Treasury bills are short-term government securities issued to finance national debt with maturities typically ranging from a few days to one year. They offer a secure investment option with fixed returns and are sold at a discount, allowing investors to profit from the difference between the purchase price and the face value upon maturity. Explore the rest of this article to understand how Treasury bills can fit into your investment strategy and enhance your portfolio.

Table of Comparison

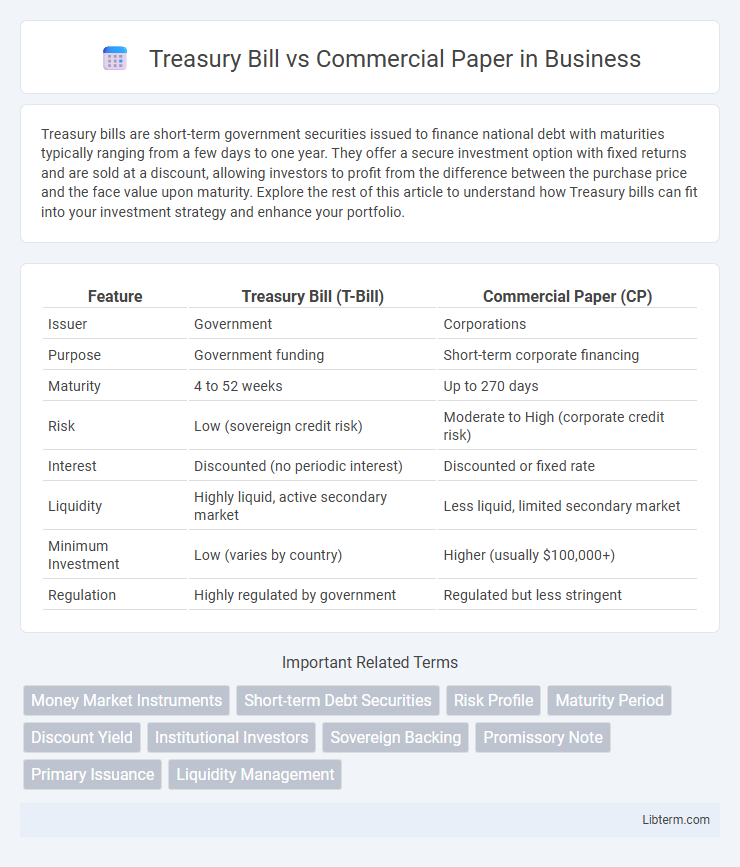

| Feature | Treasury Bill (T-Bill) | Commercial Paper (CP) |

|---|---|---|

| Issuer | Government | Corporations |

| Purpose | Government funding | Short-term corporate financing |

| Maturity | 4 to 52 weeks | Up to 270 days |

| Risk | Low (sovereign credit risk) | Moderate to High (corporate credit risk) |

| Interest | Discounted (no periodic interest) | Discounted or fixed rate |

| Liquidity | Highly liquid, active secondary market | Less liquid, limited secondary market |

| Minimum Investment | Low (varies by country) | Higher (usually $100,000+) |

| Regulation | Highly regulated by government | Regulated but less stringent |

Introduction to Treasury Bills and Commercial Paper

Treasury Bills (T-Bills) are short-term government securities issued at a discount and mature within one year, primarily used to finance national debt with minimal risk. Commercial Paper (CP) is an unsecured, short-term debt instrument issued by corporations to meet immediate funding needs, typically with maturities ranging from a few days to 270 days. Both instruments serve as vital components in money markets, offering liquidity and financing options for governments and businesses.

Key Features of Treasury Bills

Treasury Bills (T-Bills) are short-term debt instruments issued by the government with maturities ranging from a few days to one year, characterized by their zero-coupon nature and high liquidity. They are considered virtually risk-free due to government backing, with investors purchasing them at a discount and receiving face value at maturity. T-Bills have fixed denominations, a standardized auction process, and play a critical role in monetary policy implementation and cash management.

Key Features of Commercial Paper

Commercial Paper is a short-term, unsecured promissory note issued by corporations to finance immediate operational needs, typically with maturities ranging from 1 to 270 days. Unlike Treasury Bills, which are government-backed and considered virtually risk-free, Commercial Paper carries higher credit risk but offers higher yields due to the issuer's creditworthiness. It is usually issued at a discount and does not pay interest before maturity, making it a flexible and cost-effective alternative for corporate short-term financing.

Differences in Issuers and Purpose

Treasury bills are short-term government securities issued by national treasuries, primarily to finance fiscal deficits and manage monetary policy. Commercial papers are unsecured, short-term debt instruments issued by corporations to meet immediate working capital needs or operational expenses. The key distinction lies in issuers, with Treasury bills backed by government credit risk and commercial papers relying on the issuer's corporate creditworthiness.

Maturity Period Comparison

Treasury bills typically have short maturity periods ranging from a few days up to one year, making them highly liquid government debt instruments. Commercial paper maturity periods are usually shorter, often between 1 to 270 days, issued by corporations to meet short-term financing needs. Both instruments provide flexible options for investors seeking short-term investment opportunities with varying risk profiles and interest rates.

Risk and Safety Analysis

Treasury Bills (T-Bills) carry minimal risk due to government backing and short maturities, making them one of the safest investment instruments with virtually no default risk. Commercial Paper (CP), issued by corporations, carries a higher credit risk depending on the issuer's creditworthiness and typically offers higher yields as compensation for this increased risk. Investors prioritize T-Bills for capital preservation and liquidity, while CP suits those seeking higher returns with moderate exposure to credit risk.

Liquidity and Marketability

Treasury bills (T-bills) are highly liquid and marketable due to their short maturities, backed by government credit, and active secondary markets. Commercial papers have slightly lower liquidity, issued by corporations with maturities typically up to 270 days, and their marketability depends on issuer creditworthiness and market demand. Investors prefer T-bills for immediate cash access, while commercial papers offer higher returns but less predictable liquidity.

Yield and Return Potential

Treasury Bills (T-Bills) typically offer lower yields compared to Commercial Paper due to their government backing and minimal risk, making them a safer but less lucrative investment. Commercial Paper generally provides higher returns reflecting its higher risk as short-term corporate debt issued by firms with good credit ratings. Investors choose between the two based on their risk tolerance and desired yield, balancing government security against corporate return potential.

Regulatory Framework and Oversight

Treasury Bills (T-Bills) are issued and regulated by the U.S. Department of the Treasury under strict government oversight and are considered virtually risk-free due to full faith and credit backing. Commercial Papers are short-term unsecured promissory notes issued by corporations and regulated by the Securities and Exchange Commission (SEC) under the Securities Act of 1933, requiring registration unless exemptions apply. The regulatory framework ensures transparency, investor protection, and market stability, with Treasury Bills subject to federal government standards and Commercial Papers subject to corporate disclosures and creditworthiness evaluation.

Choosing Between Treasury Bills and Commercial Paper

Choosing between Treasury Bills and Commercial Paper depends on risk tolerance, investment horizon, and yield preference. Treasury Bills are government-backed securities offering low default risk and high liquidity, ideal for conservative investors seeking short-term safety. Commercial Paper provides higher yields with slightly increased credit risk, suitable for investors targeting short-term corporate debt with better returns.

Treasury Bill Infographic

libterm.com

libterm.com