Legal risk involves the potential for financial loss or reputational damage due to legal actions, regulatory non-compliance, or contractual breaches. Effective legal risk management requires identifying, assessing, and mitigating these risks to protect your business operations. Explore the rest of the article to learn strategies for minimizing legal risk and safeguarding your interests.

Table of Comparison

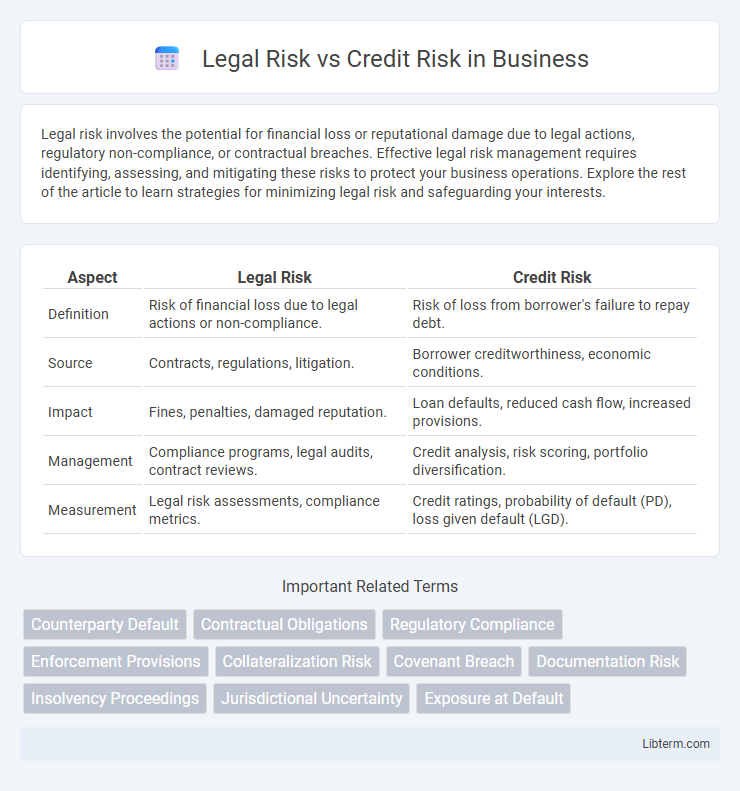

| Aspect | Legal Risk | Credit Risk |

|---|---|---|

| Definition | Risk of financial loss due to legal actions or non-compliance. | Risk of loss from borrower's failure to repay debt. |

| Source | Contracts, regulations, litigation. | Borrower creditworthiness, economic conditions. |

| Impact | Fines, penalties, damaged reputation. | Loan defaults, reduced cash flow, increased provisions. |

| Management | Compliance programs, legal audits, contract reviews. | Credit analysis, risk scoring, portfolio diversification. |

| Measurement | Legal risk assessments, compliance metrics. | Credit ratings, probability of default (PD), loss given default (LGD). |

Understanding Legal Risk: Definition and Scope

Legal risk refers to the potential for financial loss or operational disruption resulting from legal actions, regulatory changes, or non-compliance with laws and contracts. This risk encompasses issues such as litigation, contractual disputes, regulatory penalties, and changes in legislation that can impact an organization's ability to enforce agreements or operate within legal frameworks. Unlike credit risk, which centers on the probability of a borrower's default, legal risk broadly affects the enforceability and legitimacy of business transactions and compliance obligations.

What is Credit Risk? Key Concepts

Credit risk refers to the potential loss that a lender or investor faces if a borrower fails to meet their financial obligations, such as repaying a loan or making timely interest payments. Key concepts in credit risk include default probability, exposure at default (EAD), loss given default (LGD), and credit scoring models, which help assess the likelihood and impact of credit events. Effective credit risk management involves evaluating borrower's creditworthiness, monitoring financial health, and employing risk mitigation strategies like collateral or credit derivatives.

Sources of Legal Risk in Financial Transactions

Legal risk in financial transactions arises from contractual ambiguities, regulatory non-compliance, and inadequate documentation, which can lead to unenforceable agreements or penalties. Key sources include misinterpretation of contract terms, failure to adhere to evolving financial regulations such as Basel III and Dodd-Frank, and disputes over collateral or security interests. Effective legal risk management requires rigorous contract review, ongoing regulatory monitoring, and comprehensive legal due diligence to mitigate potential financial losses.

Common Causes of Credit Risk Exposure

Common causes of credit risk exposure include borrower default, deteriorating credit quality, and economic downturns that impair repayment ability. Legal risk arises when contractual obligations are unclear or unenforceable, potentially compromising debt recovery. Effective risk management integrates credit analysis with legal due diligence to mitigate potential financial losses.

Legal Risk vs Credit Risk: Core Differences

Legal risk involves potential losses arising from contract disputes, regulatory non-compliance, or litigation, impacting an organization's ability to enforce agreements. Credit risk refers to the possibility that a borrower will default on debt obligations, affecting financial institutions' loan portfolios and capital adequacy. Core differences lie in their sources: legal risk stems from legal system uncertainties, while credit risk originates from borrower creditworthiness and economic conditions.

Impact of Legal Risk on Financial Institutions

Legal risk exposes financial institutions to potential lawsuits, regulatory penalties, and contract enforcement failures that can result in significant financial losses and reputational damage. This risk disrupts operational stability by increasing compliance costs and undermining customer trust, often triggering credit risk through loan defaults or liquidity shortages. Effective legal risk management is crucial for safeguarding asset quality and maintaining regulatory capital adequacy ratios within banks and other financial entities.

How Credit Risk Affects Lending Decisions

Credit risk significantly influences lending decisions by determining the probability of borrower default, which lenders assess through credit scores, financial history, and debt-to-income ratios. Higher credit risk prompts stricter loan terms, increased interest rates, or outright loan denial to mitigate potential losses. Effective credit risk management ensures financial institutions maintain portfolio quality and regulatory compliance.

Mitigating Legal Risk: Best Practices

Mitigating legal risk involves implementing comprehensive compliance programs that adhere to evolving regulations and industry standards, reducing the likelihood of costly litigation and penalties. Regularly conducting legal audits and training employees on contractual obligations and regulatory changes strengthens organizational resilience. Employing proactive contract management, including detailed review processes and clear documentation, ensures enforceability and minimizes disputes.

Credit Risk Management Strategies

Credit risk management strategies center on assessing borrower creditworthiness through detailed financial analysis, credit scoring models, and monitoring repayment histories to minimize default potential. Effective practices include diversification of credit portfolios, setting credit limits, and implementing collateral requirements to mitigate losses. Stress testing and early warning systems enhance risk identification, enabling proactive adjustments to lending policies and credit terms.

The Interplay Between Legal and Credit Risk in Business

Legal risk directly impacts credit risk by potentially invalidating contracts or complicating debt recovery, thereby increasing the likelihood of financial loss. Effective risk management strategies must address both legal compliance and creditworthiness assessment to safeguard business transactions. Understanding the interplay between legal frameworks and credit evaluation enhances overall risk mitigation and secures financial stability.

Legal Risk Infographic

libterm.com

libterm.com