Equity represents ownership in a company, reflecting your share of its value and profits. Understanding equity is essential for evaluating investment opportunities and assessing financial health. Discover how equity impacts your financial decisions by reading the rest of this article.

Table of Comparison

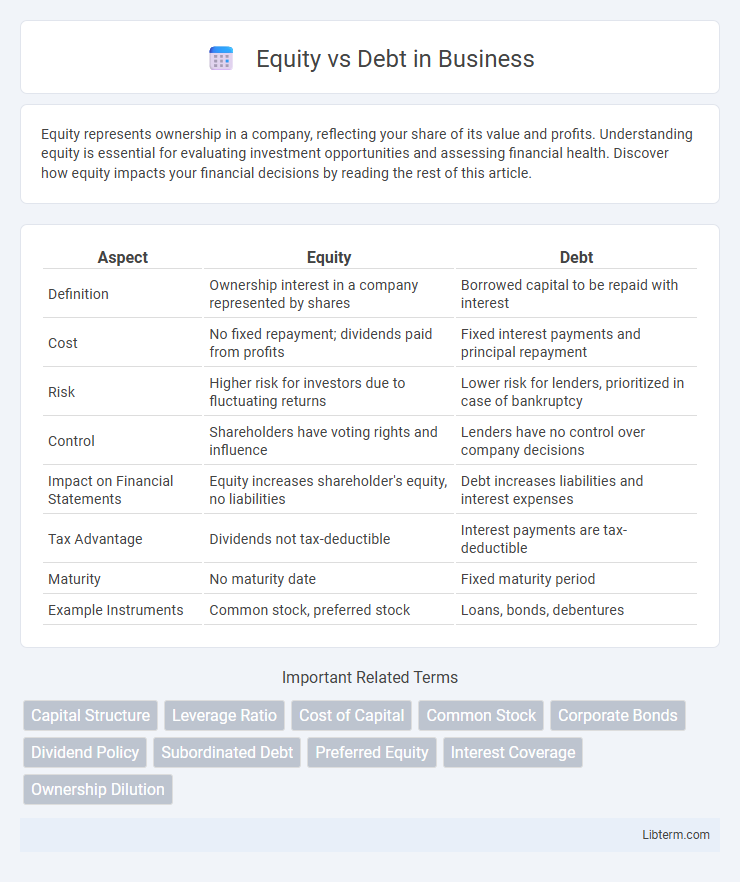

| Aspect | Equity | Debt |

|---|---|---|

| Definition | Ownership interest in a company represented by shares | Borrowed capital to be repaid with interest |

| Cost | No fixed repayment; dividends paid from profits | Fixed interest payments and principal repayment |

| Risk | Higher risk for investors due to fluctuating returns | Lower risk for lenders, prioritized in case of bankruptcy |

| Control | Shareholders have voting rights and influence | Lenders have no control over company decisions |

| Impact on Financial Statements | Equity increases shareholder's equity, no liabilities | Debt increases liabilities and interest expenses |

| Tax Advantage | Dividends not tax-deductible | Interest payments are tax-deductible |

| Maturity | No maturity date | Fixed maturity period |

| Example Instruments | Common stock, preferred stock | Loans, bonds, debentures |

Understanding Equity and Debt

Equity represents ownership in a company, providing shareholders with voting rights and a claim on future profits through dividends and capital appreciation. Debt involves borrowing funds that must be repaid with interest, creating a fixed financial obligation regardless of the company's performance. Understanding the fundamental differences between equity and debt helps businesses optimize capital structure by balancing risk, control, and cost of financing.

Key Differences Between Equity and Debt

Equity represents ownership in a company, giving investors voting rights and a share in profits through dividends, while debt involves borrowing funds that must be repaid with interest, lacking ownership stakes or voting power. Equity financing typically carries higher risk for investors but offers potential for substantial returns, whereas debt financing provides predictable interest payments and priority in claims during liquidation but limits financial flexibility. Key differences include the impact on company control, cost of capital, and the priority of claims in bankruptcy situations.

Advantages of Equity Financing

Equity financing provides businesses with the advantage of not requiring repayment, which reduces financial risk and preserves cash flow for operations and growth. It enhances a company's creditworthiness by lowering debt levels and attracts investors who may offer strategic support and industry expertise. Furthermore, equity financing allows access to substantial capital for expansion without the constraints and covenants often imposed by debt agreements.

Benefits of Debt Financing

Debt financing offers significant tax advantages since interest payments are often tax-deductible, reducing the overall cost of capital for businesses. It allows companies to retain full ownership and control without diluting existing shareholders' equity. Furthermore, debt can provide predictable repayment schedules and help improve creditworthiness when managed responsibly.

Limitations of Equity Financing

Equity financing dilutes ownership, reducing control for existing shareholders and potentially leading to conflicts over decision-making. It often involves higher costs than debt due to dividend expectations and the need to share future profits. Furthermore, issuing new equity can signal financial weakness, potentially lowering the company's stock price and investor confidence.

Drawbacks of Debt Financing

Debt financing imposes fixed repayment obligations regardless of business performance, creating cash flow pressures that can hinder operational flexibility. High levels of debt increase financial risk, potentially leading to default or bankruptcy during economic downturns. Interest expenses associated with debt reduce net profitability and limit reinvestment capacity.

Risk Factors in Equity and Debt

Equity carries higher risk due to ownership exposure, market volatility, and dividend uncertainty, which may lead to fluctuating returns for investors. Debt involves fixed interest payments and principal repayment obligations, posing credit risk and potential default risk but generally offers lower volatility compared to equity. Both instruments face macroeconomic risks, yet equity holders bear residual risk after debt obligations are met.

Impact on Ownership and Control

Equity financing dilutes ownership as investors receive shares, granting them voting rights and influence over company decisions, thereby reducing the original owners' control. Debt financing maintains ownership and control since lenders do not obtain equity or voting power, but it imposes fixed repayment obligations that can strain cash flow. Choosing between equity and debt impacts strategic decisions on maintaining control and balancing financial risk within the corporate governance structure.

Choosing Between Equity and Debt

Choosing between equity and debt financing depends on a company's current financial health, growth stage, and risk tolerance. Equity financing dilutes ownership but does not require fixed repayments, making it ideal for startups or companies seeking long-term growth without immediate cash flow pressure. Debt financing preserves ownership and offers tax-deductible interest but involves regular repayments, suitable for established businesses with stable cash flows aiming to leverage growth without giving up control.

Equity vs Debt: Which is Right for You?

Choosing between equity and debt financing depends on your business goals, cash flow, and control preferences. Equity financing provides capital in exchange for ownership stakes, reducing repayment pressure but diluting control, making it suitable for startups seeking growth without immediate debt burden. Debt financing involves borrowing funds with fixed repayment terms, preserving ownership but requiring regular payments, ideal for businesses with stable cash flow aiming to maintain control and credit history.

Equity Infographic

libterm.com

libterm.com