Liquidity risk refers to the potential difficulty a company or individual might face when trying to convert assets into cash without significant loss in value. Managing liquidity risk is crucial to ensure you can meet short-term financial obligations and avoid costly financing or forced asset sales. Explore the rest of the article to understand effective strategies for mitigating liquidity risk and safeguarding your financial stability.

Table of Comparison

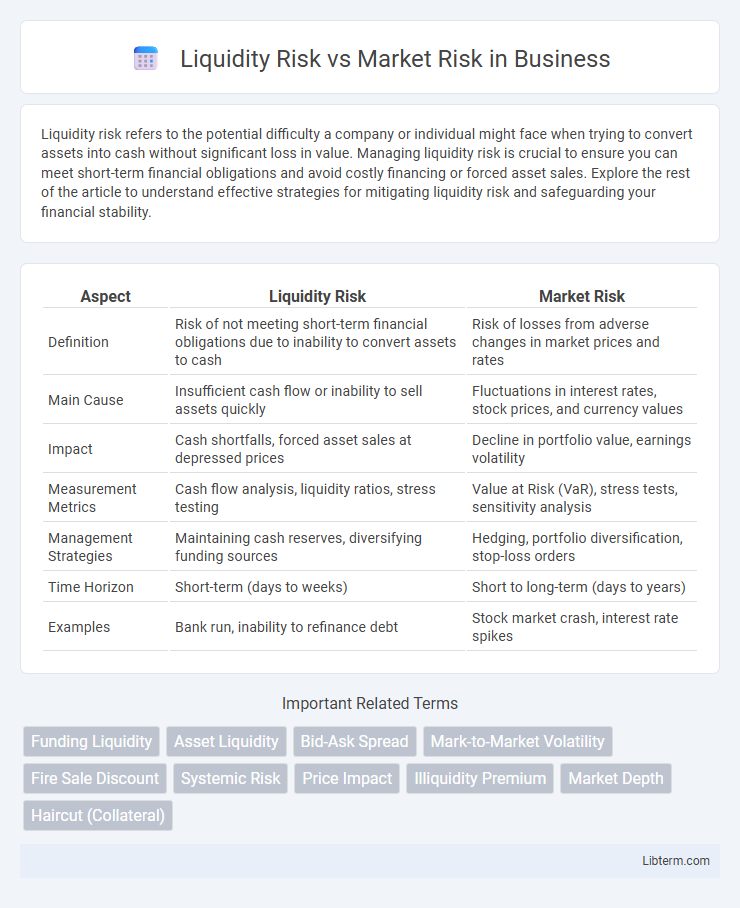

| Aspect | Liquidity Risk | Market Risk |

|---|---|---|

| Definition | Risk of not meeting short-term financial obligations due to inability to convert assets to cash | Risk of losses from adverse changes in market prices and rates |

| Main Cause | Insufficient cash flow or inability to sell assets quickly | Fluctuations in interest rates, stock prices, and currency values |

| Impact | Cash shortfalls, forced asset sales at depressed prices | Decline in portfolio value, earnings volatility |

| Measurement Metrics | Cash flow analysis, liquidity ratios, stress testing | Value at Risk (VaR), stress tests, sensitivity analysis |

| Management Strategies | Maintaining cash reserves, diversifying funding sources | Hedging, portfolio diversification, stop-loss orders |

| Time Horizon | Short-term (days to weeks) | Short to long-term (days to years) |

| Examples | Bank run, inability to refinance debt | Stock market crash, interest rate spikes |

Understanding Liquidity Risk

Liquidity risk refers to the potential inability to quickly buy or sell assets without significantly affecting their price, posing challenges for maintaining cash flow and meeting short-term obligations. It is distinct from market risk, which involves losses due to market price fluctuations, as liquidity risk centers on the ease of converting assets into cash. Effective liquidity risk management requires constant monitoring of asset liquidity profiles and holding sufficient liquid reserves to withstand market stress scenarios.

Defining Market Risk

Market risk refers to the potential financial loss resulting from fluctuations in asset prices due to factors such as interest rate changes, currency exchange rates, and equity price movements. This risk affects the value of investments and trading portfolios, making it critical for investors and financial institutions to monitor market volatility and economic indicators. Unlike liquidity risk, which involves the inability to meet short-term financial obligations, market risk primarily concerns adverse price shifts impacting marketable securities.

Key Differences Between Liquidity Risk and Market Risk

Liquidity risk refers to the potential loss arising from an inability to buy or sell assets quickly at desired prices, impacting cash flow and operational stability. Market risk involves the risk of losses due to fluctuations in market prices, including equity, interest rate, and currency risks that affect the valuation of investments. The key difference lies in liquidity risk emphasizing asset convertibility under time pressure, while market risk centers on price volatility influenced by market conditions.

Causes of Liquidity Risk

Liquidity risk arises primarily from insufficient cash flow or inability to convert assets quickly into cash without significant loss, often caused by sudden market disruptions, credit tightening, or operational inefficiencies. Market conditions such as sharp declines in asset prices or reduced buyer interest exacerbate liquidity risk by limiting the ease of asset liquidation. Firms with high leverage or exposure to volatile markets face heightened liquidity stress during economic downturns or periods of financial instability.

Causes of Market Risk

Market risk primarily arises from fluctuations in asset prices due to changes in interest rates, currency exchange rates, and equity prices. Economic factors such as inflation, geopolitical events, and shifts in investor sentiment contribute significantly to market risk volatility. Unlike liquidity risk, which stems from the inability to execute transactions promptly, market risk is driven by systemic factors impacting the entire market or specific sectors.

Impact of Liquidity Risk on Financial Institutions

Liquidity risk significantly impacts financial institutions by limiting their ability to meet short-term obligations, leading to potential insolvency and loss of investor confidence. Unlike market risk, which involves fluctuations in asset prices, liquidity risk can cause abrupt funding shortages, forcing institutions to sell assets at depressed prices and incurring substantial losses. Effective liquidity risk management is critical for maintaining operational stability and ensuring compliance with regulatory liquidity coverage ratios.

Effects of Market Risk on Investment Portfolios

Market risk significantly impacts investment portfolios by causing fluctuations in asset prices due to changes in interest rates, currency exchange rates, and equity prices. These price volatilities can lead to substantial losses, affecting portfolio value and investor returns. Effective risk management strategies, such as diversification and hedging, are essential to mitigate the adverse effects of market risk on portfolio performance.

Measuring and Assessing Liquidity Risk

Measuring liquidity risk involves analyzing cash flow projections, liquidity ratios such as the current and quick ratios, and stress testing to evaluate an entity's ability to meet short-term obligations without incurring substantial losses. Techniques like the Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR) provide regulatory benchmarks to assess liquidity resilience under different market conditions. Regular monitoring of market depth, bid-ask spreads, and funding concentrations further enhances the assessment of liquidity risk compared to market risk, which primarily focuses on price volatility and asset value fluctuations.

Tools for Managing Market Risk

Market risk is managed using tools such as Value at Risk (VaR), stress testing, and scenario analysis that quantify potential losses under various market conditions. Derivative instruments like options, futures, and swaps play a crucial role in hedging positions and mitigating exposure to price fluctuations. Portfolio diversification and asset allocation strategies further reduce sensitivity to market volatility and systematic risk factors.

Strategies to Mitigate Liquidity and Market Risks

Effective strategies to mitigate liquidity risk include maintaining adequate cash reserves, diversifying funding sources, and implementing robust liquidity stress testing to anticipate potential shortfalls. To manage market risk, firms employ diversification across asset classes, use hedging instruments such as options and futures, and apply value-at-risk (VaR) models to quantify potential losses under varying market scenarios. Integrating these strategies enhances overall financial stability by addressing both immediate liquidity needs and longer-term market fluctuations.

Liquidity Risk Infographic

libterm.com

libterm.com