Tangible assets are physical items such as machinery, buildings, and inventory that hold intrinsic value for businesses by supporting operations and generating revenue. Proper management and valuation of these assets are crucial for accurate financial reporting and maintaining your company's financial health. Explore the rest of this article to understand how to optimize the use and accounting of tangible assets effectively.

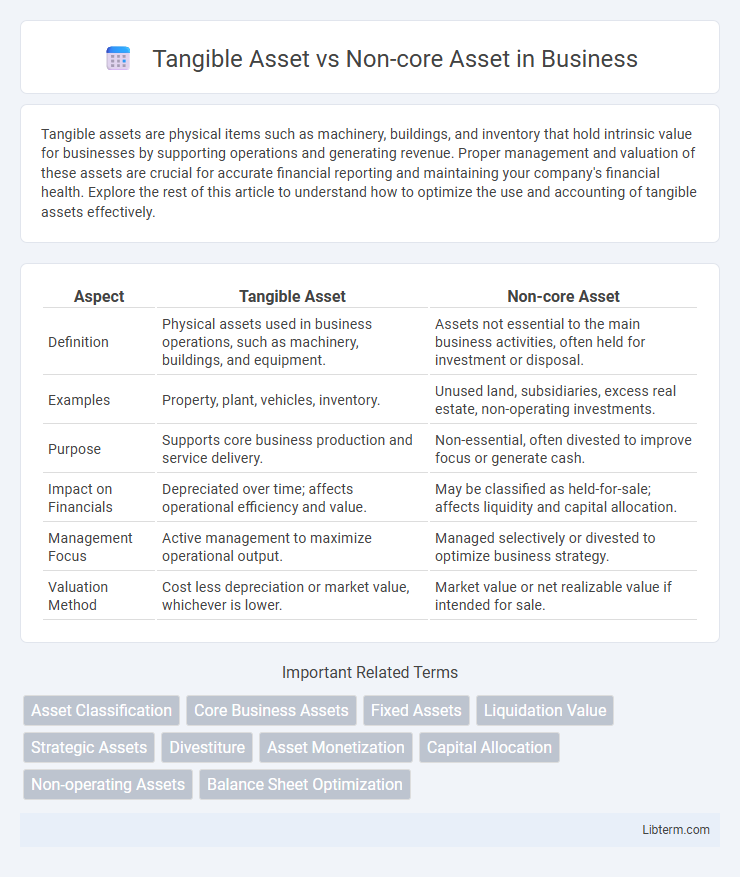

Table of Comparison

| Aspect | Tangible Asset | Non-core Asset |

|---|---|---|

| Definition | Physical assets used in business operations, such as machinery, buildings, and equipment. | Assets not essential to the main business activities, often held for investment or disposal. |

| Examples | Property, plant, vehicles, inventory. | Unused land, subsidiaries, excess real estate, non-operating investments. |

| Purpose | Supports core business production and service delivery. | Non-essential, often divested to improve focus or generate cash. |

| Impact on Financials | Depreciated over time; affects operational efficiency and value. | May be classified as held-for-sale; affects liquidity and capital allocation. |

| Management Focus | Active management to maximize operational output. | Managed selectively or divested to optimize business strategy. |

| Valuation Method | Cost less depreciation or market value, whichever is lower. | Market value or net realizable value if intended for sale. |

Introduction to Tangible Assets and Non-core Assets

Tangible assets include physical items such as machinery, buildings, and land that a company uses for its core operations and long-term value creation. Non-core assets are those not essential to a company's primary business activities, often including surplus real estate, investments, or divestitures targeted for sale to streamline operations. Understanding the distinction helps businesses optimize asset management and resource allocation for improved financial performance.

Defining Tangible Assets

Tangible assets are physical and measurable resources owned by a company, including machinery, buildings, land, and inventory, essential for daily operations and long-term value creation. These assets contrast with non-core assets, which are non-essential holdings or investments that do not directly contribute to the main business activities. Understanding tangible assets helps businesses assess their operational capacity and balance sheet strength.

Understanding Non-core Assets

Non-core assets refer to business resources or properties that are not essential to a company's primary operations or strategic goals, often including underutilized tangible assets, intellectual property, or subsidiaries. Understanding non-core assets is crucial for optimizing corporate value, as these assets can be divested or repurposed to improve liquidity, reduce operational complexity, and strengthen focus on core competencies. Effective management of non-core assets enhances capital allocation by reallocating resources to higher-yielding areas within the company's core business.

Key Differences Between Tangible and Non-core Assets

Tangible assets refer to physical items like buildings, machinery, and inventory that a company uses in its operations and are essential for core business activities. Non-core assets are assets not vital to the primary business, often held for sale or occasional use, such as surplus real estate or investments unrelated to the main business. The key differences lie in their role and importance: tangible assets support day-to-day operations, while non-core assets are supplementary and can be liquidated without disrupting core functions.

Examples of Tangible Assets

Examples of tangible assets include physical items such as machinery, buildings, vehicles, and inventory that are essential for daily business operations and hold intrinsic value. In contrast, non-core assets refer to properties or equipment not central to a company's primary activities, often considered for divestment to enhance financial focus. Tangible assets impact balance sheets directly by representing fixed or current assets critical for production and operational efficiency.

Examples of Non-core Assets

Non-core assets often include surplus land, obsolete machinery, underutilized buildings, and business units unrelated to the main operations, such as real estate holdings or investments in unrelated industries. These assets are typically divested to improve operational focus and optimize capital allocation. Unlike tangible assets directly used in production, non-core assets may not contribute significantly to the company's primary revenue streams.

Importance in Financial Reporting

Tangible assets, such as property, plant, and equipment, are crucial in financial reporting due to their direct impact on a company's balance sheet and depreciation calculations, reflecting the business's operational strength and value. Non-core assets, often non-essential investments or holdings, require careful disclosure as they can affect financial ratios and investor perceptions without representing primary revenue sources. Accurate classification and valuation of both asset types ensure transparency, compliance with accounting standards, and provide stakeholders with a clear picture of a company's financial health.

Impact on Business Valuation

Tangible assets such as property, plant, and equipment directly influence business valuation through their measurable book value and potential for generating revenue. Non-core assets, often non-essential or underutilized resources, may dilute valuation or be excluded during valuation to reflect the company's strategic focus. Accurate assessment separates core operational assets from non-core holdings, ensuring a precise representation of the company's intrinsic value in financial analysis.

Asset Management Strategies

Tangible assets, such as real estate, machinery, and equipment, require proactive asset management strategies focused on maintenance, depreciation control, and utilization optimization to maximize their physical value and operational efficiency. Non-core assets, often characterized by lower strategic relevance and including surplus properties or non-essential investments, demand a distinct approach emphasizing divestiture, redeployment, or monetization to unlock capital and improve core business focus. Effective asset management balances the enhancement of tangible assets' productivity with the strategic disposition of non-core assets to optimize overall portfolio performance and financial returns.

Conclusion: Choosing the Right Asset Mix

Selecting the right asset mix involves balancing tangible assets, which provide physical value and operational stability, with non-core assets that offer liquidity and strategic flexibility. Tangible assets like real estate, machinery, and inventory support long-term business growth, while non-core assets enable companies to optimize capital allocation and respond to market changes efficiently. Effective asset mix decisions enhance financial performance, risk management, and overall corporate resilience.

Tangible Asset Infographic

libterm.com

libterm.com