A SAFE (Simple Agreement for Future Equity) and a convertible note are popular financing instruments used by startups to raise capital without setting an immediate valuation. While SAFEs provide a straightforward agreement to convert investment into equity during future funding rounds, convertible notes function as debt that converts into equity but may accrue interest and have maturity dates. Discover how each option impacts your startup's funding strategy and which suits your needs best by reading the full article.

Table of Comparison

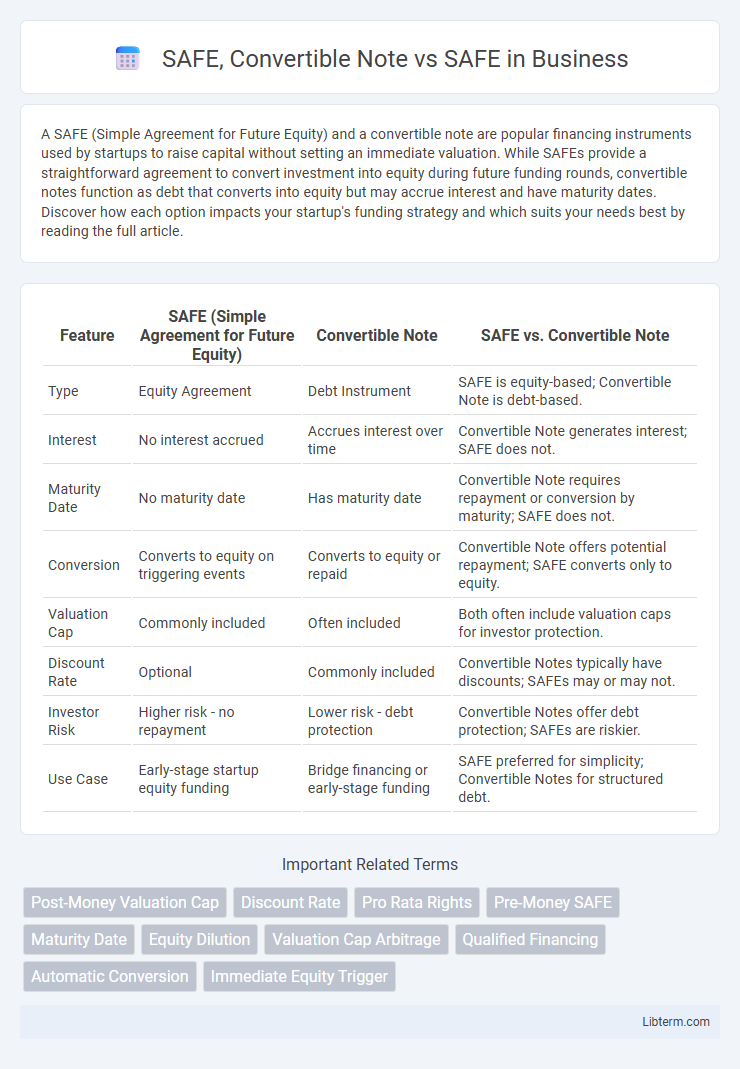

| Feature | SAFE (Simple Agreement for Future Equity) | Convertible Note | SAFE vs. Convertible Note |

|---|---|---|---|

| Type | Equity Agreement | Debt Instrument | SAFE is equity-based; Convertible Note is debt-based. |

| Interest | No interest accrued | Accrues interest over time | Convertible Note generates interest; SAFE does not. |

| Maturity Date | No maturity date | Has maturity date | Convertible Note requires repayment or conversion by maturity; SAFE does not. |

| Conversion | Converts to equity on triggering events | Converts to equity or repaid | Convertible Note offers potential repayment; SAFE converts only to equity. |

| Valuation Cap | Commonly included | Often included | Both often include valuation caps for investor protection. |

| Discount Rate | Optional | Commonly included | Convertible Notes typically have discounts; SAFEs may or may not. |

| Investor Risk | Higher risk - no repayment | Lower risk - debt protection | Convertible Notes offer debt protection; SAFEs are riskier. |

| Use Case | Early-stage startup equity funding | Bridge financing or early-stage funding | SAFE preferred for simplicity; Convertible Notes for structured debt. |

Introduction to Startup Financing Instruments

SAFE (Simple Agreement for Future Equity) offers startups a streamlined funding method by providing investors the right to equity during future financing rounds without accruing debt, contrasting with Convertible Notes which are debt instruments converting into equity under predefined conditions. Convertible Notes include interest rates and maturity dates, creating repayment obligations if conversion thresholds are unmet, whereas SAFEs avoid debt features, reducing legal complexity and negotiation time. Both instruments facilitate early-stage investment by delaying valuation until subsequent financing but differ in risk profiles and structural terms influencing startup capitalization and investor rights.

What is a SAFE?

A SAFE (Simple Agreement for Future Equity) is an investment contract that allows startups to raise capital without immediate valuation by converting the investment into equity at a future priced round. Unlike convertible notes, SAFEs do not accrue interest or have a maturity date, offering a simpler and more startup-friendly fundraising option. This instrument is popular in early-stage funding due to its straightforward terms and reduced legal complexity compared to debt instruments.

What is a Convertible Note?

A Convertible Note is a debt instrument used by startups to raise early-stage capital, which converts into equity at a future financing round, typically at a discounted price or with a valuation cap. It functions as a short-term loan that accrues interest until conversion, aligning investor and company interests by postponing valuation discussions. Compared to SAFEs (Simple Agreement for Future Equity), Convertible Notes carry repayment obligations and interest accrual, making them more complex but sometimes offering greater investor protection.

Key Similarities Between SAFE and Convertible Note

SAFE and Convertible Note both serve as early-stage financing instruments, allowing investors to convert their investment into equity during future funding rounds without setting a specific valuation at the time of the initial investment. Both instruments typically include a valuation cap and/or discount rate to provide investors with favorable terms upon conversion. Unlike traditional equity, neither SAFE nor Convertible Note requires immediate repayment, offering startups flexibility in managing cash flow while securing investment.

Major Differences Between SAFE and Convertible Note

SAFE (Simple Agreement for Future Equity) offers investors the right to purchase shares in a future equity round without accruing interest or having a maturity date, unlike Convertible Notes which are debt instruments carrying interest and a maturity timeline. Convertible Notes convert into equity at a discount or valuation cap during a priced round, while SAFEs typically convert only based on valuation caps or discounts but lack repayment terms. The absence of repayment obligations in SAFEs reduces complexity and risk for startups compared to Convertible Notes, which may require repayment if conversion does not occur.

Pros and Cons of SAFEs

SAFEs (Simple Agreements for Future Equity) offer startups a straightforward, cost-effective way to raise capital without immediate valuation, avoiding interest accrual and maturity dates unlike Convertible Notes. SAFEs provide investors with risk-sharing benefits through equity conversion during future financing, but they lack protections such as debt seniority and maturity timelines, which can delay investor returns. However, SAFEs may create uncertainty around dilution and control, potentially disadvantaging early investors compared to Convertible Notes that can impose repayment or conversion terms.

Pros and Cons of Convertible Notes

Convertible notes provide a debt instrument that converts into equity at a future financing round, offering founders the benefit of delayed valuation and investors a priority claim in case of liquidation. Pros include simplicity, investor protection through interest accrual, and capped conversion discount which incentivizes early investment. Cons involve the risk of debt repayment if no conversion event occurs, potential complications with maturity dates, and possible dilution uncertainty for founders.

Investor Perspective: SAFE vs Convertible Note

From an investor perspective, SAFEs offer simplicity and speed by eliminating interest rates and maturity dates, reducing negotiation complexities compared to convertible notes. Convertible notes provide investors with higher protection through interest accrual and maturity timelines, potentially leading to repayment if no equity conversion occurs. However, SAFEs may carry higher risk due to their non-debt status, while convertible notes secure claims as debt instruments until conversion or repayment.

Founder Perspective: SAFE vs Convertible Note

Founders prefer SAFEs (Simple Agreements for Future Equity) over convertible notes due to their streamlined structure, avoiding debt characteristics and interest accrual that complicate convertible notes. SAFEs provide more flexibility by deferring valuation discussions until the next funding round, reducing immediate negotiation pressure on founders. Unlike convertible notes, SAFEs typically do not have maturity dates, removing the risk of forced repayment and enabling founders to focus on growth without looming deadlines.

Choosing the Right Instrument for Your Startup

SAFE (Simple Agreement for Future Equity) offers a straightforward, investor-friendly option with fewer legal complexities compared to Convertible Notes, which are debt instruments with interest and maturity dates. Choosing between a SAFE and a Convertible Note depends on factors like your startup's cash flow stability, investor preferences, and fundraising timeline, as SAFEs avoid valuation negotiations while Convertible Notes provide temporary debt protection. Founders seeking simplicity and faster funding rounds often prefer SAFEs, while those needing more flexible terms or interim capital might opt for Convertible Notes.

SAFE, Convertible Note Infographic

libterm.com

libterm.com