Asset value reflects the worth of an asset based on its market price, intrinsic qualities, or potential to generate future income. Accurately assessing asset value is crucial for investment decisions, portfolio management, and financial reporting. Explore the rest of the article to understand how to effectively evaluate your asset value and make informed financial choices.

Table of Comparison

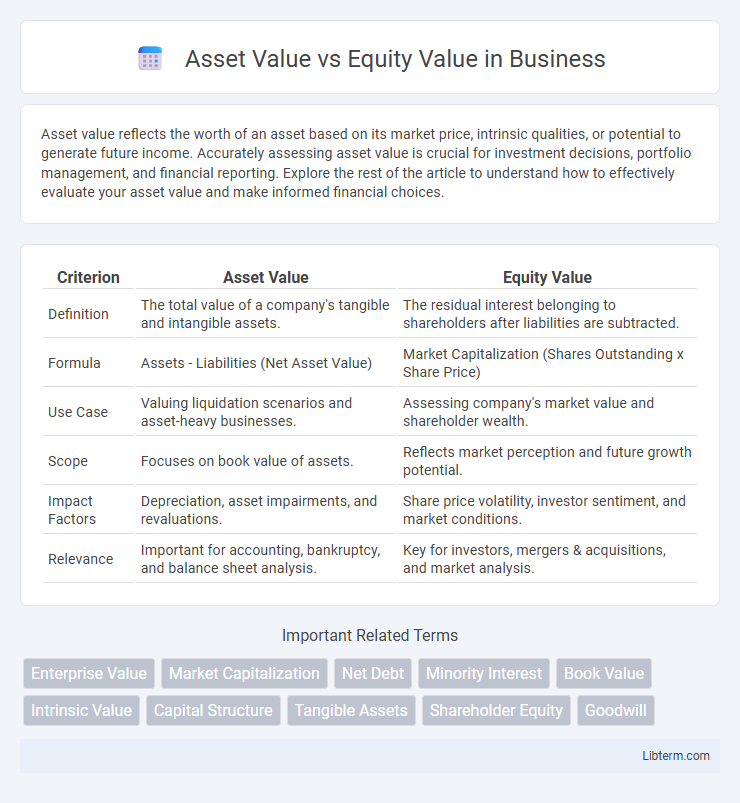

| Criterion | Asset Value | Equity Value |

|---|---|---|

| Definition | The total value of a company's tangible and intangible assets. | The residual interest belonging to shareholders after liabilities are subtracted. |

| Formula | Assets - Liabilities (Net Asset Value) | Market Capitalization (Shares Outstanding x Share Price) |

| Use Case | Valuing liquidation scenarios and asset-heavy businesses. | Assessing company's market value and shareholder wealth. |

| Scope | Focuses on book value of assets. | Reflects market perception and future growth potential. |

| Impact Factors | Depreciation, asset impairments, and revaluations. | Share price volatility, investor sentiment, and market conditions. |

| Relevance | Important for accounting, bankruptcy, and balance sheet analysis. | Key for investors, mergers & acquisitions, and market analysis. |

Introduction to Asset Value and Equity Value

Asset Value represents the total worth of a company's tangible and intangible assets, reflecting what the business owns, including property, equipment, inventory, and intellectual property. Equity Value, also known as market capitalization, indicates the value attributable to shareholders after liabilities are subtracted from total assets, representing ownership interest in the company. Understanding the difference helps investors evaluate company worth, potential returns, and financial health from both asset-based and market-based perspectives.

Defining Asset Value

Asset Value represents the total worth of a company's tangible and intangible assets, including cash, property, equipment, and intellectual property, measured at market or fair value. It reflects the replacement cost or current market price of assets owned by the business, excluding liabilities. Understanding Asset Value is crucial for asset-based valuations, liquidation analysis, and determining the fundamental worth of a company's resources.

What is Equity Value?

Equity Value, also known as market capitalization, represents the total value of a company's outstanding shares of common stock, reflecting the ownership interest held by shareholders. It is calculated by multiplying the current share price by the total number of shares outstanding, encompassing both market perceptions and investor sentiment. Equity Value excludes debt and other liabilities, differentiating it from Asset Value, which accounts for the company's total tangible and intangible assets.

Key Differences Between Asset Value and Equity Value

Asset value represents the total value of a company's tangible and intangible assets, often calculated as the book value or market value of all owned resources. Equity value, also known as market capitalization, reflects the shareholders' ownership interest, calculated by multiplying the current stock price by the total number of outstanding shares. Key differences include asset value focusing on company resources, while equity value assesses market perception and future growth potential.

Importance in Business Valuation

Asset Value measures a company's net worth based on the fair market value of its total assets minus liabilities, providing a baseline for liquidation scenarios. Equity Value represents the market value of shareholders' ownership, reflecting stock price multiplied by outstanding shares, which is crucial for investor perspectives and potential sale prices. Understanding both values is essential in business valuation to balance underlying asset worth with market perceptions and investment potential.

Methods for Calculating Asset Value

Methods for calculating asset value typically include the cost approach, market approach, and income approach. The cost approach estimates the value based on the replacement or reproduction cost of assets minus depreciation, providing a tangible asset measurement. The market approach compares similar asset sales to determine value, while the income approach calculates asset value based on the expected future cash flows generated by the asset.

Methods for Calculating Equity Value

Methods for calculating equity value primarily include the market capitalization approach, enterprise value minus net debt, and discounted cash flow (DCF) analysis. Market capitalization is computed by multiplying the current share price by the total number of outstanding shares. The DCF method involves projecting future free cash flows and discounting them to present value, then adjusting for debt and non-operating assets to derive equity value.

Impact on Investment Decisions

Asset value reflects the total worth of a company's tangible and intangible assets, crucial for investors assessing liquidation scenarios or asset-heavy businesses, while equity value represents shareholders' ownership, guiding decisions related to stock price and market capitalization. Investment decisions hinge on understanding asset value to evaluate underlying company stability and on equity value to determine market perception and potential returns. Recognizing the distinction influences strategies such as mergers, acquisitions, and portfolio diversification by aligning risk tolerance with asset-backed security.

Common Misconceptions

Asset value is often mistakenly equated with equity value, though asset value represents the total worth of a company's tangible and intangible assets, while equity value reflects shareholders' ownership after liabilities are subtracted. Many believe equity value simply equals the market capitalization, but it must account for debt, preferred stock, and cash equivalents to provide an accurate valuation. Confusing these concepts can lead to flawed investment decisions and misinterpretations of a company's financial health.

Summary and Final Thoughts

Asset Value represents the total worth of a company's tangible and intangible assets, reflecting what the business owns outright. Equity Value, also known as market capitalization, indicates the market's perception of the company's total value attributable to shareholders after liabilities are deducted. Understanding the distinction between Asset Value and Equity Value is crucial for investors and analysts in assessing a company's true financial health and investment potential.

Asset Value Infographic

libterm.com

libterm.com