A Limited Partner in a business partnership contributes capital and shares in profits but has limited liability and no involvement in daily management decisions. This role protects your personal assets from business debts while allowing you to benefit financially from the enterprise's success. Explore the article to understand how being a Limited Partner can fit your investment strategy.

Table of Comparison

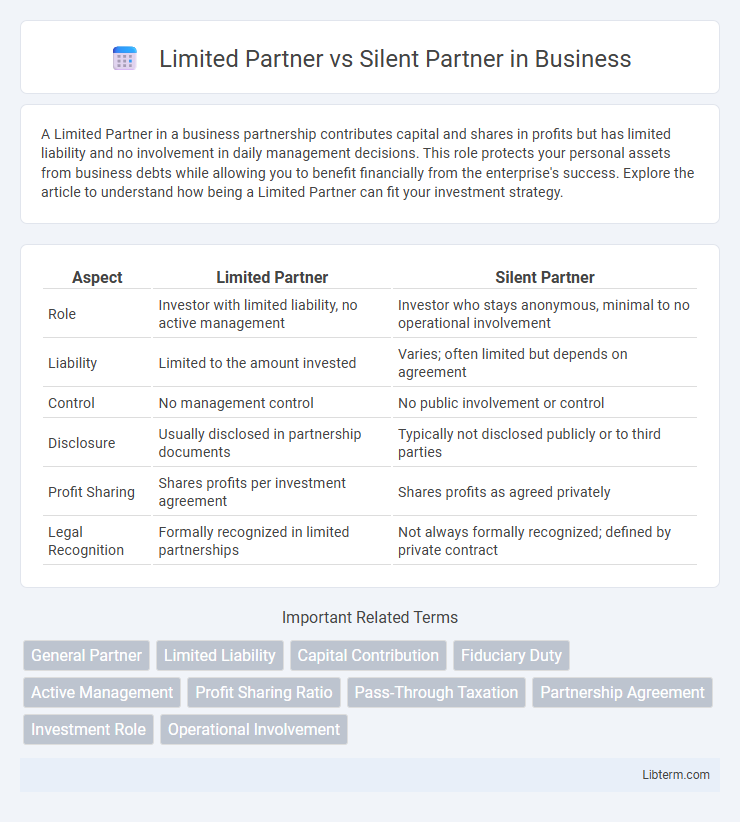

| Aspect | Limited Partner | Silent Partner |

|---|---|---|

| Role | Investor with limited liability, no active management | Investor who stays anonymous, minimal to no operational involvement |

| Liability | Limited to the amount invested | Varies; often limited but depends on agreement |

| Control | No management control | No public involvement or control |

| Disclosure | Usually disclosed in partnership documents | Typically not disclosed publicly or to third parties |

| Profit Sharing | Shares profits per investment agreement | Shares profits as agreed privately |

| Legal Recognition | Formally recognized in limited partnerships | Not always formally recognized; defined by private contract |

Understanding Limited Partners: Roles and Responsibilities

Limited partners in a partnership typically invest capital without engaging in daily management or decision-making, limiting their liability to the amount invested. Unlike silent partners, who may remain completely uninvolved and anonymous, limited partners often have a formal legal status with defined rights, such as receiving profits and accessing financial reports. Understanding the specific roles and responsibilities of limited partners helps clarify their passive yet financially significant involvement in business operations.

Who Is a Silent Partner? Definition and Characteristics

A silent partner is an investor in a business who contributes capital but does not participate in daily management or decision-making, distinguishing them from active partners. Unlike limited partners who have defined liability limits under partnership agreements, silent partners may have varying levels of liability depending on the business structure. Silent partners benefit from profit sharing while maintaining anonymity and minimal involvement, making them ideal for investors seeking passive income without operational responsibilities.

Legal Implications: Limited Partner vs Silent Partner

Limited partners have legally defined roles in a partnership, typically outlined in a limited partnership agreement, with liability limited to their investment and no involvement in daily management. Silent partners, while not active in management or business operations, may not have the same legal protections and could face unlimited liability depending on jurisdiction and partnership structure. Understanding the precise legal implications requires reviewing governing laws such as the Uniform Limited Partnership Act for limited partners and state partnership statutes for silent partners.

Investment Contributions: How Each Partner Participates

Limited partners contribute capital but usually avoid involvement in daily management, limiting their liability to the amount invested. Silent partners provide investment funds similarly but remain entirely hidden from operational activities, often retaining complete anonymity. Both types prioritize financial input over active management but differ primarily in visibility and legal recognition within the partnership structure.

Liability Exposure: Comparing Limited and Silent Partners

Limited partners have liability exposure restricted to their invested capital, ensuring personal assets remain protected from business debts and obligations. Silent partners, while often uninvolved in daily operations, may face unlimited liability depending on the partnership structure, risking personal assets beyond their initial investment. Understanding the nuances of liability exposure is crucial when choosing between limited and silent partnership roles to safeguard personal financial interests.

Decision-Making Power: Active vs Passive Involvement

Limited Partners typically have passive involvement with minimal decision-making power, as their role primarily involves financial investment without participation in daily management. Silent Partners are similar in their passive stance but may have informal influence depending on agreements, yet they remain excluded from active operational decisions. Both roles emphasize limited liability while differing from General Partners who hold active decision-making authority and direct involvement.

Profit and Loss Sharing Mechanisms

A Limited Partner typically shares profits according to their capital contribution while limiting losses to their investment amount, without participating in management decisions. In contrast, a Silent Partner also shares profits and losses based on their stake but often remains completely uninvolved in day-to-day operations, maintaining full liability exposure only if specified in the partnership agreement. Both roles protect the active partner's control but differ in legal liability and passive income distribution nuances.

Exit Strategies: Withdrawing as a Limited or Silent Partner

Limited partners typically exit by transferring their ownership interest through sale or assignment, often subject to approval by general partners and limited by partnership agreements. Silent partners, who generally have more informal roles, may withdraw by selling their stake quietly, but lack formal exit mechanisms, making negotiation with active partners essential. Both types must consider tax implications and valuation processes tied to partnership terms during withdrawal.

Key Industries Utilizing Limited or Silent Partners

Key industries utilizing Limited Partners include private equity, real estate investment, and venture capital, where they provide capital without engaging in daily operations. Silent Partners are common in small businesses and family enterprises, offering financial backing while remaining uninvolved in management decisions. Both partner types optimize investment roles by balancing capital contribution with limited liability and operational discretion.

Choosing the Right Partnership Structure for Your Business

Choosing the right partnership structure involves understanding the distinct roles of Limited Partners and Silent Partners, where Limited Partners contribute capital and have limited liability without active management responsibilities. Silent Partners also invest funds but remain completely uninvolved in daily operations and decision-making, often allowing for more flexibility in control. Assessing the level of involvement, liability protection, and control preferences is crucial to align the partnership structure with your business goals and risk tolerance.

Limited Partner Infographic

libterm.com

libterm.com