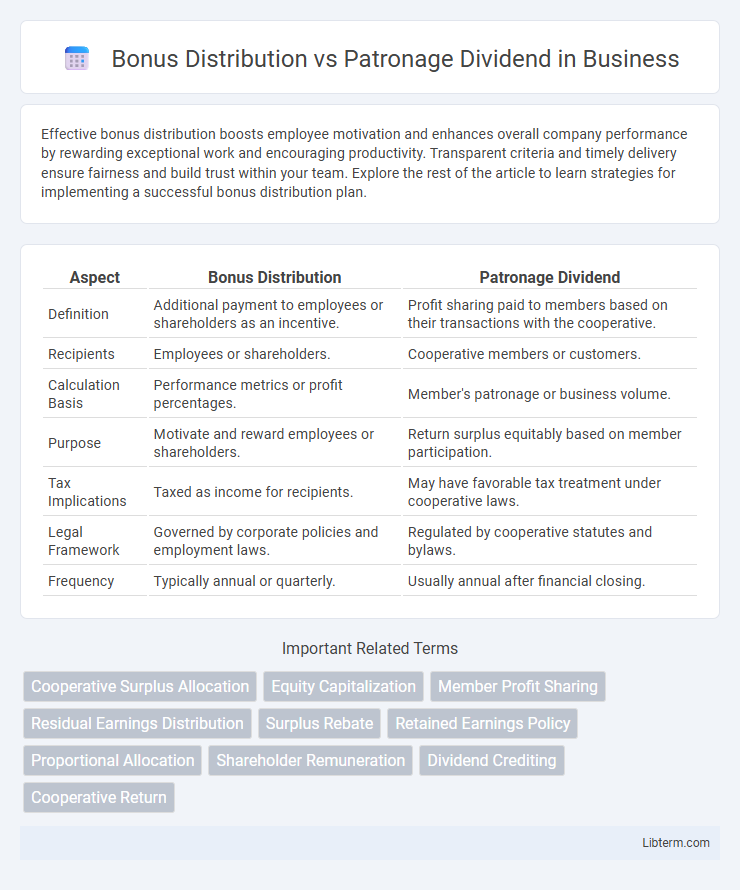

Effective bonus distribution boosts employee motivation and enhances overall company performance by rewarding exceptional work and encouraging productivity. Transparent criteria and timely delivery ensure fairness and build trust within your team. Explore the rest of the article to learn strategies for implementing a successful bonus distribution plan.

Table of Comparison

| Aspect | Bonus Distribution | Patronage Dividend |

|---|---|---|

| Definition | Additional payment to employees or shareholders as an incentive. | Profit sharing paid to members based on their transactions with the cooperative. |

| Recipients | Employees or shareholders. | Cooperative members or customers. |

| Calculation Basis | Performance metrics or profit percentages. | Member's patronage or business volume. |

| Purpose | Motivate and reward employees or shareholders. | Return surplus equitably based on member participation. |

| Tax Implications | Taxed as income for recipients. | May have favorable tax treatment under cooperative laws. |

| Legal Framework | Governed by corporate policies and employment laws. | Regulated by cooperative statutes and bylaws. |

| Frequency | Typically annual or quarterly. | Usually annual after financial closing. |

Introduction to Bonus Distribution and Patronage Dividend

Bonus distribution is a method where companies allocate a portion of profits to shareholders as additional shares, enhancing investment value without immediate cash outflow. Patronage dividends, commonly used in cooperatives, return earnings to members based on their level of participation or usage, aligning profit distribution with member contribution. Both concepts emphasize profit sharing but differ in their application and calculation criteria.

Key Definitions: Bonus Distribution vs Patronage Dividend

Bonus distribution refers to the allocation of additional shares or cash payments to shareholders based on the company's profits or retained earnings, serving as a reward for their investment. Patronage dividend is a refund or rebate given to members or customers of a cooperative based on their level of participation or transactions with the cooperative, reflecting their contribution to the cooperative's overall earnings. Both bonus distribution and patronage dividend represent profit-sharing mechanisms but differ in their basis--shareholder equity versus cooperative member patronage.

Legal Framework and Regulatory Requirements

Bonus distribution and patronage dividends are governed by distinct legal frameworks and regulatory requirements tailored to their respective financial contexts. Bonus distributions, generally declared by corporations under corporate law statutes such as the Companies Act, must comply with shareholder approval, reserve sufficiency, and disclosure norms to ensure transparency and protect investor interests. Patronage dividends, prevalent in cooperative or mutual organizations, are regulated by cooperative societies laws and IRS guidelines, requiring allocation based on member transactions and adherence to specific tax treatments to maintain cooperative status and avoid double taxation.

Eligibility Criteria for Recipients

Bonus distribution is typically granted to all employees based on company performance or individual productivity metrics, requiring active employment during the payout period. Patronage dividends are allocated exclusively to cooperative members who have conducted business with the cooperative, with eligibility often linked to the volume of transactions or patronage during the fiscal year. While bonus distribution emphasizes employment status and contribution, patronage dividends prioritize membership and economic participation within the cooperative.

Calculation Methods for Bonus and Patronage Dividend

Bonus distribution typically depends on the company's net profits and is calculated as a fixed percentage of the face value of shares held by the shareholders. Patronage dividend calculation is based on the amount of business a member transacts with a cooperative or mutual organization during a financial period, usually expressed as a percentage of the member's total purchases or sales. While bonus distribution rewards typical equity shareholders uniformly, patronage dividends incentivize members proportionally according to their level of participation in the cooperative's activities.

Purpose and Objectives of Each Distribution Method

Bonus distribution aims to reward shareholders based on the profitability of the company, reflecting their investment returns and promoting shareholder loyalty. Patronage dividends are designed to allocate earnings to cooperative members in proportion to their transactions, reinforcing member participation and supporting cooperative principles. Each distribution method aligns with distinct objectives: bonus distribution focuses on financial investment returns, while patronage dividends emphasize member engagement and equitable profit-sharing.

Financial Impact on Members and the Organization

Bonus distribution directly rewards members based on their transaction volume, increasing individual financial returns and potentially boosting member loyalty. Patronage dividends allocate profits proportionally to member contributions, aligning incentives and distributing organizational earnings more equitably. Both methods affect the organization's cash flow and capital reserves, with bonus distributions typically resulting in immediate outflows while patronage dividends can be deferred or reinvested to support long-term financial stability.

Tax Implications and Reporting

Bonus distribution is generally treated as a taxable dividend to shareholders, subject to withholding taxes and must be reported as dividend income on individual tax returns. Patronage dividends, issued by cooperatives based on members' transactions, are often deductible by the cooperative and may be reported as a return of capital or income depending on the jurisdiction, impacting the members' taxable income differently. Accurate reporting of both types on financial statements and tax filings is crucial to ensure compliance with IRS rules and to optimize tax liabilities for both entities and recipients.

Advantages and Disadvantages of Both Approaches

Bonus distribution provides immediate financial rewards to shareholders based on company profits, enhancing shareholder satisfaction and loyalty, but it can reduce retained earnings needed for growth or debt repayment. Patronage dividends allocate profits to members based on their participation or usage of cooperative services, promoting member loyalty and equitable profit sharing, yet it may complicate accounting and reduce funds available for reinvestment. Both approaches balance profit sharing and reinvestment differently, with bonus distribution favoring direct shareholder returns and patronage dividends supporting cooperative member engagement and fairness.

Choosing Between Bonus Distribution and Patronage Dividend

Choosing between bonus distribution and patronage dividends depends on a cooperative's financial strategy and member expectations. Bonus distribution typically rewards members based on the organization's overall profitability, enhancing member equity, while patronage dividends return a portion of profits proportional to individual member transactions, emphasizing fair return on patronage. Evaluating the cooperative's fiscal health, member engagement, and long-term growth goals is crucial in determining the optimal approach to profit sharing.

Bonus Distribution Infographic

libterm.com

libterm.com