Depletion refers to the gradual reduction of natural resources or asset value over time due to usage or extraction. This concept is crucial in industries like mining, oil, and gas, where resource management directly impacts financial accounting and sustainability. Explore the rest of the article to understand how depletion affects your investments and environmental strategies.

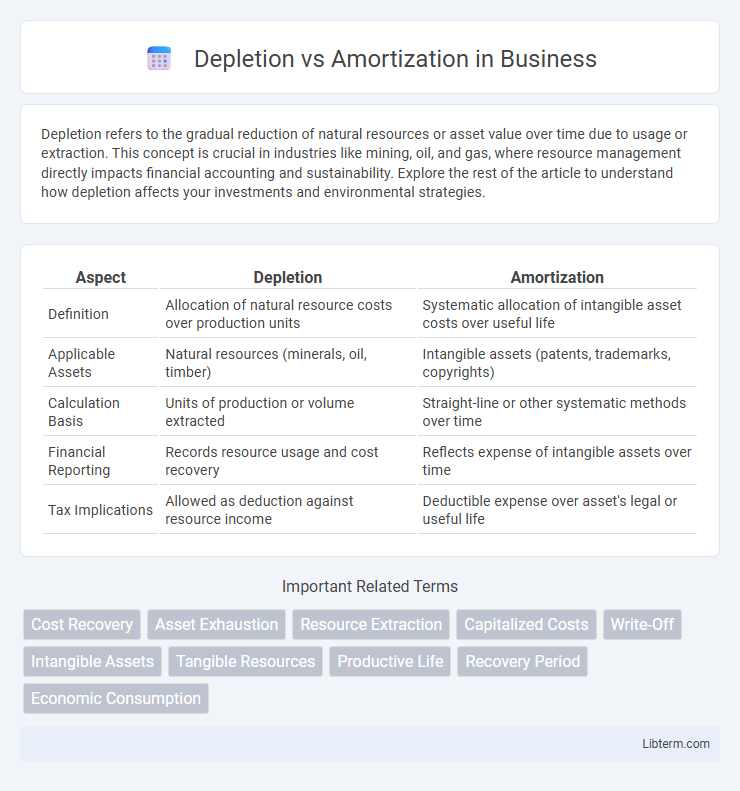

Table of Comparison

| Aspect | Depletion | Amortization |

|---|---|---|

| Definition | Allocation of natural resource costs over production units | Systematic allocation of intangible asset costs over useful life |

| Applicable Assets | Natural resources (minerals, oil, timber) | Intangible assets (patents, trademarks, copyrights) |

| Calculation Basis | Units of production or volume extracted | Straight-line or other systematic methods over time |

| Financial Reporting | Records resource usage and cost recovery | Reflects expense of intangible assets over time |

| Tax Implications | Allowed as deduction against resource income | Deductible expense over asset's legal or useful life |

Understanding Depletion and Amortization

Depletion refers to the allocation of the cost of natural resources, such as minerals, oil, and gas, over their useful extraction period, reflecting the reduction of resource quantity. Amortization pertains to the systematic expensing of intangible assets like patents, copyrights, and goodwill over their estimated useful lives. Understanding these methods is crucial for accurate financial reporting and tax compliance in industries dealing with tangible natural resources or intangible assets.

Key Differences Between Depletion and Amortization

Depletion applies to natural resource extraction like minerals, oil, and timber, reflecting the reduction of physical assets, while amortization involves systematically expensing intangible assets such as patents, copyrights, and trademarks over their useful life. Depletion is typically calculated based on units extracted or a percentage of resource quantity, whereas amortization uses a straight-line method over the asset's estimated lifespan. Key differences include asset type, calculation method, and the fact that depletion directly correlates with resource utilization, while amortization is time-based regardless of asset usage.

What is Depletion in Accounting?

Depletion in accounting refers to the systematic allocation of the cost of natural resources, such as oil, minerals, or timber, over the period these resources are extracted and sold. It accounts for the reduction in the asset's value as resources are consumed, similar to depreciation but specifically for natural resource extraction. Depletion can be calculated using the units-of-production method, which allocates cost based on the actual amount of resource extracted during a period.

Exploring Amortization: Definition and Purpose

Amortization refers to the systematic allocation of the cost of an intangible asset over its useful life, ensuring expenses are matched with the revenue generated. This accounting process helps businesses accurately reflect asset consumption on financial statements while managing tax liabilities. Unlike depletion, which applies to natural resource extraction, amortization specifically targets intangible assets like patents, copyrights, and trademarks.

Types of Assets Subject to Depletion

Depletion applies primarily to natural resources such as oil, gas, minerals, timber, and coal reserves, reflecting the consumption of these finite assets during extraction. Amortization, on the other hand, is used for intangible assets like patents, copyrights, trademarks, and goodwill, representing the systematic allocation of their cost over useful life. Natural resource companies rely on depletion methods to accurately match expenses with the extraction and sale of resources, ensuring precise asset valuation on financial statements.

Intangible Assets and Amortization Methods

Amortization refers to the systematic expense recognition of intangible assets such as patents, trademarks, and copyrights over their useful life, using methods like straight-line or units-of-production to allocate cost. Depletion, conversely, applies to natural resources and involves allocating the cost based on the quantity extracted or produced. Amortization methods for intangible assets primarily use the straight-line approach, reflecting the asset's consumption pattern, while emphasizing the non-physical nature distinguishing it from depletion processes.

Calculation Techniques for Depletion

Depletion calculation techniques primarily include cost depletion and percentage depletion, each tailored to extract natural resource expenses accurately over time. Cost depletion involves allocating the asset's total capital cost based on units extracted during the period relative to the total estimated recoverable units. Percentage depletion applies a fixed percentage rate allowed by tax codes to gross income from resource production, offering a simplified deduction method often used in oil, gas, and mineral industries.

How Amortization is Calculated

Amortization is calculated by systematically allocating the cost of an intangible asset over its useful life, often using the straight-line method, where the asset's initial cost minus any residual value is divided evenly across each accounting period. This process matches the expense with the revenue generated during the asset's useful life, ensuring precise financial reporting. Accurate amortization calculation requires detailed knowledge of the asset's purchase price, expected lifespan, and any anticipated residual value at the end of the amortization period.

Tax Implications: Depletion vs. Amortization

Depletion allows businesses in natural resource industries to deduct the reduction of resource reserves, providing tax benefits based on actual extraction and usage. Amortization offers a systematic expense deduction for intangible assets over their useful life, impacting taxable income by spreading costs over multiple periods. Choosing between depletion and amortization depends on asset type, with distinct IRS rules governing tax reporting and compliance for each method.

Choosing the Right Method for Your Business

Selecting the appropriate method between depletion and amortization depends on the nature of your business assets and industry regulations. Depletion is optimal for natural resource extraction industries, allowing you to allocate costs based on resource quantity extracted, while amortization suits intangible assets like patents or copyrights by spreading costs over their useful life. Evaluating asset type, tax implications, and financial reporting objectives ensures the chosen method aligns with your company's financial strategy.

Depletion Infographic

libterm.com

libterm.com