A well-drafted partnership agreement sets clear terms on the roles, responsibilities, and profit-sharing among partners, minimizing conflicts and ensuring smooth business operations. It also outlines procedures for dispute resolution and exit strategies, protecting your interests in unforeseen circumstances. Explore the rest of the article to understand key components that make a partnership agreement effective.

Table of Comparison

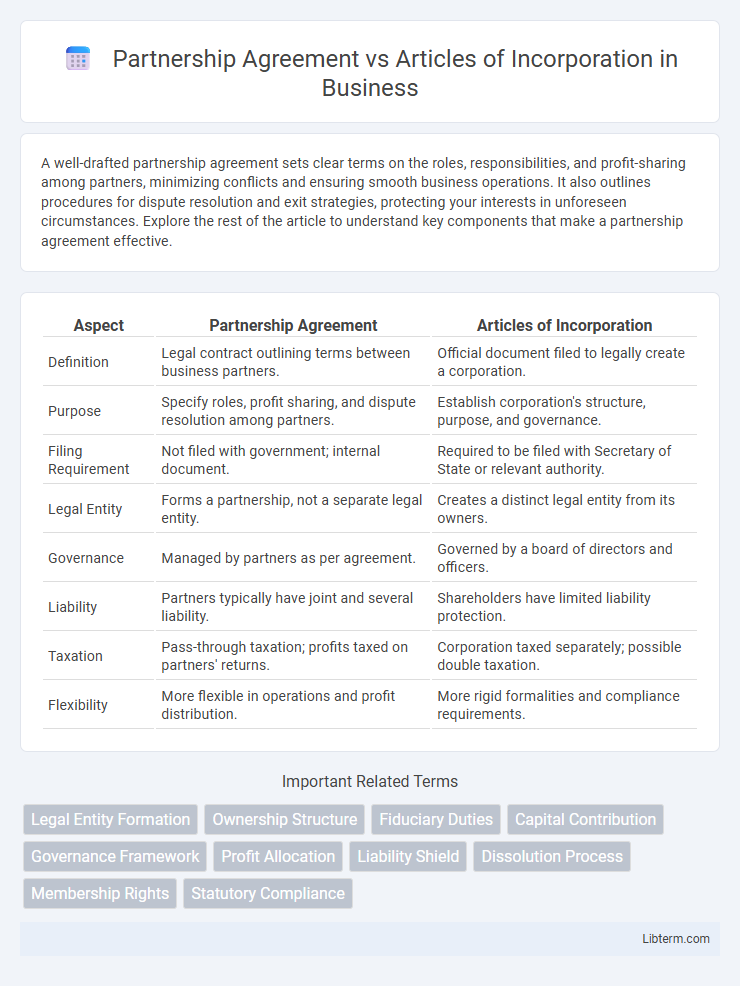

| Aspect | Partnership Agreement | Articles of Incorporation |

|---|---|---|

| Definition | Legal contract outlining terms between business partners. | Official document filed to legally create a corporation. |

| Purpose | Specify roles, profit sharing, and dispute resolution among partners. | Establish corporation's structure, purpose, and governance. |

| Filing Requirement | Not filed with government; internal document. | Required to be filed with Secretary of State or relevant authority. |

| Legal Entity | Forms a partnership, not a separate legal entity. | Creates a distinct legal entity from its owners. |

| Governance | Managed by partners as per agreement. | Governed by a board of directors and officers. |

| Liability | Partners typically have joint and several liability. | Shareholders have limited liability protection. |

| Taxation | Pass-through taxation; profits taxed on partners' returns. | Corporation taxed separately; possible double taxation. |

| Flexibility | More flexible in operations and profit distribution. | More rigid formalities and compliance requirements. |

Introduction to Partnership Agreements and Articles of Incorporation

Partnership Agreements outline the rights, responsibilities, and profit-sharing arrangements among business partners, serving as a foundational document for partnerships. Articles of Incorporation establish a corporation's legal existence by filing with the state, detailing essential information such as the company name, purpose, and share structure. Both documents are critical for defining governance and operational frameworks but apply to different business entities and legal structures.

Key Definitions and Legal Framework

A Partnership Agreement delineates the rights, responsibilities, and profit-sharing mechanisms among partners in a business, establishing a flexible legal framework tailored to the partnership's operational needs. Articles of Incorporation serve as the foundational legal document filed with a governmental body to officially create a corporation, defining key elements such as corporate purpose, stock structure, and management policies. The legal framework for partnership agreements is governed largely by state partnership laws or the Uniform Partnership Act, while Articles of Incorporation are subject to state corporate statutes regulating corporate governance and compliance.

Purpose and Core Functions

A Partnership Agreement defines the relationship, roles, profit sharing, and responsibilities among business partners, serving as a personalized contract to govern day-to-day operations and conflict resolution. Articles of Incorporation establish a corporation's legal existence, outlining its name, purpose, stock details, and structure to comply with state laws and serve as a public record. While the Partnership Agreement targets internal management and collaboration, Articles of Incorporation focus on formal registration, legal recognition, and regulatory compliance of the business entity.

Formation Process and Legal Requirements

Partnership agreements are formed through a mutual contract between partners, without mandatory filing requirements, focusing on clearly defining roles, profit sharing, and responsibilities to comply with state laws. Articles of incorporation require filing formal documents with the state government, outlining the corporation's purpose, structure, and governance, which grants the entity legal recognition. The formation process for articles of incorporation involves adherence to strict statutory requirements, including appointing a registered agent and paying filing fees, while partnership agreements rely more on private arrangements and less formal state oversight.

Ownership Structure and Management Roles

A Partnership Agreement establishes ownership percentages and management responsibilities clearly among partners, often allowing flexible roles and profit sharing tailored to mutual agreement. Articles of Incorporation define ownership through shares and outline a formal management hierarchy with directors and officers, adhering to corporate governance regulations. While a partnership emphasizes personal involvement and shared decision-making, a corporation separates ownership from management, focusing on roles defined by corporate bylaws and shareholder rights.

Liability and Risk Distribution

Partnership agreements outline the personal liability of each partner, where individuals often face unlimited liability for business debts and obligations, exposing personal assets to risk. Articles of incorporation establish a corporation as a separate legal entity, limiting shareholder liability to their investment amount, thereby reducing personal financial exposure. Risk distribution in partnerships is typically shared among partners based on the agreement, while corporations centralize risk within the entity, protecting individual shareholders from direct liability.

Taxation Differences

Partnership agreements and articles of incorporation differ significantly in taxation structures. Partnerships are generally subject to pass-through taxation, where income is reported on individual partners' tax returns, avoiding double taxation. Corporations, formed through articles of incorporation, face corporate tax rates and potential double taxation on dividends paid to shareholders, though S-corporations can elect pass-through taxation under specific IRS rules.

Document Flexibility and Amendment Procedures

Partnership agreements offer greater flexibility in drafting and customizing terms to suit individual partners' needs, allowing informal amendments with mutual consent. Articles of Incorporation are formal legal documents filed with the state, requiring structured amendment procedures such as board approval and shareholder votes, which can be time-consuming. The rigidity of Articles ensures regulatory compliance and public transparency, contrasting with the private, adaptable nature of partnership agreements.

Choosing the Right Structure for Your Business

Selecting the appropriate business structure depends on factors such as liability, management, and tax implications; a Partnership Agreement clearly defines roles, profit sharing, and responsibilities among partners, offering flexibility and simplicity for small businesses. Articles of Incorporation establish a corporation as a separate legal entity, providing limited liability protection and access to equity financing but requiring compliance with more regulations and formalities. Understanding these differences helps entrepreneurs align their business goals with the optimal legal framework to ensure growth, protection, and operational clarity.

Final Considerations and Best Practices

Final considerations in a Partnership Agreement focus on clearly defining roles, profit distribution, and dispute resolution methods to prevent conflicts and ensure smooth operations. Articles of Incorporation emphasize compliance with state regulations, outlining corporate structure, and protecting shareholder rights for legal recognition and liability protection. Best practices include regularly reviewing and updating both documents to reflect business changes, seeking legal advice for accuracy, and maintaining transparent communication among partners or shareholders.

Partnership Agreement Infographic

libterm.com

libterm.com