A payment voucher is a financial document used to authorize and record the disbursement of funds within an organization. It serves as proof of payment, detailing the amount paid, recipient information, and purpose of the transaction to maintain accurate accounting records. Explore the rest of the article to understand how payment vouchers streamline your payment processes and ensure accountability.

Table of Comparison

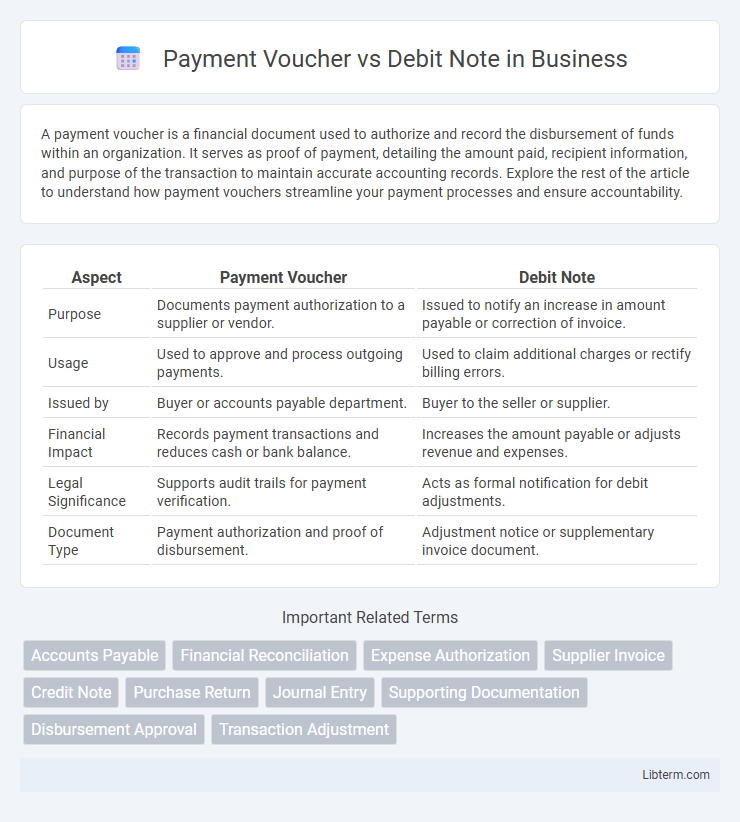

| Aspect | Payment Voucher | Debit Note |

|---|---|---|

| Purpose | Documents payment authorization to a supplier or vendor. | Issued to notify an increase in amount payable or correction of invoice. |

| Usage | Used to approve and process outgoing payments. | Used to claim additional charges or rectify billing errors. |

| Issued by | Buyer or accounts payable department. | Buyer to the seller or supplier. |

| Financial Impact | Records payment transactions and reduces cash or bank balance. | Increases the amount payable or adjusts revenue and expenses. |

| Legal Significance | Supports audit trails for payment verification. | Acts as formal notification for debit adjustments. |

| Document Type | Payment authorization and proof of disbursement. | Adjustment notice or supplementary invoice document. |

Introduction to Payment Voucher and Debit Note

A payment voucher is a document authorizing the disbursement of funds for a specific expense or purchase, often used to ensure proper authorization and record-keeping in financial transactions. A debit note is issued by a buyer to a seller to formally request a reduction in the amount payable, commonly due to returned goods or billing errors. Both documents play critical roles in maintaining accurate accounts payable and receivable records, ensuring transparency and control in financial management.

Definition of Payment Voucher

A payment voucher is an accounting document that authorizes the release of funds for a specific transaction or expense, serving as proof of payment approval and facilitating accurate record-keeping. It typically includes details such as the payee's name, payment amount, date, and the purpose of the payment, ensuring transparency in financial processes. In contrast, a debit note is a document issued to request a reduction in the amount owed, often used in cases of returned goods or billing errors.

Definition of Debit Note

A debit note is a formal document issued by a buyer to a seller to request a credit for returned goods or services or to report an undercharged amount on an invoice. It serves as evidence of a debit transaction and helps adjust account balances between both parties. Payment vouchers, in contrast, are internal documents authorizing payment disbursements and do not directly trigger account adjustments like debit notes.

Key Differences Between Payment Voucher and Debit Note

Payment vouchers serve as proof of payment authorization for expenses or purchases, detailing transaction amounts and payees, while debit notes are formal requests issued by buyers to suppliers indicating a reduction in the amount owed due to returned goods or billing errors. Payment vouchers primarily facilitate payment processing in accounting records, whereas debit notes adjust accounts payable and receivable by documenting discrepancies or returns. The key difference lies in payment vouchers initiating disbursement of funds, contrasting with debit notes signaling adjustments or credits in financial transactions.

Purpose and Use Cases of Payment Vouchers

Payment vouchers serve as formal documents authorizing the release of funds for specific transactions such as settling invoices or reimbursements, ensuring a clear audit trail and internal control within accounts payable processes. They are primarily used to validate and record payment approvals, facilitating accurate financial reporting and preventing unauthorized disbursements. While debit notes adjust or reduce amounts owed between businesses, payment vouchers focus on documenting the initiation and approval of outbound payments.

Purpose and Use Cases of Debit Notes

Debit notes serve as formal requests issued by buyers to suppliers when goods received are damaged, short, or not as per order specifications, signaling the need for a price adjustment or credit. Unlike payment vouchers, which authorize payments to vendors, debit notes primarily facilitate the correction of billing errors or return of goods, ensuring accurate financial records and inventory management. Common use cases include returning defective products, claiming price discrepancies, or adjusting overcharged invoices within procurement and accounting workflows.

Legal and Accounting Implications

A payment voucher serves as an official proof of payment, ensuring compliance with accounting standards and legal documentation requirements by recording the disbursement of funds accurately. In contrast, a debit note functions as a formal request for adjustment or reimbursement between buyer and seller, crucial for maintaining clear audit trails and adhering to tax regulations in both accounts receivable and payable. Proper use of these documents supports transparent financial reporting and legal verification during audits or dispute resolutions.

Documentation and Record-Keeping Requirements

Payment vouchers require detailed documentation including authorization signatures, payment amount, payee information, and supporting invoices to ensure accurate record-keeping and audit trails. Debit notes must include references to the original invoice, description of discrepancies or returns, and approval details for adjustments in accounts receivable records. Both documents are essential for maintaining transparent financial records and compliance with accounting standards.

Common Mistakes and Best Practices

Confusing payment vouchers with debit notes often leads to errors in financial records because payment vouchers document payments made, while debit notes request adjustments for returned goods or billing errors. Common mistakes include misclassifying these documents, resulting in inaccurate accounts payable and receivable reports. Best practices involve clearly defining and segregating these documents in accounting processes and ensuring staff training on their distinct functions to maintain accurate bookkeeping and audit trails.

Conclusion: Choosing the Right Document for Your Business

Selecting the appropriate document depends on your business transaction type: payment vouchers are ideal for authorizing and recording payments to suppliers, ensuring accurate cash flow management. Debit notes serve to formally request adjustments for overcharges or goods returned, providing clear documentation for accounts receivable and payable reconciliation. Understanding their distinct purposes optimizes financial record-keeping and supports transparent auditing processes.

Payment Voucher Infographic

libterm.com

libterm.com