The margin of safety measures the difference between a product's actual performance and the minimum required performance, ensuring a buffer against unexpected failures or errors in design. It plays a crucial role in engineering, investing, and business decisions by providing a quantitative cushion to protect against uncertainties. Explore the rest of the article to understand how applying a margin of safety can safeguard your projects and investments.

Table of Comparison

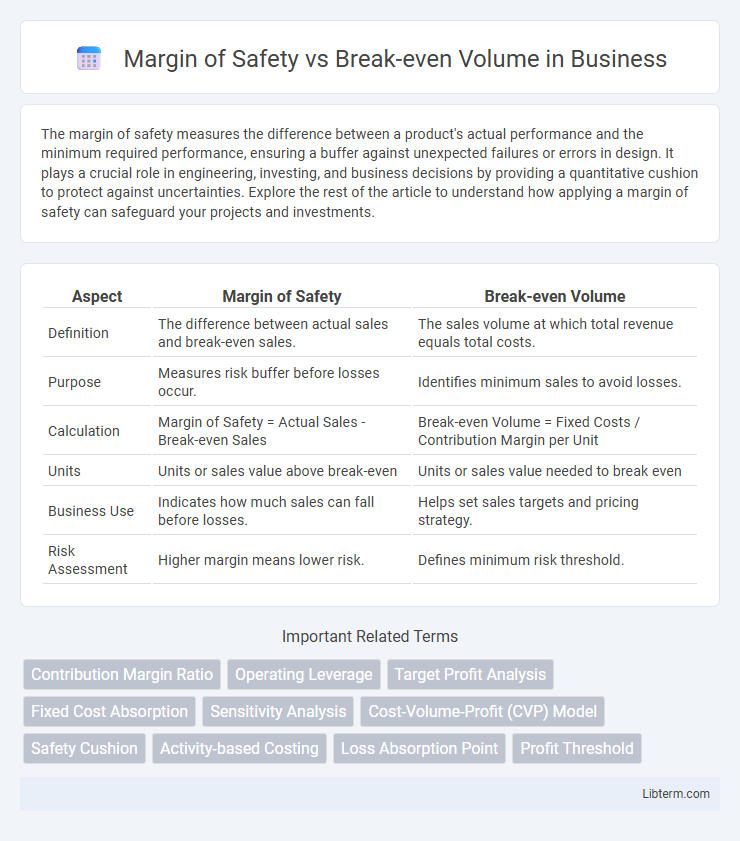

| Aspect | Margin of Safety | Break-even Volume |

|---|---|---|

| Definition | The difference between actual sales and break-even sales. | The sales volume at which total revenue equals total costs. |

| Purpose | Measures risk buffer before losses occur. | Identifies minimum sales to avoid losses. |

| Calculation | Margin of Safety = Actual Sales - Break-even Sales | Break-even Volume = Fixed Costs / Contribution Margin per Unit |

| Units | Units or sales value above break-even | Units or sales value needed to break even |

| Business Use | Indicates how much sales can fall before losses. | Helps set sales targets and pricing strategy. |

| Risk Assessment | Higher margin means lower risk. | Defines minimum risk threshold. |

Introduction to Margin of Safety and Break-even Volume

Margin of Safety represents the difference between actual sales and break-even sales, indicating the buffer before a business incurs losses. Break-even Volume is the sales quantity at which total revenues equal total costs, resulting in zero profit or loss. Understanding both concepts helps managers assess financial risk and make informed production and sales decisions.

Defining Margin of Safety

Margin of Safety represents the difference between actual sales and the break-even volume, indicating the extent to which sales can decline before a business incurs a loss. It quantifies risk by measuring how much sales can drop without affecting profitability, serving as a critical indicator for financial stability. Break-even volume, on the other hand, is the exact sales level at which total revenues equal total costs, resulting in zero profit or loss.

Understanding Break-even Volume

Break-even volume represents the minimum number of units that must be sold to cover total fixed and variable costs, ensuring zero profit or loss. Understanding break-even volume involves analyzing fixed costs, variable costs per unit, and selling price per unit to determine the point where total revenue equals total expenses. This metric is crucial for businesses to assess risk levels and make informed pricing and production decisions.

Key Differences between Margin of Safety and Break-even Volume

Margin of Safety represents the excess sales revenue beyond the break-even point, indicating how much sales can drop before a business incurs a loss. Break-even Volume is the exact quantity of sales needed to cover all fixed and variable costs, resulting in zero profit or loss. The key difference lies in Margin of Safety highlighting risk buffer while Break-even Volume defines the minimum sales threshold for financial stability.

Importance in Financial Analysis

Margin of Safety quantifies the cushion a company has before incurring losses, highlighting financial resilience, while Break-even Volume identifies the minimum sales needed to cover fixed and variable costs, ensuring operational viability. Understanding both metrics is crucial for risk assessment and strategic planning, enabling accurate forecasting and informed decision-making to safeguard profitability. These parameters facilitate efficient resource allocation by pinpointing sales thresholds and margin buffers in financial performance analysis.

Calculating Margin of Safety

Margin of Safety represents the difference between actual sales and break-even volume, indicating the extent sales can drop before a company incurs losses. It is calculated by subtracting the break-even volume from actual or projected sales, then dividing by actual sales to express it as a percentage. This metric helps businesses assess risk by quantifying how much sales can decline without affecting profitability.

Calculating Break-even Volume

Calculating break-even volume requires dividing total fixed costs by the contribution margin per unit, indicating the exact sales volume needed to cover all expenses without profit or loss. This critical financial metric helps businesses determine the minimum output required to avoid losses and guides pricing and cost management decisions. Understanding the relationship between break-even volume and margin of safety enables firms to assess profitability risks and set sales targets above the break-even threshold.

Practical Applications in Business Decision-making

Margin of Safety quantifies the cushion between actual sales and break-even volume, enabling businesses to assess risk tolerance in fluctuating markets. Break-even volume determines the minimum sales units required to cover fixed and variable costs, crucial for pricing strategies and cost control. Together, these metrics guide investment decisions, operational adjustments, and strategic planning to enhance profitability and minimize financial exposure.

Impact on Risk Assessment and Planning

Margin of Safety quantifies the difference between actual sales and break-even volume, acting as a buffer to absorb sales fluctuations and reduce financial risk. Break-even volume marks the minimum sales level needed to avoid losses, serving as a critical threshold in risk assessment and operational planning. A larger margin of safety indicates lower risk and greater flexibility, guiding managers to make more informed decisions regarding budgeting, resource allocation, and contingency strategies.

Summary: Choosing the Right Metric for Your Business

Margin of Safety quantifies the buffer between actual sales and break-even volume, indicating how much sales can drop before incurring losses. Break-even Volume represents the exact sales level needed to cover all fixed and variable costs without profit or loss. Selecting the right metric depends on business priorities: Margin of Safety aids risk assessment and financial resilience, while Break-even Volume focuses on minimum sales targets to maintain viability.

Margin of Safety Infographic

libterm.com

libterm.com