A leveraged buyout (LBO) is a financial transaction where a company is acquired using a significant amount of borrowed money, with the assets of the company often serving as collateral. This strategy enables investors to increase their potential returns by minimizing initial equity investment. Explore the rest of the article to understand how leveraged buyouts work and their impact on businesses and investors.

Table of Comparison

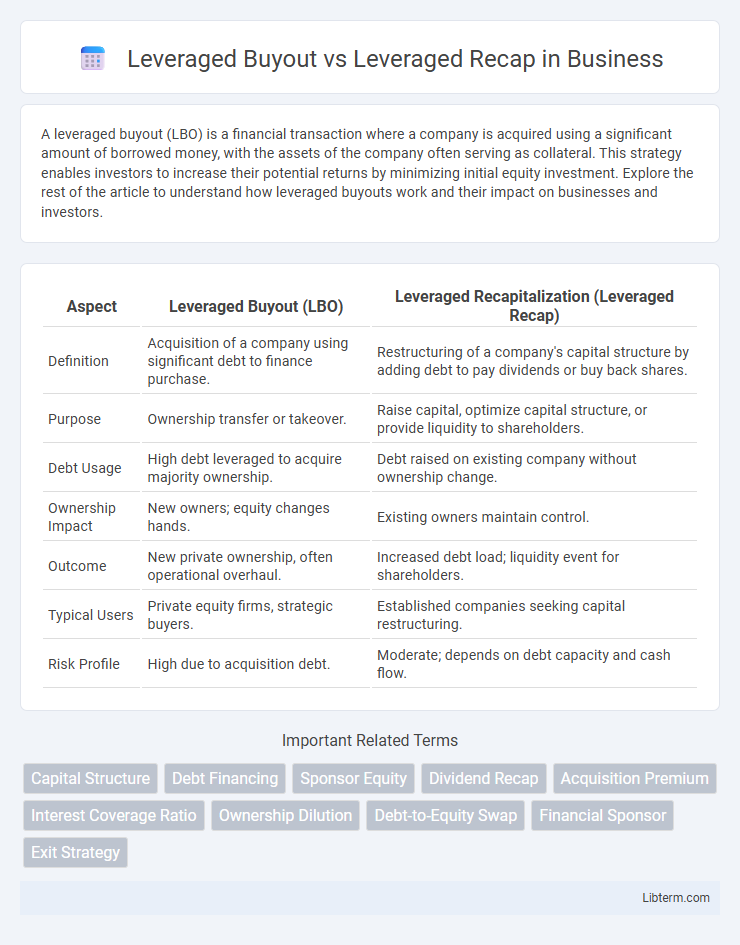

| Aspect | Leveraged Buyout (LBO) | Leveraged Recapitalization (Leveraged Recap) |

|---|---|---|

| Definition | Acquisition of a company using significant debt to finance purchase. | Restructuring of a company's capital structure by adding debt to pay dividends or buy back shares. |

| Purpose | Ownership transfer or takeover. | Raise capital, optimize capital structure, or provide liquidity to shareholders. |

| Debt Usage | High debt leveraged to acquire majority ownership. | Debt raised on existing company without ownership change. |

| Ownership Impact | New owners; equity changes hands. | Existing owners maintain control. |

| Outcome | New private ownership, often operational overhaul. | Increased debt load; liquidity event for shareholders. |

| Typical Users | Private equity firms, strategic buyers. | Established companies seeking capital restructuring. |

| Risk Profile | High due to acquisition debt. | Moderate; depends on debt capacity and cash flow. |

Introduction to Leveraged Buyout and Leveraged Recap

A Leveraged Buyout (LBO) involves acquiring a company using a significant amount of borrowed funds, typically secured by the target's assets and cash flows, to finance the purchase while minimizing equity investment. In contrast, a Leveraged Recapitalization (Leveraged Recap) restructures a company's capital structure by increasing debt and returning capital to shareholders through dividends or share buybacks without changing ownership control. LBOs are primarily focused on acquisition and control transfer, whereas Leveraged Recaps are used for optimizing balance sheets and providing liquidity to existing shareholders.

Key Definitions: Leveraged Buyout (LBO)

A Leveraged Buyout (LBO) is a financial transaction where a company is acquired primarily through debt, using the target's assets as collateral to secure the loans. This strategy enables buyers to make large acquisitions without committing significant equity capital. LBOs are often employed by private equity firms aiming to improve operational efficiency and increase the company's value before exiting the investment.

Key Definitions: Leveraged Recapitalization (Recap)

Leveraged Recapitalization (Recap) is a financial strategy where a company restructures its capital by increasing debt to repurchase equity shares or pay dividends, enhancing shareholder value or stabilizing ownership. Unlike a Leveraged Buyout (LBO), which involves purchasing a company primarily through debt and changing ownership, a recapitalization keeps existing shareholders but alters the debt-equity ratio. This approach can improve liquidity, optimize capital structure, and provide strategic flexibility without a full ownership transition.

Primary Objectives: LBO vs Leveraged Recap

Leveraged Buyouts (LBOs) primarily aim to acquire a controlling interest in a company using significant debt, enabling private equity firms to gain ownership and improve operational efficiency. Leveraged Recapitalizations focus on restructuring a company's balance sheet by increasing debt to distribute dividends or buy back shares, enhancing shareholder value without changing ownership control. Both strategies utilize leverage but differ fundamentally in their objectives: LBOs target ownership acquisition, while leveraged recaps prioritize capital restructuring and shareholder returns.

Deal Structure and Financing

Leveraged Buyouts (LBOs) involve acquiring a company using a significant amount of debt secured by the target's assets and cash flows, typically resulting in full or majority ownership transfer and operational control. Leveraged Recapitalizations (Leveraged Recaps) restructure a company's existing capital by increasing debt to pay dividends or repurchase shares, without changing ownership control. Both deal structures rely heavily on debt financing, but LBOs fund an acquisition, while Leveraged Recaps optimize the balance sheet and return capital to shareholders.

Impact on Company Ownership

A Leveraged Buyout (LBO) typically results in a significant transfer of company ownership to the acquiring investors by using debt to finance the purchase, often leading to majority control by private equity firms. In contrast, a Leveraged Recapitalization (Recap) involves the company taking on additional debt to pay dividends or buy back shares, allowing existing owners to retain control while increasing financial leverage. The ownership impact of an LBO is substantial due to the change in ownership structure, whereas a leveraged recapitalization mainly adjusts the capital structure without ceding control.

Risks and Rewards of LBOs

Leveraged Buyouts (LBOs) involve acquiring a company primarily through debt, presenting high financial risks due to significant leverage, but offer substantial rewards via potential equity appreciation if the company's value increases post-acquisition. The risk includes increased bankruptcy probability and cash flow constraints from debt service obligations, while rewards stem from control over operational improvements and tax benefits from interest deductions. In contrast, Leveraged Recapitalizations use debt to restructure balance sheets without changing ownership, carrying lower acquisition risk but less upside potential compared to LBOs.

Risks and Rewards of Leveraged Recaps

Leveraged Recapitalizations involve a company taking on significant debt to pay a large dividend or repurchase shares, posing risks such as increased financial leverage that can strain cash flow and heighten default risk during economic downturns. The rewards include substantial shareholder value extraction and optimized capital structure without ceding control, offering an alternative to full ownership change seen in Leveraged Buyouts (LBOs). Unlike LBOs, which transfer ownership and restructure operations, Leveraged Recaps focus on risk management through steady cash generation and balance sheet adjustments while maintaining existing management and strategic direction.

Strategic Use Cases: When to Choose LBO or Recap

Leveraged Buyouts (LBOs) are ideal for acquiring companies with stable cash flows and growth potential, enabling new ownership to improve operations and increase value through financial leverage. Leveraged Recapitalizations (Recaps) are typically chosen to restructure a company's balance sheet, returning capital to shareholders or defending against takeovers without changing control. Companies pursuing expansion or ownership transitions often opt for LBOs, while mature firms seeking liquidity or debt optimization prefer leveraged recaps.

Conclusion: Selecting the Right Leverage Strategy

Choosing between a Leveraged Buyout (LBO) and a Leveraged Recapitalization (Recap) depends on the company's strategic goals and financial condition. An LBO is ideal for acquiring control of a target company through significant debt financing, maximizing potential returns but increasing risk exposure. Leveraged Recaps optimize capital structure by adding debt to fund dividends or share repurchases without a change in ownership, improving liquidity while maintaining operational stability.

Leveraged Buyout Infographic

libterm.com

libterm.com