Collect internal feedback |

| Duration | Several weeks to months | Short-term, early development |

| Risk Level | Lower risk, closer to final | Higher risk, experimental |

Understanding Alpha and Beta: Key Definitions

Alpha represents the excess return of an investment relative to the return of a benchmark index, measuring skill or added value by a portfolio manager. Beta quantifies the sensitivity of an asset's returns to market movements, indicating its systematic risk compared to the overall market. Understanding these concepts is crucial for evaluating investment performance and risk management strategies.

Historical Context: The Origins of Alpha and Beta

Alpha and Beta terms originated in finance during the mid-20th century, with Alpha representing excess returns above market benchmarks and Beta measuring volatility relative to the market. The Capital Asset Pricing Model (CAPM), developed in the 1960s by William Sharpe, fundamentally shaped these concepts by formalizing Beta as a risk metric and Alpha as performance beyond expected returns. These metrics have since evolved, becoming essential tools for portfolio management and investment performance analysis.

Fundamental Differences Between Alpha and Beta

Alpha represents the excess return of an investment relative to a benchmark index, indicating the value a portfolio manager adds through active management. Beta measures the sensitivity of an asset's returns to market movements, reflecting its systematic risk and volatility compared to the overall market. While alpha assesses performance and skill, beta quantifies risk exposure, making both crucial for evaluating investment strategies.

Alpha and Beta in Investment Strategies

Alpha in investment strategies represents the excess return generated by an asset or portfolio relative to a benchmark index, indicating the value added by active management. Beta measures an asset's sensitivity to market movements, reflecting its systematic risk and volatility compared to the overall market. Investors seeking to maximize alpha focus on security selection and market timing, while those emphasizing beta aim to achieve returns through broad market exposure.

Risk Management: Alpha vs Beta Approach

The Beta approach in risk management emphasizes measuring and controlling systemic risks linked to market volatility and economic cycles, leveraging beta coefficients to quantify asset sensitivity to market movements. The Alpha approach prioritizes generating excess returns through active risk-taking, focusing on unique, non-market risks and strategic asset selection to outperform benchmarks. Effective risk management balances Beta's market-related risk assessment with Alpha's targeted risk strategies to optimize portfolio performance while mitigating potential losses.

Measuring Performance: Alpha Metrics Explained

Alpha metrics quantify an investment's excess return relative to a benchmark index, serving as a key indicator of a portfolio manager's ability to generate value beyond market movements. Measuring performance through alpha involves calculating the difference between the actual return and the expected return based on the portfolio's beta, which represents systematic market risk. Investors rely on alpha to assess skillful management, distinguishing genuine outperformance from returns driven solely by market exposure.

The Role of Beta in Portfolio Diversification

Beta measures a stock's sensitivity to market movements, indicating its volatility relative to the overall market, while Alpha represents the stock's performance relative to its expected return given its Beta. In portfolio diversification, Beta plays a crucial role by helping investors balance market risk; low or negative Beta stocks can reduce overall portfolio volatility during market downturns. Incorporating assets with varying Beta values optimizes risk-adjusted returns, enhancing the portfolio's resilience against market fluctuations.

Alpha Generation Techniques for Investors

Alpha generation techniques for investors primarily involve exploiting market inefficiencies through advanced quantitative models, alternative data analysis, and active portfolio management strategies aimed at outperforming benchmark indices. Incorporating machine learning algorithms and real-time sentiment analysis enhances the precision of alpha signals, allowing investors to capitalize on transient market opportunities. Risk-adjusted performance measurement and continuous strategy refinement are critical to sustaining alpha over time in dynamic market conditions.

Common Misconceptions About Alpha and Beta

Common misconceptions about alpha and beta often confuse these terms as personality traits, while they are actually market risk measures in finance--alpha represents excess returns beyond a benchmark, and beta indicates volatility relative to the market. Many assume a high beta stock is inherently risky, but this depends on an investor's risk tolerance and portfolio strategy. Misunderstanding these metrics can lead to poor investment decisions, emphasizing the importance of distinguishing alpha as performance and beta as systematic risk.

Choosing the Right Approach: Alpha, Beta, or Both?

Selecting the right testing approach depends on product goals, target audience, and feedback needs; alpha testing involves internal teams identifying bugs early, while beta testing engages real users to provide user experience insights and uncover broader issues. Combining both alpha and beta phases offers comprehensive validation, ensuring functional stability during alpha and real-world usability during beta. Organizations aiming for robust software quality often plan sequential alpha and beta cycles to maximize issue detection and enhance product readiness.

Beta Infographic

libterm.com

libterm.com