A Shareholders Agreement is a crucial document that outlines the rights, responsibilities, and obligations of shareholders within a company, ensuring smooth governance and conflict resolution. It protects Your investment by defining decision-making processes, dividend policies, and dispute mechanisms tailored to the company's unique needs. Explore the rest of the article to understand how this agreement can safeguard Your interests and strengthen business partnerships.

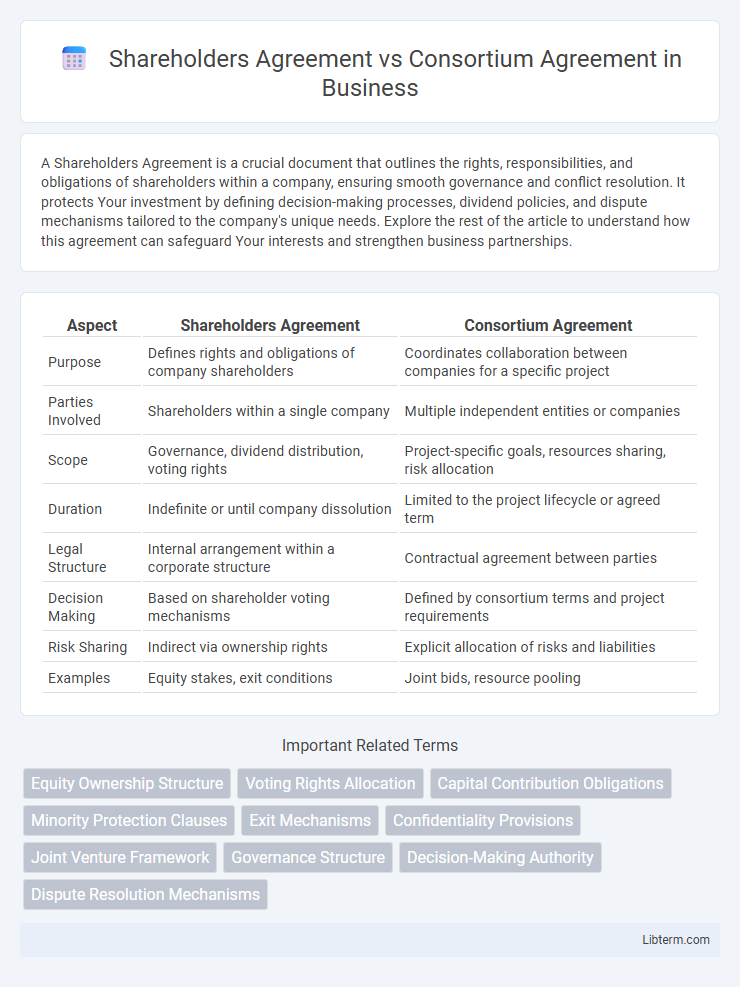

Table of Comparison

| Aspect | Shareholders Agreement | Consortium Agreement |

|---|---|---|

| Purpose | Defines rights and obligations of company shareholders | Coordinates collaboration between companies for a specific project |

| Parties Involved | Shareholders within a single company | Multiple independent entities or companies |

| Scope | Governance, dividend distribution, voting rights | Project-specific goals, resources sharing, risk allocation |

| Duration | Indefinite or until company dissolution | Limited to the project lifecycle or agreed term |

| Legal Structure | Internal arrangement within a corporate structure | Contractual agreement between parties |

| Decision Making | Based on shareholder voting mechanisms | Defined by consortium terms and project requirements |

| Risk Sharing | Indirect via ownership rights | Explicit allocation of risks and liabilities |

| Examples | Equity stakes, exit conditions | Joint bids, resource pooling |

Introduction to Shareholders and Consortium Agreements

Shareholders Agreements define the rights and obligations of company owners, specifying governance, decision-making processes, and exit strategies, ensuring alignment among shareholders. Consortium Agreements establish collaborative frameworks between multiple businesses for joint projects, detailing resource sharing, responsibilities, and profit distribution while preserving individual autonomy. Both agreements are essential for managing partnerships, but Shareholders Agreements focus on ownership structure, whereas Consortium Agreements concentrate on project-based cooperation.

Defining Shareholders Agreement

A Shareholders Agreement is a legally binding contract among a company's shareholders that outlines their rights, responsibilities, and obligations regarding the management and operation of the company. It typically covers governance issues, share transfer restrictions, dividend policies, and dispute resolution mechanisms. This agreement ensures clarity and protection of shareholders' interests, distinguishing it from a Consortium Agreement, which governs collaboration between multiple parties for a specific project without creating a separate legal entity.

Defining Consortium Agreement

A Consortium Agreement is a legally binding contract between multiple parties collaborating on a specific project while maintaining their separate legal identities. It outlines the allocation of responsibilities, intellectual property rights, financial contributions, and decision-making processes to ensure seamless cooperation. Unlike a Shareholders Agreement, which governs the relationship between shareholders within a single company, a Consortium Agreement focuses on joint ventures without creating a new corporate entity.

Key Differences Between Shareholders and Consortium Agreements

Shareholders agreements primarily govern the relationship, rights, and obligations of company shareholders, focusing on corporate governance, share transfer restrictions, and dividend policies. Consortium agreements involve collaboration between multiple parties or companies to achieve a specific project or business objective, emphasizing joint responsibilities, risk-sharing, and resource contributions. Key differences include the scope of application--corporate entity management versus project-based cooperation--and the legal frameworks underpinning ownership rights versus contractual obligations for joint ventures.

Legal Framework and Jurisdiction Considerations

Shareholders Agreements establish the rights and obligations of shareholders within a company, governed primarily by corporate law and the jurisdiction where the company is incorporated. Consortium Agreements regulate collaborations between multiple independent entities for a specific project, often governed by contract law and the jurisdiction where the consortium operates or the project is located. Jurisdiction considerations affect dispute resolution mechanisms, enforceability, and regulatory compliance unique to the legal frameworks applicable to either shareholders or consortium members.

Parties Involved in Each Agreement

A Shareholders Agreement primarily involves the company's shareholders, detailing their rights, obligations, and share ownership structure within the corporate entity. A Consortium Agreement brings together multiple independent organizations or businesses collaborating on a specific project, clarifying each party's contributions, responsibilities, and liabilities. While Shareholders Agreements govern internal relations within a company, Consortium Agreements manage cooperation between distinct entities for joint ventures or large-scale projects.

Rights and Obligations Under Each Agreement

Shareholders Agreements grant rights such as voting power, dividend entitlements, and decision-making controls, while imposing obligations related to share transfer restrictions and confidentiality among shareholders. Consortium Agreements primarily focus on defining each party's roles, resource contributions, and responsibilities to achieve a specific project, emphasizing collaboration and liability sharing. Rights under Consortium Agreements often include joint control of the project outcome, with obligations tied to performance milestones and cost-sharing arrangements.

Termination and Exit Clauses Comparison

Shareholders Agreements typically include detailed termination and exit clauses that govern the transfer of shares, buy-sell provisions, and conditions for voluntary or involuntary exit of shareholders, ensuring control over ownership changes and protecting minority interests. Consortium Agreements focus on the termination of the joint venture, outlining conditions for project completion, breach, or mutual consent, and define exit mechanisms related to withdrawal from collaborative activities rather than share ownership. The key distinction lies in Shareholders Agreements managing equity exit strategies, while Consortium Agreements emphasize operational disengagement and resource reallocation upon project termination.

Practical Scenarios for Each Agreement

Shareholders Agreements primarily govern relationships among company shareholders, detailing rights, obligations, and dispute resolution mechanisms in private companies where investors seek control and profit-sharing stability. Consortium Agreements are tailored for collaborative projects involving multiple independent entities, specifying contributions, roles, liabilities, and joint objectives in sectors like construction, research, or large-scale development projects. Practical scenarios for Shareholders Agreements include startups solidifying equity stakes and decision-making processes, while Consortium Agreements commonly arise in complex infrastructure projects requiring pooled expertise and shared risk management.

Choosing the Right Agreement for Your Business Needs

Selecting the appropriate agreement depends on your business structure and goals: a Shareholders Agreement governs the relationship, rights, and obligations among company shareholders, providing clarity on decision-making and dispute resolution within a corporate framework. In contrast, a Consortium Agreement outlines the collaboration terms between distinct businesses or entities working together on a specific project without forming a new company. Understanding your operational needs, project scope, and long-term objectives is essential to choosing between these contracts for effective governance and risk management.

Shareholders Agreement Infographic

libterm.com

libterm.com