Risk pooling minimizes the impact of individual risks by combining multiple risks into a single group, spreading potential losses across all participants. This approach enhances financial stability for businesses and individuals by reducing uncertainty and smoothing out volatility in claims or losses. Discover how risk pooling can safeguard your financial interests and optimize your risk management strategies in the full article.

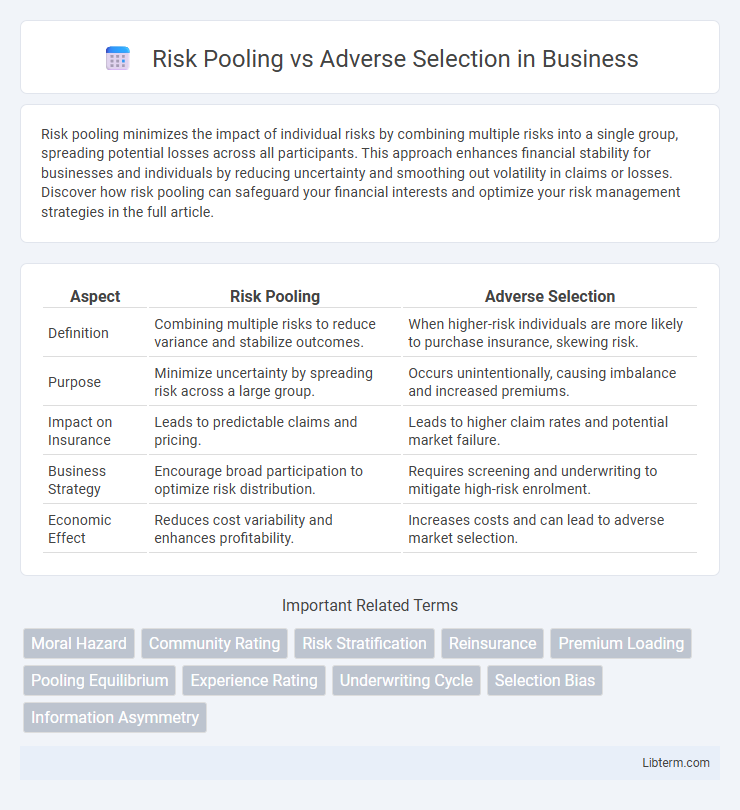

Table of Comparison

| Aspect | Risk Pooling | Adverse Selection |

|---|---|---|

| Definition | Combining multiple risks to reduce variance and stabilize outcomes. | When higher-risk individuals are more likely to purchase insurance, skewing risk. |

| Purpose | Minimize uncertainty by spreading risk across a large group. | Occurs unintentionally, causing imbalance and increased premiums. |

| Impact on Insurance | Leads to predictable claims and pricing. | Leads to higher claim rates and potential market failure. |

| Business Strategy | Encourage broad participation to optimize risk distribution. | Requires screening and underwriting to mitigate high-risk enrolment. |

| Economic Effect | Reduces cost variability and enhances profitability. | Increases costs and can lead to adverse market selection. |

Introduction to Risk Pooling and Adverse Selection

Risk pooling involves combining multiple risks to reduce the overall uncertainty for individuals by spreading potential losses across a larger group, which enhances financial stability. Adverse selection occurs when individuals with higher risk are more likely to purchase insurance, leading to an imbalanced risk pool and increased costs for insurers. Understanding the dynamics between risk pooling and adverse selection is critical for designing effective insurance contracts and maintaining sustainable risk-sharing mechanisms.

Defining Risk Pooling: Concept and Importance

Risk pooling is a fundamental insurance concept where multiple individuals or entities combine their risks to reduce the overall uncertainty and financial impact of potential losses. By aggregating diverse risk profiles, risk pooling enables insurers to predict losses more accurately, stabilize premiums, and provide equitable coverage to policyholders. This mechanism is crucial for minimizing the effects of adverse selection, where individuals with higher risk are more likely to seek insurance, leading to imbalanced risk distribution and potential insurer losses.

What is Adverse Selection? Key Characteristics

Adverse selection refers to a situation in insurance markets where individuals with higher risk are more likely to purchase insurance, leading to an imbalance in the risk pool. Key characteristics include asymmetric information between buyers and insurers, resulting in higher-than-expected claims and increased premiums. This phenomenon undermines risk pooling efficiency by concentrating high-risk individuals and causing market inefficiencies.

Risk Pooling vs Adverse Selection: Core Differences

Risk pooling involves aggregating multiple individual risks into a single group to reduce the overall uncertainty and stabilize premiums, enhancing financial protection. Adverse selection occurs when higher-risk individuals are more likely to purchase insurance, leading to imbalanced risk pools and increased costs for insurers. The core difference lies in risk pooling's ability to spread risk evenly across a diverse group, whereas adverse selection distorts this balance by concentrating higher risks within the pool.

How Risk Pooling Mitigates Insurance Challenges

Risk pooling mitigates insurance challenges by aggregating individual risks, thereby reducing the uncertainty and variability of claims across a large group. This collective sharing of risk prevents adverse selection by ensuring that premiums reflect the average risk, discouraging high-risk individuals from disproportionately inflating costs. By spreading risk evenly, insurers maintain solvency and provide more stable coverage options for all policyholders.

Adverse Selection Impact on Insurance Markets

Adverse selection significantly distorts insurance markets by attracting higher-risk individuals who are more likely to file claims, causing a disproportionate number of costly payouts. This imbalance increases premiums for all policyholders, potentially driving low-risk individuals out of the market and shrinking the risk pool. Effective risk pooling mechanisms mitigate adverse selection by spreading risk across a diverse group, stabilizing premiums and enhancing market sustainability.

Real-World Examples of Risk Pooling

Risk pooling is effectively demonstrated by health insurance cooperatives where members share medical costs, reducing individual financial risk and promoting affordability. In agriculture, crop insurance pools risks among farmers, mitigating losses from unpredictable weather events and stabilizing income. Car insurance companies use risk pooling by aggregating premiums from many drivers to cover accident claims, balancing costs across a diverse group regardless of individual claim history.

Case Studies Illustrating Adverse Selection

Case studies of adverse selection often reveal how asymmetric information leads to market inefficiencies, particularly in insurance markets where high-risk individuals disproportionately enroll, driving up costs for all participants. One notable example is the early 2000s health insurance exchanges, where insurers faced adverse selection as sicker individuals purchased more coverage, causing premium spikes and market instability. These cases underscore the challenges of risk pooling when adverse selection undermines balanced risk distribution essential for sustainable insurance models.

Strategies to Minimize Adverse Selection Risks

Risk pooling spreads the financial impact of risks across multiple participants, mitigating individual exposure and stabilizing overall costs. Strategies to minimize adverse selection risks include implementing comprehensive underwriting processes, requiring detailed risk disclosures, and using tiered pricing models based on risk profiles. Encouraging a diverse and balanced pool of insured individuals ensures healthier risk distribution and reduces the likelihood of high-risk participants disproportionately affecting the insurance pool.

Future Trends in Managing Risk Pooling and Adverse Selection

Future trends in managing risk pooling and adverse selection emphasize leveraging advanced data analytics and AI to improve risk assessment accuracy and tailor insurance products dynamically. Blockchain technology is increasingly adopted for transparent and secure information sharing, reducing information asymmetry that fuels adverse selection. Furthermore, personalized risk pools based on real-time data and behavioral insights are expected to optimize risk distribution and enhance overall market efficiency.

Risk Pooling Infographic

libterm.com

libterm.com