An Initial Public Offering (IPO) marks the first time a private company offers shares to the public, providing access to capital markets for growth and expansion. This process involves rigorous financial scrutiny, regulatory compliance, and strategic planning to maximize valuation and investor interest. Discover how an IPO can transform your business and what steps you need to succeed by reading the rest of the article.

Table of Comparison

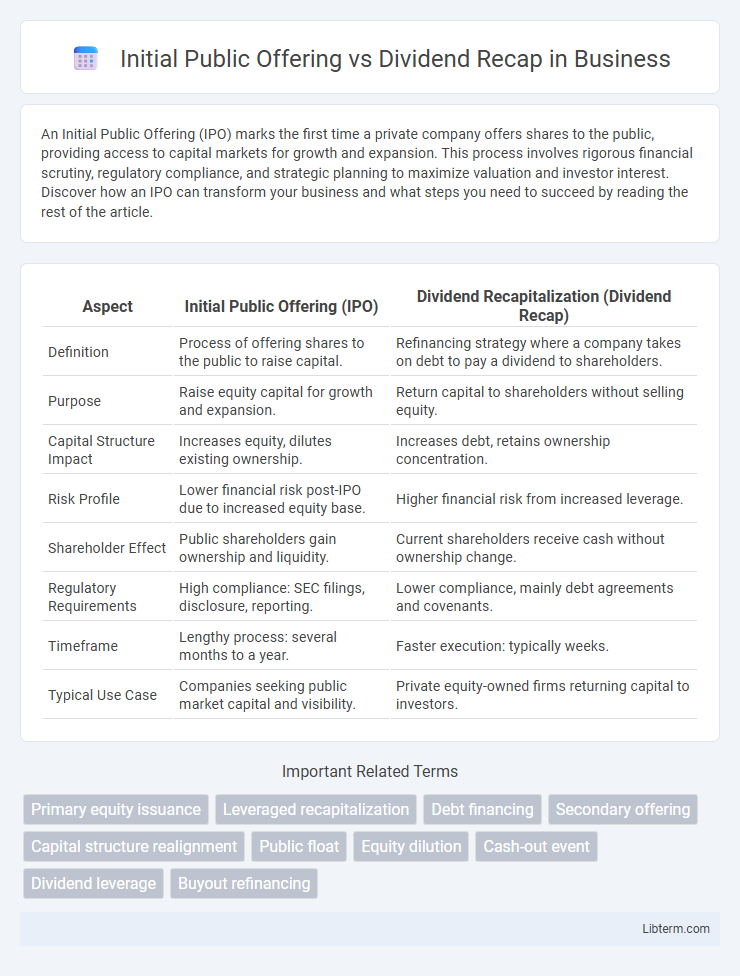

| Aspect | Initial Public Offering (IPO) | Dividend Recapitalization (Dividend Recap) |

|---|---|---|

| Definition | Process of offering shares to the public to raise capital. | Refinancing strategy where a company takes on debt to pay a dividend to shareholders. |

| Purpose | Raise equity capital for growth and expansion. | Return capital to shareholders without selling equity. |

| Capital Structure Impact | Increases equity, dilutes existing ownership. | Increases debt, retains ownership concentration. |

| Risk Profile | Lower financial risk post-IPO due to increased equity base. | Higher financial risk from increased leverage. |

| Shareholder Effect | Public shareholders gain ownership and liquidity. | Current shareholders receive cash without ownership change. |

| Regulatory Requirements | High compliance: SEC filings, disclosure, reporting. | Lower compliance, mainly debt agreements and covenants. |

| Timeframe | Lengthy process: several months to a year. | Faster execution: typically weeks. |

| Typical Use Case | Companies seeking public market capital and visibility. | Private equity-owned firms returning capital to investors. |

Introduction to Initial Public Offerings (IPO)

An Initial Public Offering (IPO) marks a company's first sale of shares to the public, enabling access to capital markets for raising substantial funds. This process increases transparency and regulatory compliance, enhancing investor confidence while providing liquidity to early investors and founders. Unlike dividend recapitalizations, which involve taking on debt to pay dividends, IPOs create equity value and offer long-term growth potential through expanded shareholder participation.

Understanding Dividend Recapitalizations

Dividend recapitalizations allow companies to raise cash by increasing debt instead of issuing new equity, differentiating them from Initial Public Offerings (IPOs) where new shares are sold to public investors. This strategy enables existing shareholders to extract value without diluting ownership, leveraging the company's cash flow to cover debt service. Understanding dividend recaps is crucial for investors seeking alternative liquidity events beyond traditional equity markets and IPO processes.

Key Differences Between IPOs and Dividend Recaps

Initial Public Offerings (IPOs) involve a company offering its shares to the public for the first time, providing capital for growth and creating liquidity for early investors. Dividend Recapitalizations (Dividend Recaps) allow private companies to borrow funds or issue debt to pay dividends to shareholders without selling equity, often increasing leverage and financial risk. The key difference lies in IPOs raising new equity capital while Dividend Recaps return capital to shareholders through debt, impacting company ownership and financial structure distinctly.

Strategic Objectives: IPO vs Dividend Recap

Initial Public Offering (IPO) primarily aims to raise capital by selling shares to the public, enabling business expansion, debt reduction, or enhancing market visibility. Dividend Recapitalization (Dividend Recap) focuses on returning cash to shareholders by increasing company debt without selling equity, often used for shareholder liquidity or financial restructuring. While IPOs prioritize growth and long-term market positioning, dividend recaps emphasize immediate shareholder returns and maintaining control.

Financial Implications for Companies

An Initial Public Offering (IPO) provides companies with substantial capital influx by selling equity to the public, enhancing liquidity and enabling debt reduction or growth investment. A Dividend Recapitalization (Dividend Recap) involves raising debt to pay dividends to shareholders, increasing leverage and financial risk but offering immediate returns to investors without equity dilution. Companies must balance IPO's potential for long-term financial stability against Dividend Recap's short-term cash flow impact and elevated debt servicing obligations.

Impact on Ownership Structure

Initial Public Offering (IPO) dilutes existing ownership by introducing new public shareholders, often reducing the percentage held by founders and early investors. Dividend Recapitalization allows existing owners to extract cash by increasing company debt, maintaining control without altering equity stakes. The choice between IPO and dividend recap significantly impacts control dynamics and shareholder influence within a company.

Effects on Shareholder Value

An Initial Public Offering (IPO) typically increases shareholder value by providing liquidity, enhancing company visibility, and enabling access to capital for growth. Dividend Recapitalization (Dividend Recap) offers immediate cash returns to shareholders but may increase corporate leverage, potentially risking long-term value. IPOs align shareholder interests with future growth prospects, while dividend recaps prioritize short-term payout at the expense of balance sheet strength.

Risks and Challenges of Each Approach

Initial Public Offerings (IPOs) involve significant risks such as market volatility, regulatory scrutiny, and high costs, which can lead to undervaluation and dilution of ownership for existing shareholders. Dividend Recapitalizations pose challenges including increased financial leverage and the potential for reduced credit ratings, which may constrain future growth and increase bankruptcy risk. Both approaches require careful evaluation of market conditions, company cash flow stability, and shareholder expectations to balance immediate liquidity needs against long-term financial health.

Choosing the Right Path: Factors to Consider

Choosing between an Initial Public Offering (IPO) and a Dividend Recapitalization (Dividend Recap) depends on factors such as company growth stage, capital needs, and shareholder goals. IPOs provide access to public markets for long-term capital and liquidity but involve regulatory scrutiny and market volatility. Dividend Recaps offer immediate cash returns to shareholders by leveraging debt without diluting ownership, best suited for mature companies with stable cash flows.

Real-World Examples and Case Studies

Initial Public Offerings (IPOs) and Dividend Recapitalizations serve distinct financial strategies for companies seeking capital or shareholder returns. For instance, Facebook's 2012 IPO raised approximately $16 billion to fund expansion and innovation, illustrating IPOs' role in growth financing. Conversely, Dell's 2013 dividend recapitalization involved issuing debt to pay shareholders a $3.4 billion dividend, demonstrating how mature firms use div recaps to return capital without diluting ownership.

Initial Public Offering Infographic

libterm.com

libterm.com