Venture capital firms provide essential funding and strategic support to startups and early-stage companies, fueling innovation and growth in competitive markets. These firms evaluate business models, market potential, and management teams to invest in scalable ventures with high return prospects. Explore this article to understand how venture capital can accelerate your business success and the key factors to consider when choosing an investor.

Table of Comparison

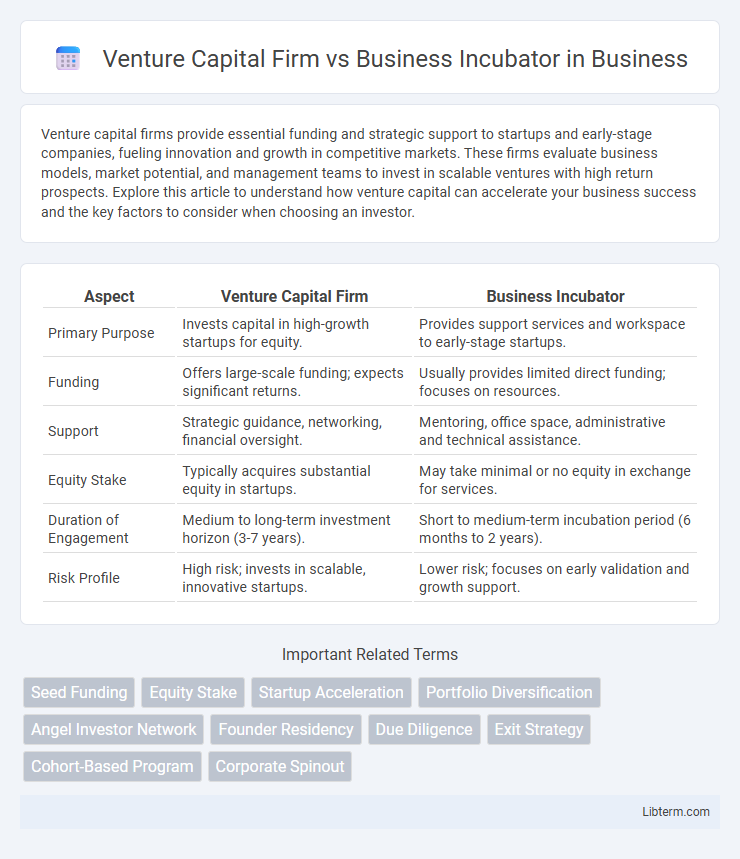

| Aspect | Venture Capital Firm | Business Incubator |

|---|---|---|

| Primary Purpose | Invests capital in high-growth startups for equity. | Provides support services and workspace to early-stage startups. |

| Funding | Offers large-scale funding; expects significant returns. | Usually provides limited direct funding; focuses on resources. |

| Support | Strategic guidance, networking, financial oversight. | Mentoring, office space, administrative and technical assistance. |

| Equity Stake | Typically acquires substantial equity in startups. | May take minimal or no equity in exchange for services. |

| Duration of Engagement | Medium to long-term investment horizon (3-7 years). | Short to medium-term incubation period (6 months to 2 years). |

| Risk Profile | High risk; invests in scalable, innovative startups. | Lower risk; focuses on early validation and growth support. |

Introduction to Venture Capital Firms and Business Incubators

Venture capital firms invest equity in high-potential startups, providing not only funding but strategic guidance and industry connections to accelerate growth and maximize returns. Business incubators offer early-stage companies resources such as office space, mentorship, and operational support to nurture development during the critical initial phases. Both structures aim to foster innovation and business success, yet venture capital firms focus on scalable investment opportunities while incubators emphasize hands-on support and infrastructure.

Core Differences Between Venture Capital Firms and Business Incubators

Venture capital firms primarily provide funding and strategic guidance to high-growth startups in exchange for equity, focusing on scaling businesses with potential for significant financial returns. Business incubators offer startups resources such as office space, mentorship, and networking opportunities to foster early-stage development and operational stability. The core difference lies in their objectives: venture capital firms aim for financial investment and growth acceleration, while incubators emphasize nurturing startups through foundational support services.

Funding Models: Investing vs Supporting Startups

Venture capital firms provide direct investment by purchasing equity stakes in startups, aiming for high returns through scalable growth and eventual exit strategies such as IPOs or acquisitions. Business incubators primarily offer non-equity support including mentorship, office space, and resources to nurture early-stage startups until they become self-sustainable. Funding from venture capital is typically monetary and tied to company performance, while incubators focus on comprehensive developmental support with minimal or no initial financial investment.

Equity Stakes: Ownership Structures and Returns

Venture capital firms typically acquire significant equity stakes in startups, aiming for high returns through ownership dilution and eventual exit strategies such as IPOs or acquisitions. In contrast, business incubators often take smaller or no equity, focusing on providing resources and mentorship without demanding substantial ownership. The differing equity stakes reflect distinct ownership structures and return expectations, with VC firms prioritizing financial gains and incubators emphasizing startup growth and long-term sustainability.

Services Offered: Mentorship, Networking, and Resources

Venture capital firms provide significant financial investment along with strategic mentorship to scale startups rapidly, leveraging extensive networks of industry experts and investors. Business incubators offer tailored mentorship programs emphasizing hands-on business development, access to shared office spaces, and essential resources such as administrative support and early-stage guidance. Both entities foster networking opportunities but incubators often create a collaborative peer environment, while venture capital firms connect startups with high-profile partnerships and potential follow-on funding.

Selection Criteria for Startups: What Each Looks For

Venture capital firms prioritize startups with high growth potential, scalable business models, and strong market traction, often seeking proven teams and innovative technologies. Business incubators focus more on early-stage startups, assessing the founder's commitment, product feasibility, and the potential for community impact or local economic development. Both entities evaluate the startup's business plan and market opportunity but differ in risk tolerance and development stage preferences.

Typical Stages of Startup Involvement

Venture capital firms typically engage with startups during the growth and expansion stages, providing significant funding to scale operations, accelerate product development, and enter new markets. Business incubators primarily support startups in the earliest stages by offering mentorship, office space, and access to resources to refine ideas and build a viable business model. The involvement of venture capital emphasizes financial investment and strategic guidance, while business incubators focus on foundational support and nurturing innovation.

Impact on Startup Growth and Development

Venture capital firms provide startups with significant financial investment, strategic guidance, and access to extensive industry networks, accelerating growth and scaling potential. Business incubators offer startups essential resources such as office space, mentorship, and business services, fostering early-stage development and product refinement. While venture capital firms emphasize rapid market expansion and fundraising, incubators focus on nurturing foundational business skills and reducing operational risks during the initial phases.

Pros and Cons: Venture Capital Firms vs Business Incubators

Venture capital firms provide substantial funding and strategic guidance to high-growth startups but often demand significant equity and control, posing risks for founders seeking independence. Business incubators offer mentorship, networking opportunities, and low-cost resources, fostering early-stage development with less financial pressure but may have limited funding capacity and longer timelines to scale. Choosing between venture capital firms and business incubators depends on a startup's need for capital intensity versus support infrastructure and growth velocity.

Choosing the Right Path for Your Startup

Selecting the right growth avenue is crucial for startup success, with venture capital firms offering substantial funding and strategic mentorship for scaling high-potential businesses. Business incubators provide early-stage startups with essential resources, office space, and networking opportunities to refine their product and business model. Assessing your startup's current stage, financial needs, and long-term goals helps determine whether the capital infusion and market access of venture capital or the supportive environment and development guidance of an incubator is the optimal choice.

Venture Capital Firm Infographic

libterm.com

libterm.com