Reputational risk can severely impact your business's trustworthiness and customer loyalty, leading to financial losses and damaged stakeholder relationships. Proactively managing this risk involves monitoring public perception, addressing potential crises swiftly, and maintaining transparent communication. Discover effective strategies to safeguard your reputation and strengthen your brand by reading the rest of the article.

Table of Comparison

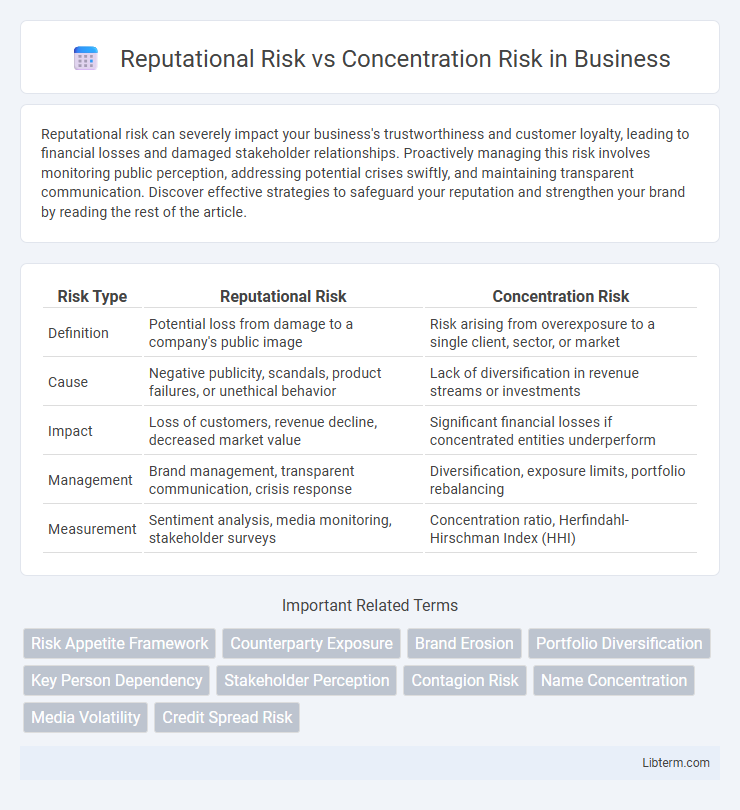

| Risk Type | Reputational Risk | Concentration Risk |

|---|---|---|

| Definition | Potential loss from damage to a company's public image | Risk arising from overexposure to a single client, sector, or market |

| Cause | Negative publicity, scandals, product failures, or unethical behavior | Lack of diversification in revenue streams or investments |

| Impact | Loss of customers, revenue decline, decreased market value | Significant financial losses if concentrated entities underperform |

| Management | Brand management, transparent communication, crisis response | Diversification, exposure limits, portfolio rebalancing |

| Measurement | Sentiment analysis, media monitoring, stakeholder surveys | Concentration ratio, Herfindahl-Hirschman Index (HHI) |

Introduction to Reputational Risk and Concentration Risk

Reputational risk refers to the potential loss an organization faces due to damage to its public image or stakeholder trust, often stemming from negative publicity, unethical behavior, or operational failures. Concentration risk involves the vulnerability that arises when a company's assets, investments, or exposures are heavily focused in a single area, industry, or counterparty, increasing the impact of adverse events on financial stability. Both risks are critical in risk management frameworks, requiring continuous monitoring to safeguard long-term organizational resilience.

Defining Reputational Risk

Reputational risk refers to the potential loss a company faces when its public image or stakeholder trust is damaged due to negative events or perceptions. Unlike concentration risk, which involves overexposure to a single counterparty, sector, or asset, reputational risk focuses on intangible harm affecting brand value and customer loyalty. Managing reputational risk requires proactive communication, ethical practices, and crisis management to safeguard long-term business sustainability.

Understanding Concentration Risk

Concentration risk arises when a financial institution or portfolio has significant exposure to a single counterparty, sector, or geographic region, increasing vulnerability to adverse events impacting that concentrated area. Unlike reputational risk, which concerns potential damage to brand value or public perception, concentration risk directly affects financial stability through loss amplification. Effective risk management involves diversification strategies, stress testing, and setting exposure limits to mitigate the impact of concentration risk on overall portfolio performance.

Key Differences Between Reputational and Concentration Risk

Reputational risk arises from potential damage to a company's brand or public image, often triggered by negative publicity or unethical behavior, impacting stakeholder trust and long-term profitability. Concentration risk refers to the vulnerability caused by overexposure to a single client, sector, or geographic region, leading to significant financial losses if that specific area faces downturns. Unlike reputational risk, which is intangible and perception-based, concentration risk is quantifiable through portfolio analysis and diversification metrics.

Causes of Reputational Risk in Organizations

Reputational risk in organizations primarily arises from ethical breaches, poor customer service, and failure to meet stakeholder expectations, leading to diminished trust and brand value. Other significant causes include regulatory non-compliance, negative media coverage, and ineffective crisis management strategies. These factors collectively threaten an organization's reputation more directly than concentration risk, which relates to financial exposure to a single counterparty or sector.

Factors Contributing to Concentration Risk

Concentration risk arises from excessive exposure to a single counterparty, industry, geographic region, or asset class, amplifying potential losses if adverse events impact that specific area. Key factors contributing to concentration risk include lack of portfolio diversification, high dependence on a few clients or sectors, and regulatory or economic environments that limit investment options. These risks are critical to monitor for maintaining financial stability and mitigating potential significant downturns.

Impact of Reputational Risk on Business Value

Reputational risk directly affects business value by undermining stakeholder trust, leading to customer attrition and decreased market capitalization. Negative perceptions can trigger regulatory scrutiny, legal penalties, and impaired access to capital, causing material financial losses. Effective management of reputational risk is critical for sustaining brand equity and long-term shareholder value compared to concentration risk, which primarily threatens financial stability through exposure to specific assets or counterparties.

Financial Consequences of Concentration Risk

Concentration risk in finance leads to significant financial consequences, including substantial losses from a lack of diversification across assets, sectors, or counterparties, which heightens vulnerability to market fluctuations or defaults. Highly concentrated portfolios or exposures can trigger liquidity crises and credit downgrades, directly impacting capital reserves and regulatory compliance costs. Unlike reputational risk, which primarily affects brand value and customer trust, the financial fallout from concentration risk is quantifiable through increased volatility, impaired asset values, and potential bankruptcy scenarios.

Risk Mitigation Strategies for Both Risks

Reputational risk mitigation strategies include proactive stakeholder communication, rigorous compliance programs, and real-time monitoring of social and media channels to detect and address negative sentiment early. Concentration risk is mitigated by diversifying portfolios across multiple sectors, geographies, and counterparties, alongside implementing exposure limits and stress testing to assess potential impacts. Both risks benefit from an integrated risk management framework that includes continuous assessment, scenario analysis, and embedding risk culture across the organization.

Conclusion: Managing Reputational and Concentration Risk

Effective management of reputational and concentration risks requires robust monitoring and diversified strategies to mitigate potential financial and brand damage. Implementing comprehensive risk assessments and maintaining transparent communication channels strengthens resilience against unexpected exposures. Organizations that integrate reputational safeguards with concentration risk controls enhance long-term stability and stakeholder trust.

Reputational Risk Infographic

libterm.com

libterm.com