A reverse merger allows a private company to become publicly traded by acquiring an existing public company, bypassing the traditional initial public offering process. This strategy can save time and reduce costs associated with going public while providing immediate access to capital markets. Explore the rest of the article to understand how a reverse merger might benefit your business.

Table of Comparison

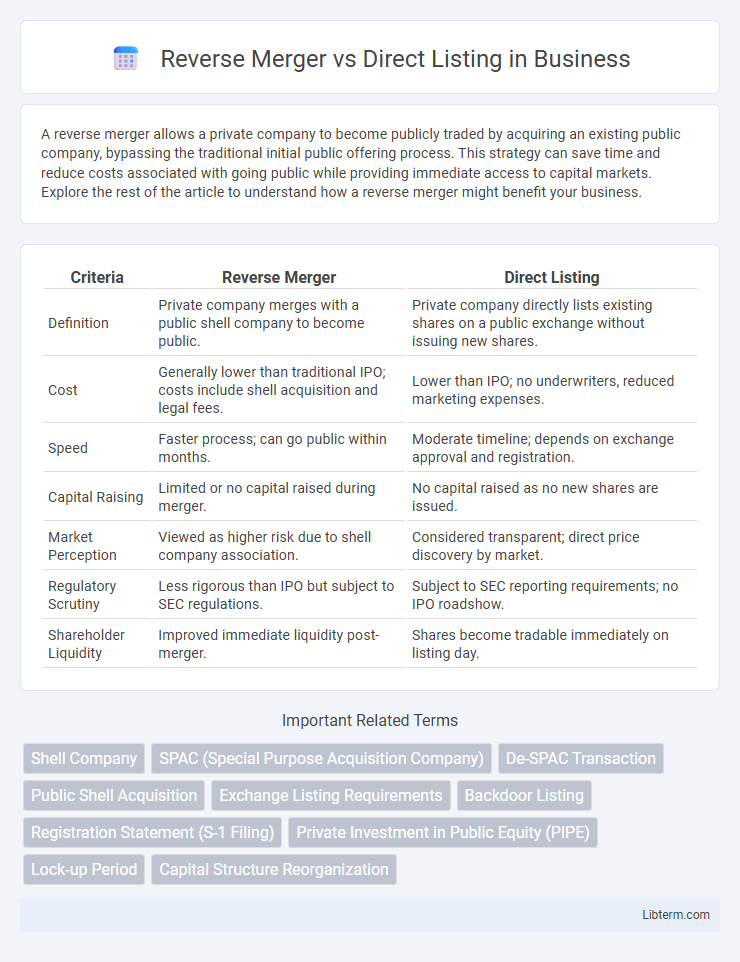

| Criteria | Reverse Merger | Direct Listing |

|---|---|---|

| Definition | Private company merges with a public shell company to become public. | Private company directly lists existing shares on a public exchange without issuing new shares. |

| Cost | Generally lower than traditional IPO; costs include shell acquisition and legal fees. | Lower than IPO; no underwriters, reduced marketing expenses. |

| Speed | Faster process; can go public within months. | Moderate timeline; depends on exchange approval and registration. |

| Capital Raising | Limited or no capital raised during merger. | No capital raised as no new shares are issued. |

| Market Perception | Viewed as higher risk due to shell company association. | Considered transparent; direct price discovery by market. |

| Regulatory Scrutiny | Less rigorous than IPO but subject to SEC regulations. | Subject to SEC reporting requirements; no IPO roadshow. |

| Shareholder Liquidity | Improved immediate liquidity post-merger. | Shares become tradable immediately on listing day. |

Introduction to Reverse Mergers and Direct Listings

Reverse mergers enable private companies to become publicly traded by merging with an already public shell company, offering a faster and often less costly alternative to traditional initial public offerings (IPOs). Direct listings allow existing shareholders to sell shares directly on a public exchange without issuing new shares or raising capital, providing greater liquidity and market-driven pricing. Both methods bypass typical IPO underwriting processes, making them attractive options for firms seeking public market access with fewer regulatory hurdles.

Understanding Reverse Mergers: Key Concepts

Reverse mergers offer a strategic alternative for private companies seeking public status by merging with an existing public shell company, enabling faster market entry without a traditional IPO. This method facilitates immediate access to capital markets and liquidity by bypassing extensive regulatory requirements and underwriting processes typically associated with direct listings. Key concepts include the importance of thorough due diligence on the shell company, the potential for fewer disclosure obligations, and the risk of inheriting unknown liabilities.

What is a Direct Listing?

A direct listing is a method for a company to go public by offering existing shares to the public without issuing new shares or raising capital, bypassing traditional underwriting. This process allows shareholders, including employees and investors, to sell their shares directly on the stock exchange, providing immediate liquidity. Companies typically choose direct listings to save on underwriting fees and avoid dilution of ownership.

Core Differences Between Reverse Merger and Direct Listing

Reverse mergers involve a private company acquiring a publicly traded shell company to bypass the traditional IPO process, enabling faster market entry with potentially lower costs but higher regulatory scrutiny. Direct listings allow companies to become publicly traded by listing existing shares on an exchange without issuing new ones or raising capital, preserving ownership stakes and avoiding dilution. The core difference lies in reverse mergers facilitating faster, often less transparent access with a shell company, while direct listings emphasize market-driven price discovery and investor transparency without capital infusion.

Advantages of Reverse Merger for Companies

Reverse mergers offer companies quicker access to public markets compared to traditional IPOs, significantly reducing time and costs associated with regulatory approvals. This method enables private firms to bypass some of the intensive scrutiny and extensive disclosures typically required, allowing for greater flexibility in financial reporting and business operations. Moreover, reverse mergers provide immediate liquidity for shareholders and easier access to capital markets, facilitating faster growth and expansion opportunities.

Benefits of Choosing a Direct Listing Route

Direct listings offer enhanced liquidity by allowing existing shareholders to sell their shares immediately without lock-up periods, attracting a broader investor base. This method reduces underwriting fees significantly compared to traditional IPOs or reverse mergers, resulting in substantial cost savings. Companies benefit from transparent price discovery through market-driven trading, fostering investor confidence and long-term market performance.

Risks and Drawbacks of Reverse Mergers

Reverse mergers pose significant risks including limited investor confidence due to perceived lack of transparency and potential for undisclosed liabilities from the private company. Regulatory scrutiny is often heightened, increasing legal and compliance risks, while liquidity issues may arise as reverse mergers typically attract less market attention compared to traditional IPOs or direct listings. The risk of poor post-merger performance and stock price volatility can lead to substantial financial losses for investors.

Potential Challenges of Direct Listings

Direct listings pose potential challenges such as limited capital raised since no new shares are issued, which can restrict funding opportunities compared to traditional IPOs. They often face less market stability during initial trading due to the absence of underwriter support, increasing price volatility. Furthermore, companies may encounter difficulties in garnering investor attention without the marketing efforts typically provided through a conventional underwriting process.

Key Considerations When Choosing Between Reverse Merger and Direct Listing

Key considerations when choosing between a reverse merger and direct listing include speed, cost, and market perception. A reverse merger offers a faster, often less expensive route to public markets but may carry a stigma affecting investor confidence. Direct listings avoid dilution and underwriter fees, providing liquidity for existing shareholders, yet they require strong brand recognition and market demand to succeed effectively.

Conclusion: Which Path Is Best for Your Company?

Choosing between a reverse merger and a direct listing depends on your company's specific goals, timeline, and financial situation. A reverse merger offers a quicker route to public markets with potentially less scrutiny, benefiting firms seeking rapid access to capital, while a direct listing provides greater liquidity and valuation transparency without diluting ownership. Evaluating factors such as growth stage, investor appetite, and regulatory readiness ensures selecting the optimal path for sustainable market entry and shareholder value.

Reverse Merger Infographic

libterm.com

libterm.com