Operating profit measures a company's earnings from core business activities, excluding expenses like taxes and interest. It provides insight into operational efficiency and profitability before non-operating costs. Discover how understanding your operating profit can improve financial decisions by reading the rest of the article.

Table of Comparison

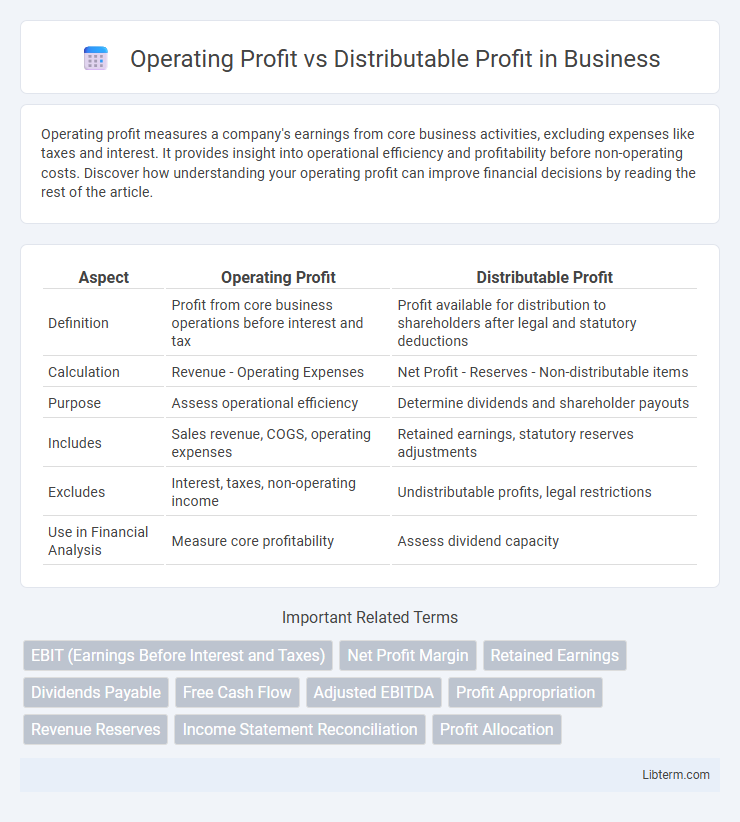

| Aspect | Operating Profit | Distributable Profit |

|---|---|---|

| Definition | Profit from core business operations before interest and tax | Profit available for distribution to shareholders after legal and statutory deductions |

| Calculation | Revenue - Operating Expenses | Net Profit - Reserves - Non-distributable items |

| Purpose | Assess operational efficiency | Determine dividends and shareholder payouts |

| Includes | Sales revenue, COGS, operating expenses | Retained earnings, statutory reserves adjustments |

| Excludes | Interest, taxes, non-operating income | Undistributable profits, legal restrictions |

| Use in Financial Analysis | Measure core profitability | Assess dividend capacity |

Understanding Operating Profit: Definition and Calculation

Operating profit, also known as operating income, represents the profit a company generates from its core business operations, excluding non-operating income and expenses such as taxes and interest. It is calculated by subtracting operating expenses, including cost of goods sold (COGS), wages, and depreciation, from gross profit. This metric provides a clear insight into the company's efficiency in managing its primary activities before considering the effects of financing and tax strategies.

What Is Distributable Profit? Key Concepts

Distributable profit refers to the portion of a company's earnings available for dividend distribution to shareholders after accounting for operating costs, taxes, and statutory reserves. Unlike operating profit, which measures core business profitability before financing and tax expenses, distributable profit reflects the net profit legally permissible for distribution under corporate and accounting regulations. Understanding distributable profit is crucial for ensuring compliance with legal frameworks designed to protect creditors and maintain company solvency.

Core Differences Between Operating Profit and Distributable Profit

Operating profit represents the earnings generated from a company's core business operations, excluding expenses such as interest and taxes, providing a measure of operational efficiency. Distributable profit, on the other hand, is the portion of net profit available for distribution to shareholders as dividends after accounting for retained earnings, taxes, and statutory reserves. The core difference lies in operating profit reflecting operational performance, while distributable profit indicates the actual cash or profit eligible for payout to investors.

Components Included in Operating Profit

Operating Profit primarily includes revenues generated from core business operations minus operating expenses such as cost of goods sold, wages, depreciation, and administrative expenses. It excludes non-operating income, taxes, interest expenses, and extraordinary items, focusing strictly on operational efficiency. Understanding these components provides clearer insight into a company's profitability from its fundamental business activities.

Factors That Affect Distributable Profit

Distributable profit is influenced by factors such as non-cash expenses, prior period adjustments, and statutory reserves, which reduce the amount available for distribution despite the operating profit reported. Operating profit reflects earnings before interest and taxes, but distributable profit accounts for compliance with legal restrictions and company policies on profit allocation. Changes in deferred tax liabilities, depreciation methods, and extraordinary items also significantly impact the final distributable profit figure.

Importance of Operating Profit in Business Performance

Operating profit is crucial in evaluating a company's core business efficiency, reflecting earnings before interest and taxes, excluding non-operating income or expenses. It highlights the profitability generated from primary operations, providing a clear picture of business performance without the influence of financial and investment activities. Distributable profit depends on operating profit but adjusts for non-cash items, reserves, and legal constraints, making operating profit the fundamental measure for assessing operational success and decision-making.

Legal Considerations for Distributable Profits

Distributable profits are strictly regulated by corporate law, ensuring companies only distribute profits legally available after covering liabilities and maintaining capital requirements. Operating profit, while indicative of business performance, does not directly determine the amount available for dividends under legal frameworks such as the Companies Act or jurisdiction-specific financial regulations. Failure to comply with legal restrictions on distributable profits can result in penalties, director liabilities, and potential shareholder disputes.

How Operating Profit Influences Dividend Policy

Operating profit serves as a primary indicator of a company's core profitability and directly influences its dividend policy by determining the available earnings for distribution after covering operating expenses. A higher operating profit generally signals robust business performance, enabling management to declare more substantial dividends while maintaining sufficient reserves for growth and stability. Companies prioritize consistent operating profit to ensure sustainable dividend payouts, reflecting financial health and investor confidence.

Comparing Reporting Methods: Operating vs Distributable Profit

Operating profit, calculated before interest and taxes, reflects core business performance and excludes non-operating items, providing a clear measure of operational efficiency. Distributable profit, often derived from net profit adjusted for non-cash items and statutory reserves, determines the actual earnings available for shareholder dividends. Comparing reporting methods highlights that operating profit emphasizes operational results, while distributable profit focuses on cash flow and compliance with dividend distribution rules.

Practical Examples: Analyzing Operating and Distributable Profits

Operating profit represents a company's earnings before interest and taxes, reflecting core business performance, while distributable profit indicates the portion of profit available for shareholder dividends after accounting for legal reserves and prior losses. For example, a company with $1 million in operating profit may have only $700,000 as distributable profit if $300,000 is allocated to statutory reserves or retained earnings. Analyzing both metrics helps stakeholders understand real business profitability and the actual funds shareholders can receive as dividends.

Operating Profit Infographic

libterm.com

libterm.com