Asset management firms specialize in managing investments on behalf of individuals and institutions to maximize returns and minimize risks through diversified portfolios. These firms utilize advanced financial strategies, market analysis, and risk assessment tools to tailor investment solutions that align with your financial goals. Explore the rest of this article to understand how asset management firms can optimize your wealth growth and secure your financial future.

Table of Comparison

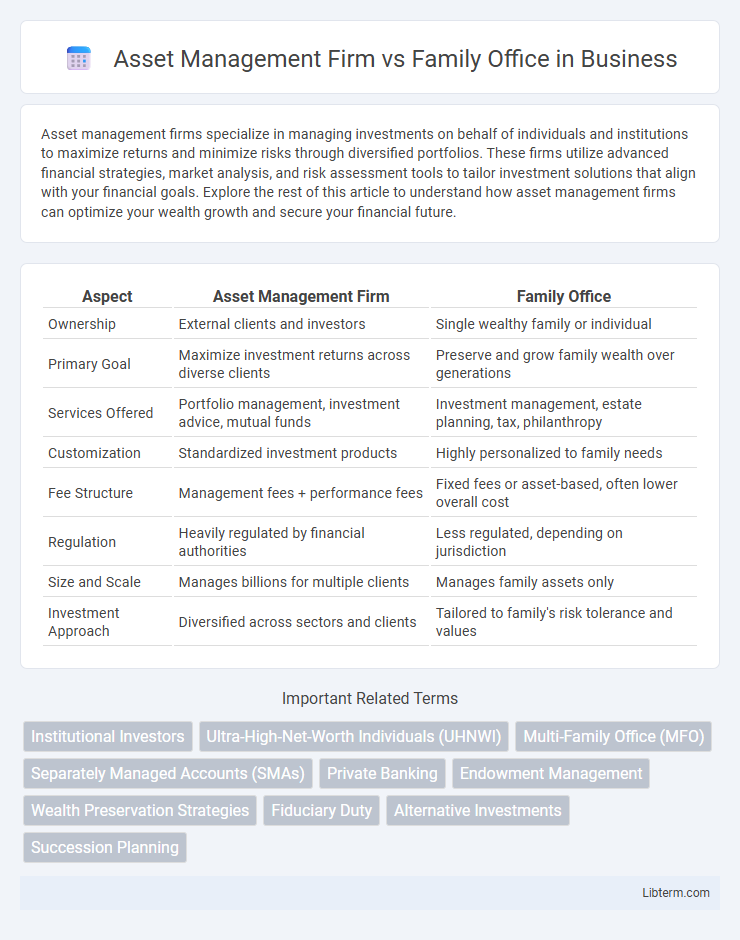

| Aspect | Asset Management Firm | Family Office |

|---|---|---|

| Ownership | External clients and investors | Single wealthy family or individual |

| Primary Goal | Maximize investment returns across diverse clients | Preserve and grow family wealth over generations |

| Services Offered | Portfolio management, investment advice, mutual funds | Investment management, estate planning, tax, philanthropy |

| Customization | Standardized investment products | Highly personalized to family needs |

| Fee Structure | Management fees + performance fees | Fixed fees or asset-based, often lower overall cost |

| Regulation | Heavily regulated by financial authorities | Less regulated, depending on jurisdiction |

| Size and Scale | Manages billions for multiple clients | Manages family assets only |

| Investment Approach | Diversified across sectors and clients | Tailored to family's risk tolerance and values |

Introduction: Understanding Asset Management Firms and Family Offices

Asset management firms specialize in managing investment portfolios for a wide range of clients, including individuals, corporations, and institutions, using diversified strategies to optimize returns. Family offices provide personalized wealth management services exclusively to high-net-worth families, focusing on long-term financial planning, estate management, and philanthropy. Both entities aim to preserve and grow wealth but differ significantly in their client base, scope of services, and operational approach.

Key Differences Between Asset Management Firms and Family Offices

Asset management firms primarily serve multiple clients with diverse investment portfolios, emphasizing scalable investment strategies and regulatory compliance, whereas family offices manage the wealth and financial affairs of a single high-net-worth family, offering personalized services such as estate planning and philanthropy management. Asset management firms typically generate revenue through management fees based on assets under management (AUM), while family offices often have a fixed operating budget funded by the family's wealth, prioritizing long-term wealth preservation over growth. The organizational structure of asset management firms is more corporate and client-focused, contrasting with the bespoke, holistic approach of family offices tailored exclusively to the family's unique needs and values.

Services Offered by Asset Management Firms

Asset management firms specialize in portfolio management, investment advisory, and risk assessment services tailored to institutional and retail clients. Their offerings include asset allocation, financial planning, and market research to optimize investment returns and manage volatility. These firms leverage advanced analytics and regulatory compliance expertise to provide scalable solutions across diverse asset classes.

Services Provided by Family Offices

Family offices provide comprehensive, personalized wealth management services including estate planning, tax optimization, philanthropy coordination, and succession planning tailored to ultra-high-net-worth families. Unlike asset management firms that primarily focus on investment portfolio management and financial returns, family offices offer holistic financial oversight, lifestyle management, and concierge services. They ensure integration of financial, legal, and personal affairs, promoting long-term family legacy preservation.

Client Profiles: Who Uses Asset Management Firms vs Family Offices?

Asset management firms primarily serve high-net-worth individuals, institutional investors, and corporations seeking diversified investment portfolios managed by professional fund managers. Family offices cater exclusively to ultra-high-net-worth families requiring bespoke wealth management solutions, including estate planning, tax optimization, philanthropy, and generational wealth transfer. Client profiles for family offices often involve those with complex financial needs and a desire for privacy and personalized services, contrasting with asset management firms' broader client base focused mainly on investment performance.

Investment Strategies and Approaches

Asset management firms typically employ diversified investment strategies targeting a wide range of asset classes to maximize returns for multiple clients, utilizing structured portfolio models, risk assessment tools, and market analysis. Family offices adopt a highly personalized approach, tailoring investment strategies to the specific goals, risk tolerance, and legacy planning needs of a single family, often integrating alternative assets, private equity, and direct investments. Both emphasize long-term wealth preservation but differ in customization, with family offices offering bespoke services and asset management firms focusing on scalable, standardized solutions.

Cost Structure and Fee Transparency

Asset management firms typically charge clients management fees ranging from 0.5% to 2% of assets under management, along with potential performance-based fees, resulting in a more standardized but sometimes opaque fee structure. Family offices often incur higher fixed costs due to bespoke services, including personalized investment strategies, tax planning, and estate management, while offering greater fee transparency aligned with the family's unique financial goals. The cost efficiency of asset management firms is balanced by broad service scopes, whereas family offices provide tailored solutions with more explicit, often upfront, fee disclosures.

Privacy, Confidentiality, and Personalization

Asset management firms prioritize standardized financial strategies targeting a wide client base, often limiting personalized attention and confidentiality to regulated industry standards. Family offices emphasize unparalleled privacy and confidentiality by managing wealth exclusively for high-net-worth families, offering bespoke investment solutions tailored to unique family dynamics and long-term goals. The personalized approach and stringent privacy protocols of family offices distinguish them from asset management firms, catering to clients seeking discreet, customized wealth management services.

Regulatory Environment and Compliance

Asset management firms operate under stringent regulatory frameworks such as the Investment Advisers Act of 1940 and SEC regulations, requiring comprehensive compliance programs, regular audits, and detailed reporting to protect investors. Family offices, often managing wealth for a single family, may be exempt from many federal regulations under the SEC's family office rule, leading to less regulatory oversight but still necessitating adherence to applicable state laws and tax regulations. Understanding these differences is crucial for proper governance, risk management, and ensuring fiduciary responsibilities are met within the respective regulatory environments.

Choosing the Right Option for Your Wealth Management Needs

Choosing between an asset management firm and a family office depends on the complexity and scale of your wealth management needs. Asset management firms offer diversified investment strategies and professional portfolio management ideal for clients seeking expert asset growth and risk mitigation. Family offices provide personalized, comprehensive services including estate planning, tax optimization, and intergenerational wealth transfer, making them suitable for ultra-high-net-worth individuals requiring tailored solutions and privacy.

Asset Management Firm Infographic

libterm.com

libterm.com