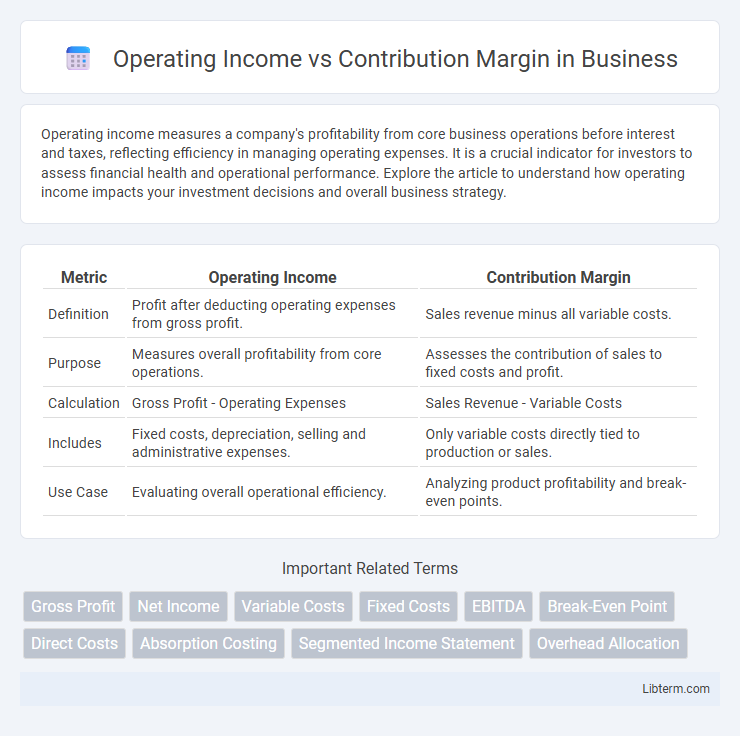

Operating income measures a company's profitability from core business operations before interest and taxes, reflecting efficiency in managing operating expenses. It is a crucial indicator for investors to assess financial health and operational performance. Explore the article to understand how operating income impacts your investment decisions and overall business strategy.

Table of Comparison

| Metric | Operating Income | Contribution Margin |

|---|---|---|

| Definition | Profit after deducting operating expenses from gross profit. | Sales revenue minus all variable costs. |

| Purpose | Measures overall profitability from core operations. | Assesses the contribution of sales to fixed costs and profit. |

| Calculation | Gross Profit - Operating Expenses | Sales Revenue - Variable Costs |

| Includes | Fixed costs, depreciation, selling and administrative expenses. | Only variable costs directly tied to production or sales. |

| Use Case | Evaluating overall operational efficiency. | Analyzing product profitability and break-even points. |

Understanding Operating Income: Definition and Importance

Operating income represents a company's profit after deducting operating expenses such as wages, depreciation, and cost of goods sold from gross profit, highlighting the core profitability of business operations. It provides key insights into operational efficiency and helps investors assess the company's ability to generate earnings from its primary activities before interest and taxes. Understanding operating income is crucial for evaluating management's effectiveness in controlling costs and driving revenue growth within the competitive market landscape.

What Is Contribution Margin? Key Concepts Explained

Contribution margin is the difference between sales revenue and variable costs, indicating how much revenue contributes to fixed costs and profit. It is a crucial metric for understanding the profitability of individual products or services by isolating the impact of variable expenses. Operating income, in contrast, accounts for both fixed and variable costs, reflecting the overall profitability of the business after all operating expenses.

Calculating Operating Income: Step-by-Step Guide

To calculate operating income, subtract the total operating expenses, including fixed and variable costs, from the total gross profit. Begin by determining the total revenue, then deduct the cost of goods sold (COGS) to find the gross profit. Finally, subtract all operating expenses such as selling, general and administrative (SG&A) costs to arrive at the operating income, which reflects a company's profitability from core business operations.

How to Determine Contribution Margin: Formula and Example

Contribution margin is calculated by subtracting variable costs from sales revenue, expressed as Contribution Margin = Sales Revenue - Variable Costs. For example, if a product sells for $100 and its variable costs are $60, the contribution margin is $40 per unit, representing the amount available to cover fixed costs and generate profit. Analyzing contribution margin helps businesses understand how much revenue contributes to fixed expenses and profitability, unlike operating income which accounts for all expenses including fixed costs and overhead.

Key Differences: Operating Income vs Contribution Margin

Operating Income reflects a company's profitability after deducting operating expenses such as salaries, rent, and utilities, while Contribution Margin measures the amount remaining from sales revenue after variable costs are subtracted, indicating the capacity to cover fixed costs. Operating Income provides insight into overall operational efficiency, incorporating fixed and variable expenses, whereas Contribution Margin emphasizes the impact of variable costs on profitability. Understanding the Key Differences between Operating Income and Contribution Margin is essential for accurate financial analysis and strategic decision-making in cost management and pricing.

Impact of Fixed and Variable Costs on Both Metrics

Operating income reflects the profit after deducting both fixed and variable costs from total revenue, making it sensitive to changes in fixed expenses such as rent and salaries. Contribution margin highlights revenue remaining after variable costs are subtracted, emphasizing the impact of direct production costs like materials and labor on profitability. The fixed costs influence operating income more significantly, while contribution margin provides insight into how variable costs affect the ability to cover those fixed expenses and generate profit.

Role of Operating Income in Financial Analysis

Operating income measures a company's profitability by subtracting operating expenses from gross profit, reflecting core business performance before taxes and interest. It plays a crucial role in financial analysis by providing insights into operational efficiency and the ability to generate earnings from regular business activities. Unlike contribution margin, which highlights variable cost coverage and product-level profitability, operating income evaluates overall business sustainability and management effectiveness.

Strategic Decision-Making Using Contribution Margin

Contribution margin provides critical insight into product profitability by isolating variable costs from sales revenue, enabling managers to identify which products contribute most to covering fixed costs and generating profit. Operating income includes fixed costs and is less effective for tactical decision-making, while contribution margin supports strategic choices such as pricing, product mix optimization, and cost control initiatives. Using contribution margin analysis empowers businesses to allocate resources efficiently, prioritize high-margin products, and improve overall financial performance.

Common Misconceptions About Operating Income and Contribution Margin

Operating income is frequently misunderstood as a direct measure of cash flow, though it includes non-cash expenses like depreciation, whereas contribution margin strictly reflects the incremental profit per unit after variable costs. Many assume contribution margin accounts for fixed costs, but it only covers variable expenses and helps assess product profitability and pricing decisions. Misinterpreting these differences leads to flawed business analysis and suboptimal financial strategies.

Which Metric Should Businesses Prioritize for Growth?

Operating income measures overall profitability by subtracting operating expenses from gross profit, reflecting a company's efficiency in managing fixed and variable costs. Contribution margin highlights the incremental profit from each unit sold by subtracting variable costs from sales revenue, crucial for pricing and production decisions. Businesses aiming for sustainable growth should prioritize contribution margin to optimize product mix and cost control, while also monitoring operating income to ensure long-term financial health.

Operating Income Infographic

libterm.com

libterm.com