Operating capital represents the funds a business uses to manage its daily operations, including expenses like payroll, inventory, and rent. Efficient management of operating capital ensures liquidity and operational stability, directly impacting your company's ability to meet short-term obligations and invest in growth opportunities. Explore the rest of the article to discover strategies for optimizing your operating capital and enhancing financial performance.

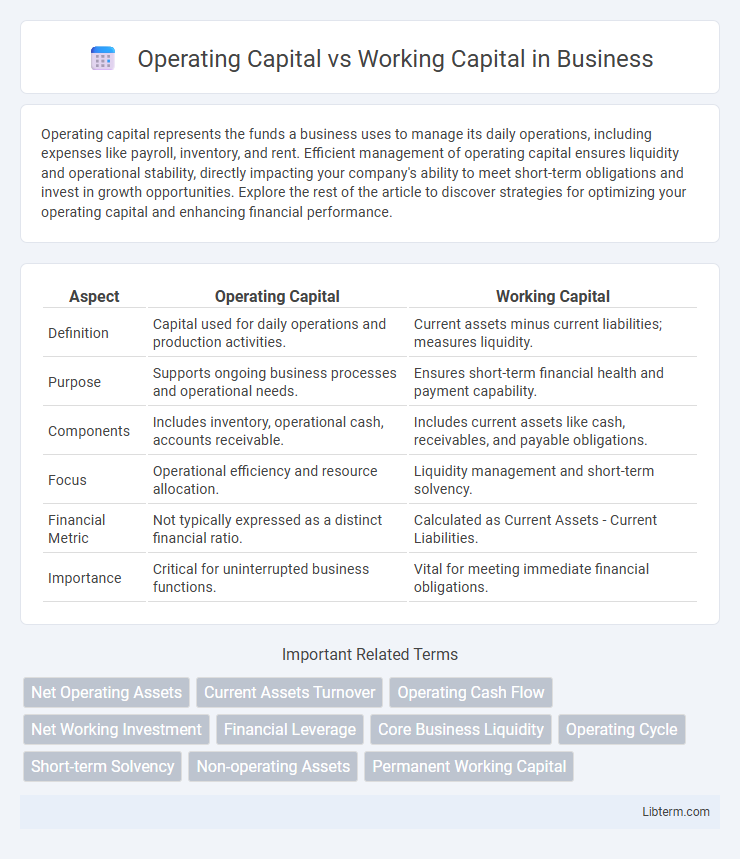

Table of Comparison

| Aspect | Operating Capital | Working Capital |

|---|---|---|

| Definition | Capital used for daily operations and production activities. | Current assets minus current liabilities; measures liquidity. |

| Purpose | Supports ongoing business processes and operational needs. | Ensures short-term financial health and payment capability. |

| Components | Includes inventory, operational cash, accounts receivable. | Includes current assets like cash, receivables, and payable obligations. |

| Focus | Operational efficiency and resource allocation. | Liquidity management and short-term solvency. |

| Financial Metric | Not typically expressed as a distinct financial ratio. | Calculated as Current Assets - Current Liabilities. |

| Importance | Critical for uninterrupted business functions. | Vital for meeting immediate financial obligations. |

Understanding Operating Capital

Operating capital refers to the funds a company uses to support its day-to-day business operations, including expenses such as inventory, payroll, and accounts receivable. It differs from working capital, which is a financial metric calculated as current assets minus current liabilities, representing short-term liquidity. Understanding operating capital is crucial for managing the resources necessary to maintain efficient business processes and sustain production flow.

Defining Working Capital

Working capital is a financial metric that represents the difference between a company's current assets and current liabilities, indicating its short-term liquidity and operational efficiency. Operating capital, often used interchangeably with working capital, specifically refers to the funds required to cover day-to-day business operations, including inventory management, accounts receivable, and accounts payable. Precise calculation of working capital is essential for maintaining smooth operational flow and ensuring the company can meet its short-term obligations.

Key Differences Between Operating and Working Capital

Operating capital refers to the funds a company uses for everyday business activities, including cash, inventory, and receivables, while working capital specifically measures the difference between current assets and current liabilities, indicating short-term financial health. Operating capital emphasizes the resources actively deployed in operations, whereas working capital assesses liquidity and the company's ability to meet short-term obligations. The key difference lies in operating capital's broader scope encompassing all operational assets, whereas working capital is a financial metric focused on net current assets available for immediate use.

Components of Operating Capital

Operating capital primarily consists of current assets such as cash, accounts receivable, and inventory, which are essential for daily business operations. It also includes current liabilities like accounts payable and accrued expenses that must be managed to maintain liquidity. Understanding these components helps businesses optimize cash flow and ensure efficient operational management.

Elements of Working Capital

Working capital consists of current assets and current liabilities, essential elements include cash, accounts receivable, inventory, accounts payable, and accrued expenses. Operating capital differs by emphasizing the funds tied up in day-to-day business operations, excluding long-term assets and liabilities. Proper management of these components ensures liquidity and operational efficiency, balancing cash flow against short-term obligations.

Importance of Operating Capital in Business

Operating capital represents the funds a business uses for its core day-to-day operations, encompassing cash, inventory, and receivables essential for maintaining smooth production and service delivery. Its importance lies in ensuring liquidity to meet short-term obligations and operational expenses, directly impacting business stability and growth potential. Effective management of operating capital optimizes cash flow, reduces financing costs, and sustains continuous operational efficiency.

Role of Working Capital in Daily Operations

Working capital represents the liquidity available for a company's day-to-day operations, including managing accounts receivable, inventory, and short-term liabilities. Efficient working capital management ensures businesses can meet short-term obligations and maintain smooth operational functions without financial disruptions. Unlike operating capital, which encompasses all capital resources used for business operations, working capital specifically measures the firm's short-term financial health essential for daily activities.

Measuring and Calculating Operating Capital

Operating capital is calculated by subtracting current liabilities from current assets directly involved in daily operations, such as inventory, accounts receivable, and accounts payable. Measuring operating capital focuses on the liquidity needed to sustain core business functions without considering non-operational items like short-term debt or cash reserves. Accurate calculation of operating capital provides insight into a company's efficiency in managing its operational resources and short-term financial health.

Strategies to Optimize Working Capital

Effective strategies to optimize working capital include improving inventory management by implementing just-in-time (JIT) techniques and using demand forecasting tools to reduce excess stock. Accelerating accounts receivable through automated invoicing and offering early payment discounts enhances cash flow and minimizes collection periods. Negotiating favorable payment terms with suppliers extends accounts payable timelines, reducing immediate cash outflow and improving the operating capital cycle.

Impact of Capital Management on Business Performance

Effective management of operating capital, which includes current assets and liabilities excluding short-term debt, directly influences liquidity and operational efficiency, driving improved business performance. Working capital, defined as current assets minus current liabilities, measures a company's ability to cover short-term obligations and fund day-to-day operations, impacting cash flow stability and risk management. Optimizing both operating and working capital enhances profitability by reducing financing costs and supporting consistent growth through better resource allocation.

Operating Capital Infographic

libterm.com

libterm.com