Acquisition involves the strategic process of obtaining assets, companies, or technologies to enhance business growth and competitive advantage. Understanding the key steps and considerations in acquisitions can help you make informed decisions that align with your goals. Explore the rest of the article to discover essential insights and best practices for successful acquisitions.

Table of Comparison

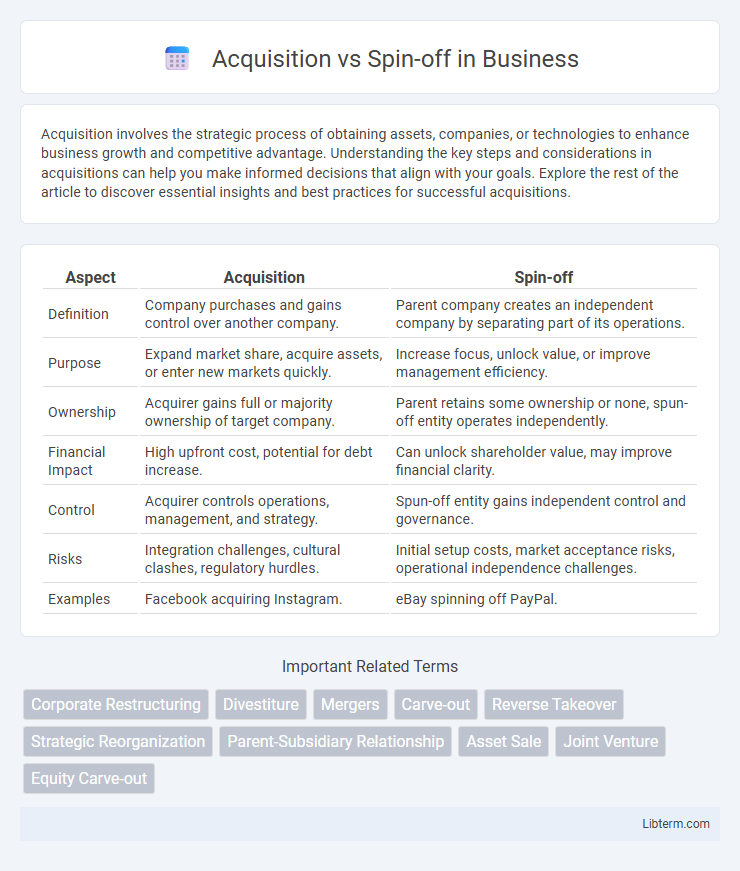

| Aspect | Acquisition | Spin-off |

|---|---|---|

| Definition | Company purchases and gains control over another company. | Parent company creates an independent company by separating part of its operations. |

| Purpose | Expand market share, acquire assets, or enter new markets quickly. | Increase focus, unlock value, or improve management efficiency. |

| Ownership | Acquirer gains full or majority ownership of target company. | Parent retains some ownership or none, spun-off entity operates independently. |

| Financial Impact | High upfront cost, potential for debt increase. | Can unlock shareholder value, may improve financial clarity. |

| Control | Acquirer controls operations, management, and strategy. | Spun-off entity gains independent control and governance. |

| Risks | Integration challenges, cultural clashes, regulatory hurdles. | Initial setup costs, market acceptance risks, operational independence challenges. |

| Examples | Facebook acquiring Instagram. | eBay spinning off PayPal. |

Understanding Acquisitions and Spin-offs

Acquisitions involve one company purchasing another to expand market share, diversify products, or gain new technologies, often leading to integration of operations and resources. Spin-offs occur when a parent company separates a division or subsidiary into an independent entity, allowing focused management and unlocking shareholder value through distinct market positioning. Understanding these corporate restructuring strategies is crucial for assessing impacts on company growth, financial performance, and competitive dynamics.

Key Differences Between Acquisitions and Spin-offs

Acquisitions involve one company purchasing another to consolidate resources, control operations, and expand market share, while spin-offs create a new independent company by separating a division or subsidiary from the parent organization. Key differences include control transfer, with acquisitions resulting in ownership change and spin-offs maintaining parent company shareholdings distributed to shareholders. Financial impact also varies; acquisitions often require significant capital investment, whereas spin-offs aim to unlock shareholder value by allowing the new entity to operate autonomously.

Strategic Motivations Behind Acquisitions

Acquisitions are driven by strategic motivations such as expanding market share, acquiring new technologies, and achieving economies of scale to enhance competitive advantage. Companies pursue acquisitions to enter new markets quickly, diversify product portfolios, and leverage synergies that enhance operational efficiencies. In contrast, spin-offs often focus on unlocking shareholder value by allowing separated business units to focus on core competencies independently.

Strategic Motivations Behind Spin-offs

Spin-offs are primarily driven by strategic motivations such as unlocking shareholder value by separating non-core or underperforming units from the parent company. They enable focused management teams to pursue independent growth strategies, improve operational efficiency, and attract targeted investors aligned with the spin-off's specific business model. This strategic realignment often leads to enhanced market valuation and innovation opportunities for both the parent company and the spun-off entity.

Financial Impacts of Acquisitions vs Spin-offs

Acquisitions often require significant capital outlay and can increase a company's debt load, affecting cash flow and financial stability in the short term. Spin-offs typically unlock shareholder value by creating independent entities with clearer financial profiles, potentially boosting stock performance and reducing conglomerate discount. The financial impact of acquisitions may include goodwill impairment risks, whereas spin-offs can enhance operational efficiency and focus, improving long-term profitability metrics.

Risks and Challenges of Acquisitions

Acquisitions involve significant risks such as cultural clashes, integration difficulties, and overvaluation of the target company, which can lead to financial losses and operational disruptions. Challenges include managing differing organizational structures, aligning strategic goals, and retaining key talent during the transition. Failure to address these risks effectively can result in decreased shareholder value and long-term competitive disadvantages.

Risks and Challenges of Spin-offs

Spin-offs face significant risks including market acceptance uncertainty as newly independent entities lack established brand recognition and customer loyalty, increasing revenue volatility. Operational challenges arise from the need to develop standalone infrastructure, systems, and management teams, often leading to higher initial costs and inefficiencies. Financial risks include limited access to capital markets and potential liquidity constraints, which can hinder growth and competitive positioning in the absence of parent company support.

Case Studies: Successful Acquisitions and Spin-offs

Amazon's acquisition of Whole Foods in 2017 expanded its physical retail presence and boosted grocery delivery services, demonstrating strategic market integration. Conversely, PayPal's spin-off from eBay in 2015 allowed both entities to focus on core competencies, with PayPal flourishing independently in digital payments. These case studies highlight how acquisitions can drive rapid market entry while spin-offs enable focused growth and operational efficiency.

How to Decide: Acquisition or Spin-off?

Deciding between acquisition and spin-off depends on strategic goals, financial health, and market conditions. Acquisitions are optimal for rapid growth, market expansion, or acquiring new capabilities, while spin-offs suit companies aiming to unlock shareholder value or focus on core operations by separating non-core assets. Evaluating factors like integration complexity, cost, regulatory impact, and potential for innovation helps determine the best approach.

Future Trends in Corporate Restructuring

Future trends in corporate restructuring emphasize a dynamic balance between acquisitions and spin-offs driven by digital transformation and market specialization. Increasingly, companies pursue acquisitions to rapidly scale technology capabilities and global reach, while spin-offs enable focused innovation and agility within autonomous business units. Data from recent market analyses show a surge in strategic spin-offs in technology and healthcare sectors, reflecting a shift toward streamlined structures fostering accelerated growth and shareholder value.

Acquisition Infographic

libterm.com

libterm.com