Management consulting delivers expert strategies to improve organizational performance and drive growth through data-driven analysis and tailored solutions. Professionals in this field help You navigate complex challenges, optimize processes, and implement best practices across various industries. Discover how management consulting can transform Your business by reading the rest of the article.

Table of Comparison

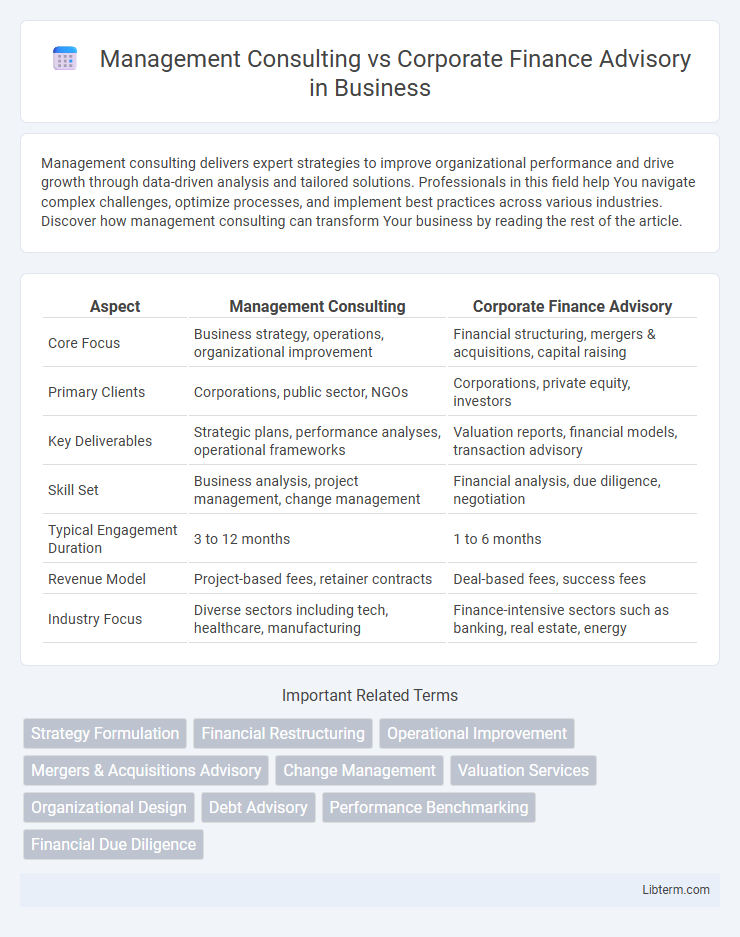

| Aspect | Management Consulting | Corporate Finance Advisory |

|---|---|---|

| Core Focus | Business strategy, operations, organizational improvement | Financial structuring, mergers & acquisitions, capital raising |

| Primary Clients | Corporations, public sector, NGOs | Corporations, private equity, investors |

| Key Deliverables | Strategic plans, performance analyses, operational frameworks | Valuation reports, financial models, transaction advisory |

| Skill Set | Business analysis, project management, change management | Financial analysis, due diligence, negotiation |

| Typical Engagement Duration | 3 to 12 months | 1 to 6 months |

| Revenue Model | Project-based fees, retainer contracts | Deal-based fees, success fees |

| Industry Focus | Diverse sectors including tech, healthcare, manufacturing | Finance-intensive sectors such as banking, real estate, energy |

Introduction to Management Consulting and Corporate Finance Advisory

Management consulting focuses on helping organizations improve performance through strategic analysis, operational efficiency, and organizational change. Corporate finance advisory involves providing expert guidance on mergers, acquisitions, capital raising, and financial restructuring to optimize a company's financial health. Both fields require strong analytical skills but differ in their primary objective--management consulting targets operational and strategic improvements, while corporate finance advisory focuses on financial transactions and capital management.

Key Differences Between Management Consulting and Corporate Finance Advisory

Management consulting primarily focuses on improving organizational performance through strategic planning, operational efficiency, and change management, whereas corporate finance advisory centers on financial transactions like mergers and acquisitions, capital raising, and valuation. Management consultants analyze business processes, organizational structure, and market strategies, while corporate finance advisors provide expertise in financial modeling, due diligence, and deal structuring. The key difference lies in management consulting's broad organizational improvement scope versus corporate finance advisory's specialized focus on financial strategy and transaction execution.

Core Services Offered by Management Consultants

Management consultants specialize in diagnosing organizational challenges, optimizing business processes, and implementing strategic initiatives to enhance overall performance, covering areas such as operations, human resources, and technology integration. Their core services include market entry strategies, organizational restructuring, change management, and performance improvement. Unlike corporate finance advisory, which centers on financial transactions such as mergers and acquisitions, capital raising, and valuation, management consulting prioritizes holistic business transformation and operational excellence.

Core Services Provided by Corporate Finance Advisors

Corporate finance advisors specialize in services such as mergers and acquisitions (M&A), capital raising, financial restructuring, and valuation analysis to optimize a company's financial strategy. Their core expertise includes navigating complex transactions, securing investment, and providing strategic financial guidance to enhance shareholder value. These advisors differ from management consultants by focusing primarily on financial deal execution and capital market activities rather than operational improvements.

Typical Client Profiles and Industries Served

Management consulting primarily serves a diverse range of industries such as technology, healthcare, and retail, targeting clients including large corporations seeking strategic transformation, operational efficiency, and market expansion. Corporate finance advisory focuses on clients in sectors like banking, private equity, and real estate, assisting entities such as investment firms and corporate finance departments with mergers and acquisitions, capital raising, and financial restructuring. Typical client profiles for management consulting involve C-suite executives driving organizational change, while corporate finance advisory clients often include CFOs and financial directors managing complex financial transactions.

Required Skills and Professional Backgrounds

Management Consulting demands strong analytical thinking, problem-solving abilities, and expertise in strategic planning, often acquired through degrees in business administration, economics, or engineering combined with experience in project management. Corporate Finance Advisory requires in-depth financial modeling, valuation techniques, and knowledge of capital markets, typically supported by backgrounds in finance, accounting, or economics and professional certifications such as CFA or CPA. Both fields value excellent communication skills and the capacity to work under pressure, but their core competencies reflect the distinct focus on operational strategy versus financial transactions.

Project Lifecycle: Management Consulting vs Corporate Finance Advisory

Management Consulting typically emphasizes the entire project lifecycle from problem identification, strategic planning, implementation, to performance evaluation, ensuring sustainable organizational improvements. Corporate Finance Advisory focuses more intensively on the transactional phases within the project lifecycle, including valuation, due diligence, deal structuring, and post-merger integration. Both fields require expertise in risk assessment and stakeholder management but differ in scope where consulting is broader and finance advisory is more specialized in financial outcomes.

Career Pathways and Growth Opportunities

Management consulting offers diverse career pathways in strategy, operations, and organizational development, emphasizing problem-solving skills and client engagement to foster rapid professional growth. Corporate finance advisory focuses on mergers and acquisitions, capital raising, and financial restructuring, providing deep expertise in financial analysis and deal execution, which can lead to senior roles in investment banking or corporate finance departments. Both fields present robust advancement opportunities, with management consulting facilitating transitions into executive leadership and corporate finance advisory enabling specialization in financial strategy and capital markets.

Compensation and Work-Life Balance Comparison

Management consulting roles typically offer competitive base salaries with performance bonuses, but often demand long hours and frequent travel, impacting work-life balance. Corporate finance advisory positions tend to provide slightly lower base pay but offer more predictable schedules, which can enhance work-life balance for professionals prioritizing stability. Compensation in both fields varies by firm size and geography, with senior roles in corporate finance sometimes matching or exceeding management consulting pay levels.

Choosing the Right Path: Which Advisory Role Suits You?

Management consulting focuses on improving organizational performance through strategy, operations, and change management, ideal for professionals seeking broad business impact and diverse industry exposure. Corporate finance advisory specializes in mergers, acquisitions, capital raising, and financial restructuring, best suited for those with strong financial analysis skills and an interest in transactional deal-making. Selecting the right advisory role depends on your strengths, career goals, and whether you prefer strategic problem-solving or financial transaction expertise.

Management Consulting Infographic

libterm.com

libterm.com