Management fees are charges imposed by investment managers to oversee and administer your portfolio, covering services such as asset allocation, performance monitoring, and administrative costs. These fees directly impact your overall investment returns, making it essential to understand their structure and industry standards. Explore the rest of the article to learn how to evaluate management fees and optimize your investment strategy.

Table of Comparison

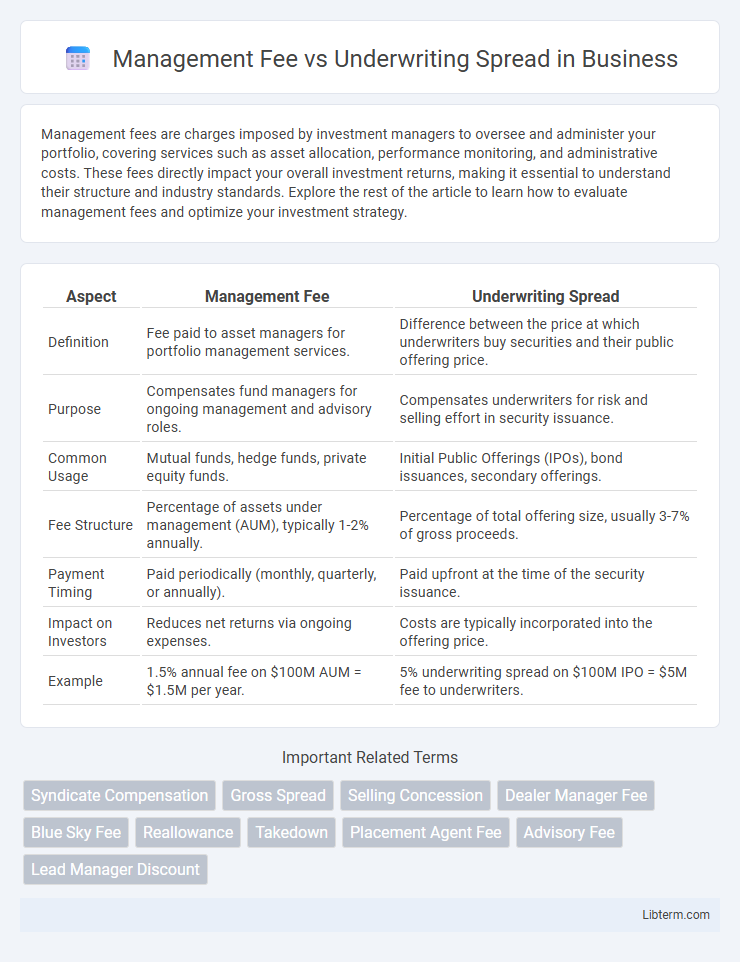

| Aspect | Management Fee | Underwriting Spread |

|---|---|---|

| Definition | Fee paid to asset managers for portfolio management services. | Difference between the price at which underwriters buy securities and their public offering price. |

| Purpose | Compensates fund managers for ongoing management and advisory roles. | Compensates underwriters for risk and selling effort in security issuance. |

| Common Usage | Mutual funds, hedge funds, private equity funds. | Initial Public Offerings (IPOs), bond issuances, secondary offerings. |

| Fee Structure | Percentage of assets under management (AUM), typically 1-2% annually. | Percentage of total offering size, usually 3-7% of gross proceeds. |

| Payment Timing | Paid periodically (monthly, quarterly, or annually). | Paid upfront at the time of the security issuance. |

| Impact on Investors | Reduces net returns via ongoing expenses. | Costs are typically incorporated into the offering price. |

| Example | 1.5% annual fee on $100M AUM = $1.5M per year. | 5% underwriting spread on $100M IPO = $5M fee to underwriters. |

Introduction to Management Fee and Underwriting Spread

Management fee represents the fixed percentage charged by investment managers for overseeing a fund or transaction, commonly ranging from 1% to 2% of assets under management. Underwriting spread refers to the difference between the price paid by underwriters to issuers and the price at which securities are sold to the public, encompassing gross spread components such as management fees, underwriting fees, and selling concessions. Both fees play critical roles in investment banking, fund operations, and capital raising processes, directly impacting net proceeds and investor returns.

Defining Management Fee in Capital Markets

Management fee in capital markets refers to the fixed percentage charged by asset managers for overseeing and administering investment funds, typically calculated on the total assets under management (AUM). This fee compensates for portfolio management, research, compliance, and operational costs, distinct from the underwriting spread, which represents the compensation to underwriters for risk and distribution during securities issuance. Understanding management fees is critical for investors to evaluate fund performance net of expenses and for fund managers to maintain sustainable operations.

Understanding the Underwriting Spread

The underwriting spread represents the difference between the price at which underwriters purchase securities from the issuer and the price at which they sell them to the public, serving as compensation for underwriting risk and distribution efforts. It typically includes components such as the management fee, underwriting fee, and selling concession, with the management fee constituting a portion allocated for administrative and organizational activities. Understanding the underwriting spread is crucial for issuers to evaluate the total cost of raising capital through public offerings and for investors to comprehend the pricing structure of new securities.

Key Differences Between Management Fee and Underwriting Spread

Management fee represents the fixed percentage charged by investment managers for overseeing and administering a fund or securities offering, typically calculated on the assets under management. Underwriting spread refers to the difference between the price paid by underwriters to issuers and the price at which securities are sold to the public, encompassing compensation for risk and distribution costs. Key differences include the management fee being a recurring charge based on assets managed, whereas the underwriting spread is a one-time transaction cost tied to the issuance of new securities.

Components of an Underwriting Spread

The underwriting spread consists of three main components: the management fee, the underwriting fee, and the selling concession, each representing a portion of the total compensation received by underwriters in a securities offering. The management fee is a fixed amount paid to the syndicate manager for coordinating the offering, while the underwriting fee compensates syndicate members for their risk in purchasing the securities. The selling concession rewards brokers for selling the securities to investors, making the underwriting spread a critical factor in determining the cost structure of an issuance.

Factors Influencing Management Fees

Management fees are influenced by fund size, investment strategy complexity, and operational costs, with larger funds often negotiating lower percentage fees due to economies of scale. Market conditions and competitive pressures also impact fee structures, prompting fund managers to adjust rates to attract and retain investors. In contrast, underwriting spreads depend primarily on deal size, risk profile, and syndicate participation, reflecting transaction-specific underwriting activities rather than ongoing fund management.

Impact on Issuer Costs

Management fees are fixed percentages paid to investment banks for advisory services during securities offerings, directly increasing issuer costs without variation based on fundraising success. Underwriting spreads include the gross spread covering management fees, underwriting fees, and selling concessions, collectively representing the total compensation to underwriters and significantly determining the net proceeds raised by the issuer. A higher underwriting spread reduces the issuer's net capital inflow, making efficient negotiation of both fees essential to minimize overall issuance costs.

Market Practices and Fee Structures

Management fees in investment banking typically range from 1% to 2% of the committed capital, reflecting the ongoing advisory and administrative services provided by fund managers. Underwriting spreads vary widely depending on deal size and risk, often comprising 3% to 7% of the gross proceeds and are divided into components such as the manager's fee, underwriting fee, and selling concession. Market practices favor transparent fee structures, with management fees providing steady income and underwriting spreads aligning incentives for successful capital raising and risk absorption.

Trends in Management Fees and Underwriting Spreads

Management fees in private equity and investment funds have shown a gradual decline, shifting from the traditional 2% annual rate to averages closer to 1.5% due to investor pressure and competitive market dynamics. Underwriting spreads, particularly in IPO and bond issuances, have experienced compression as heightened market efficiency and increased competition among underwriters reduce transaction costs. The trend indicates a convergence towards more cost-effective fund management and capital raising processes, optimizing returns for investors in both primary offerings and fund operations.

Choosing the Right Fee Structure for Your Offering

Selecting the appropriate fee structure for your offering requires understanding the distinctions between management fees and underwriting spreads. Management fees, typically a fixed percentage of assets, provide predictable revenue and cover ongoing services, while underwriting spreads represent the difference between the securities' offering price and the price paid to issuers, reflecting compensation for risk and distribution efforts. Evaluating factors such as deal size, market conditions, and the level of underwriting risk helps issuers optimize cost efficiency and align incentives with underwriters.

Management Fee Infographic

libterm.com

libterm.com