Incremental cost refers to the additional expense incurred when producing one more unit of a product or service, crucial for making decisions on pricing, production levels, and profitability. Understanding your incremental costs helps optimize resource allocation and improve financial performance. Explore the rest of the article to discover how incremental cost impacts business strategy and decision-making.

Table of Comparison

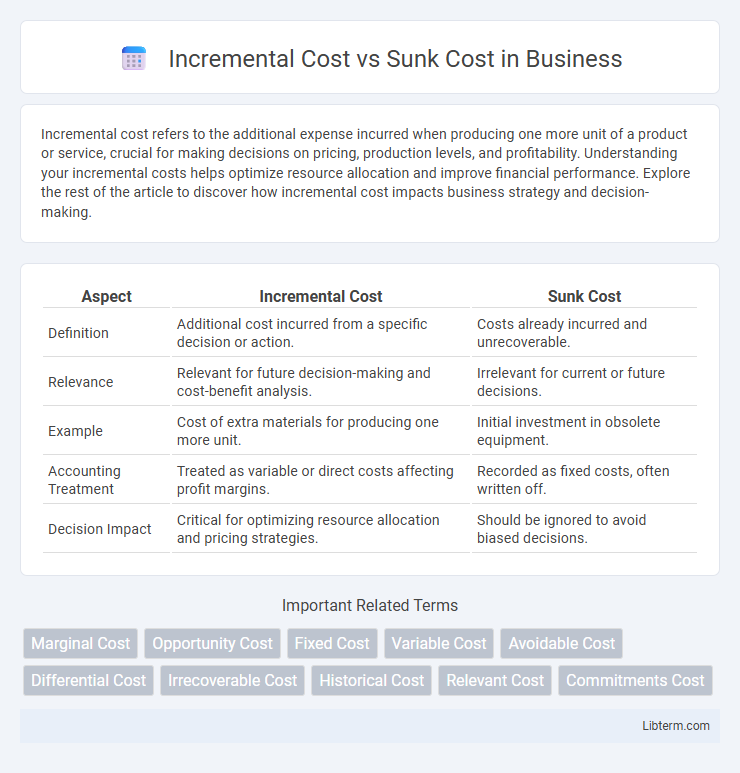

| Aspect | Incremental Cost | Sunk Cost |

|---|---|---|

| Definition | Additional cost incurred from a specific decision or action. | Costs already incurred and unrecoverable. |

| Relevance | Relevant for future decision-making and cost-benefit analysis. | Irrelevant for current or future decisions. |

| Example | Cost of extra materials for producing one more unit. | Initial investment in obsolete equipment. |

| Accounting Treatment | Treated as variable or direct costs affecting profit margins. | Recorded as fixed costs, often written off. |

| Decision Impact | Critical for optimizing resource allocation and pricing strategies. | Should be ignored to avoid biased decisions. |

Understanding Incremental Cost: Definition and Importance

Incremental cost refers to the additional expense incurred when producing one more unit of a product or service, making it a crucial metric for decision-making in business operations. It excludes sunk costs, which are past expenditures that cannot be recovered or altered by future actions. Understanding incremental cost helps businesses evaluate the financial impact of scaling production, optimizing resource allocation, and improving profitability.

What are Sunk Costs? Key Concepts Explained

Sunk costs refer to expenses that have already been incurred and cannot be recovered, regardless of future decisions. These costs should not influence ongoing or future business choices because they remain the same whether a project continues or terminates. Understanding sunk costs helps managers avoid the sunk cost fallacy, which can lead to inefficient resource allocation by considering irrelevant past expenditures.

Differences Between Incremental and Sunk Costs

Incremental cost refers to the additional expense incurred when producing one more unit of a product or service, directly impacting decision-making on whether to increase output. Sunk cost represents a past expenditure that cannot be recovered and should not influence current or future business decisions. The key difference lies in incremental costs being relevant for future choices while sunk costs are irrelevant and should be disregarded in economic evaluation.

Real-World Examples of Incremental Costs

Incremental costs represent the additional expenses incurred when making a business decision, such as producing one more unit of a product or launching a new marketing campaign. For example, a manufacturing company deciding whether to increase production will consider the incremental costs of raw materials, labor, and shipping for each extra unit produced, excluding sunk costs like previously purchased machinery. Retailers often analyze incremental costs by comparing the variable expenses of stocking additional inventory against the fixed sunk costs of their existing store infrastructure to determine profitability.

Common Scenarios Involving Sunk Costs

Common scenarios involving sunk costs include investments in obsolete technology, non-refundable marketing expenses, and research and development funds already spent. Businesses often face challenges when deciding to continue a project due to sunk costs, which should not influence future decisions. Understanding that sunk costs are irrecoverable helps managers focus on incremental costs for evaluating potential returns.

Impact on Business Decision-Making

Incremental cost directly influences business decision-making by highlighting the additional expenses incurred from a specific choice, which helps managers evaluate profitability and operational efficiency for new projects or expansions. Sunk costs, being past expenditures that cannot be recovered, should not affect current decisions as their inclusion can lead to irrational commitment and financial losses. Understanding the distinction ensures businesses focus on relevant financial data, optimizing resource allocation and strategic planning.

Incremental Cost in Budget Planning

Incremental cost refers to the additional expenses incurred when choosing one budget option over another, playing a critical role in budget planning by highlighting the financial impact of specific decisions. Accurate identification of incremental costs enables managers to focus on relevant expenses that will change with a project, improving resource allocation and cost control. This cost analysis contrasts with sunk costs, which are past expenditures that should not influence current budgeting decisions.

Sunk Cost Fallacy: Avoiding Costly Mistakes

Sunk cost fallacy occurs when individuals continue investing in a failing project due to previously incurred costs that cannot be recovered, rather than evaluating future incremental costs and benefits. Recognizing sunk costs as irrelevant to current decisions helps avoid poor financial choices and resource misallocation. Businesses improve profitability and strategic outcomes by focusing on incremental costs and disregarding sunk costs in decision-making processes.

How to Calculate Incremental and Sunk Costs

Incremental cost is calculated by determining the additional expenses incurred from choosing one option over another, typically by subtracting the total cost of the base scenario from the total cost of the alternative scenario. Sunk cost represents past expenditures that cannot be recovered and is calculated by summing all historical costs already incurred on a project or investment, which should be excluded from future decision-making. Accurate calculation of incremental cost involves identifying variable and fixed costs associated with the decision, while sunk cost identification requires reviewing accounting records to isolate non-recoverable past expenses.

Best Practices for Cost Analysis in Financial Management

Incremental cost analysis focuses on assessing additional expenses incurred from specific decisions, enabling accurate evaluation of cost-benefit scenarios in financial management. Best practices emphasize isolating relevant costs that directly impact future cash flows, while excluding sunk costs, which are past expenditures that cannot be recovered and should not influence decision-making. Implementing precise cost categorization and utilizing incremental cost data enhances budgeting, forecasting, and strategic decision quality.

Incremental Cost Infographic

libterm.com

libterm.com