Efficiency maximizes output while minimizing waste and effort, leading to improved productivity and cost savings in any operation. Streamlined processes and strategic resource management are key to achieving superior efficiency in both personal and professional settings. Discover practical tips to enhance your efficiency throughout the rest of this article.

Table of Comparison

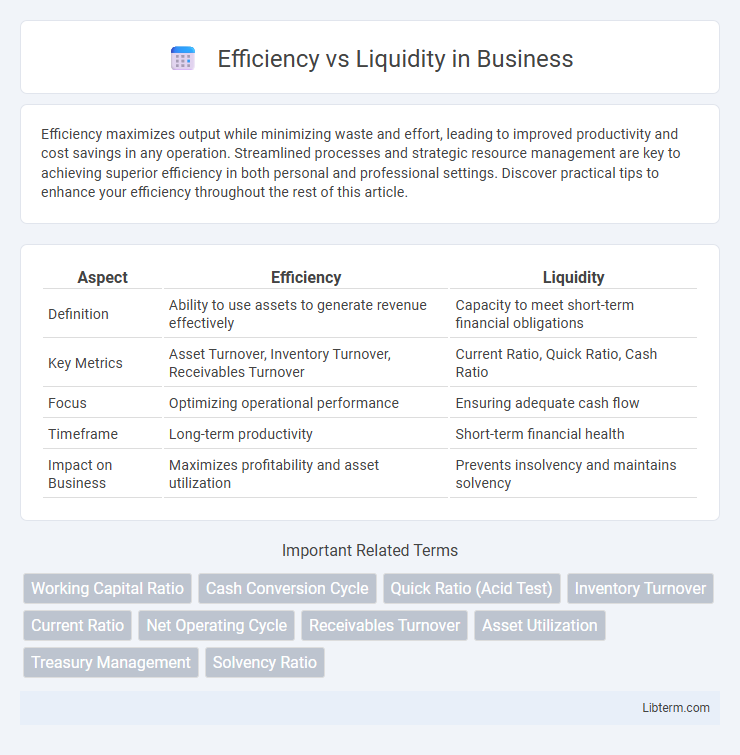

| Aspect | Efficiency | Liquidity |

|---|---|---|

| Definition | Ability to use assets to generate revenue effectively | Capacity to meet short-term financial obligations |

| Key Metrics | Asset Turnover, Inventory Turnover, Receivables Turnover | Current Ratio, Quick Ratio, Cash Ratio |

| Focus | Optimizing operational performance | Ensuring adequate cash flow |

| Timeframe | Long-term productivity | Short-term financial health |

| Impact on Business | Maximizes profitability and asset utilization | Prevents insolvency and maintains solvency |

Understanding Efficiency and Liquidity: Key Differences

Efficiency measures how effectively a company uses its assets and liabilities to generate sales and maximize profits, often assessed through ratios like asset turnover and return on assets. Liquidity refers to the company's ability to meet short-term obligations using its most liquid assets, evaluated by metrics such as the current ratio and quick ratio. Understanding these concepts highlights that efficiency emphasizes operational performance, while liquidity focuses on financial stability and solvency.

The Importance of Efficiency in Business Operations

Efficiency in business operations directly impacts profitability by maximizing resource utilization and minimizing waste, enabling faster production cycles and reduced operational costs. High operational efficiency enhances cash flow stability and supports liquidity by ensuring ongoing revenue generation and timely expense management. Prioritizing efficiency allows businesses to maintain competitive advantage and financial resilience in fluctuating market conditions.

Liquidity: Definition and Role in Financial Health

Liquidity refers to a company's ability to quickly convert assets into cash to meet short-term obligations. High liquidity ensures smooth operational continuity by providing sufficient cash flow to cover immediate expenses, reducing the risk of insolvency. Maintaining optimal liquidity levels balances operational efficiency with financial stability, supporting overall financial health.

Measuring Efficiency: Common Metrics and Indicators

Efficiency in business operations is commonly measured using metrics such as asset turnover ratio, inventory turnover, and accounts receivable turnover, which indicate how well a company utilizes its assets to generate sales. Liquidity, assessed through ratios like the current ratio and quick ratio, reflects a firm's ability to meet short-term obligations without compromising operational efficiency. Monitoring these indicators simultaneously helps balance efficient asset use with sufficient liquidity to maintain smooth financial operations.

Evaluating Liquidity: Ratios and Best Practices

Evaluating liquidity involves analyzing key financial ratios such as the current ratio, quick ratio, and cash ratio, which measure a company's ability to meet short-term obligations efficiently. Best practices include regularly monitoring these ratios to maintain an optimal balance between sufficient liquidity and operational efficiency, preventing cash flow issues or excessive idle assets. Industry benchmarks and trend analysis further enhance liquidity management, ensuring resources are allocated effectively without compromising financial stability.

Trade-Offs: Balancing Efficiency with Liquidity

Balancing efficiency with liquidity involves managing the trade-offs between maximizing asset utilization and maintaining ample cash flow to meet short-term obligations. High efficiency often requires investing in less liquid assets that yield greater returns, while liquidity prioritizes holding more liquid assets to ensure operational flexibility and reduce financial risk. Firms must optimize this balance by aligning their capital structure and working capital strategies to sustain growth and solvency under varying market conditions.

Sector-Specific Impacts: Efficiency vs Liquidity in Different Industries

Efficiency and liquidity metrics vary significantly across industries, influenced by sector-specific operational demands and capital structures. Manufacturing sectors prioritize efficiency ratios like inventory turnover to optimize production costs, while maintaining lower liquidity levels due to stable cash flows. Conversely, service industries emphasize higher liquidity ratios to manage fluctuating cash needs, often accepting lower efficiency metrics due to less inventory dependency.

Efficiency vs Liquidity in Crisis Management

Efficiency in crisis management emphasizes the optimal use of resources to maintain operations with minimal waste, while liquidity ensures immediate access to cash or assets for urgent obligations. During crises, maintaining liquidity is crucial for meeting short-term liabilities and stabilizing the organization, but excessive focus on liquidity can reduce operational efficiency by tying up resources that could be better utilized. Balancing efficiency with liquidity allows organizations to navigate financial stress effectively, ensuring both sustainable operations and sufficient cash flow to address emergencies.

Case Studies: Real-World Examples of Efficiency and Liquidity

Case studies from companies like Amazon demonstrate how high operational efficiency boosts profitability while maintaining adequate liquidity for short-term obligations. In contrast, Tesla's rapid growth highlights liquidity challenges despite strong efficiency, emphasizing the need for balancing cash flow and asset utilization. These examples show that optimal financial health requires managing both efficiency ratios and liquidity metrics effectively.

Strategies for Optimizing Both Efficiency and Liquidity

Balancing efficiency and liquidity requires implementing robust cash flow forecasting and real-time financial monitoring to optimize working capital management. Employing strategies such as inventory optimization, dynamic receivables collection, and flexible payables scheduling enhances operational efficiency while maintaining sufficient liquidity. Leveraging technology-driven analytics and automated processes enables businesses to make data-driven decisions that improve asset utilization without compromising cash availability.

Efficiency Infographic

libterm.com

libterm.com