Restructuring streamlines your organization by realigning resources, processes, and roles to improve efficiency and adapt to market changes. It enables companies to reduce costs, eliminate redundancies, and foster innovation, ensuring long-term competitiveness. Discover how effective restructuring can transform your business by exploring the strategies outlined in this article.

Table of Comparison

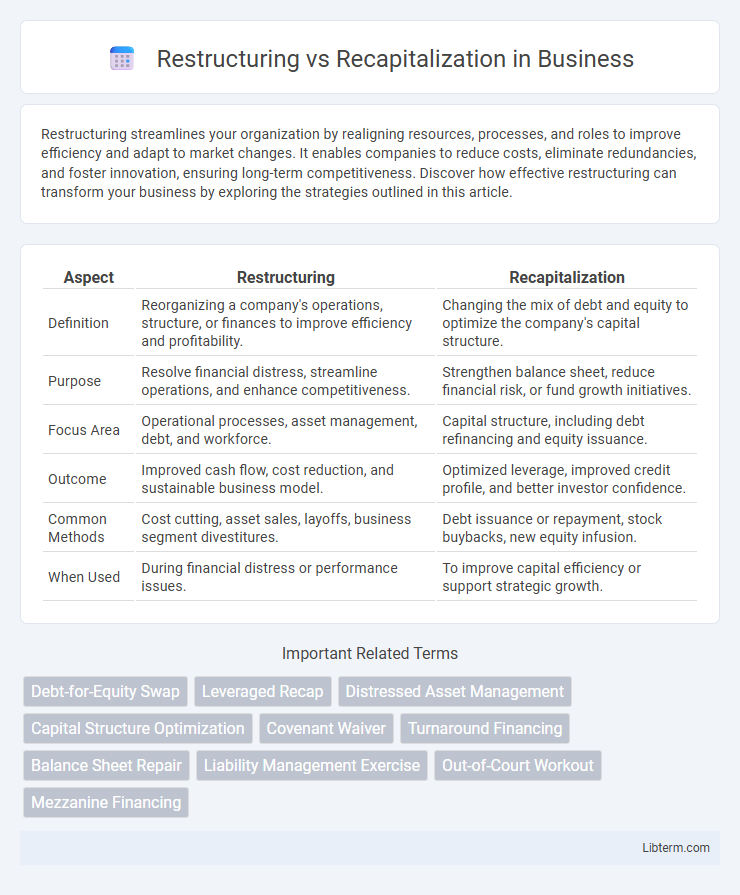

| Aspect | Restructuring | Recapitalization |

|---|---|---|

| Definition | Reorganizing a company's operations, structure, or finances to improve efficiency and profitability. | Changing the mix of debt and equity to optimize the company's capital structure. |

| Purpose | Resolve financial distress, streamline operations, and enhance competitiveness. | Strengthen balance sheet, reduce financial risk, or fund growth initiatives. |

| Focus Area | Operational processes, asset management, debt, and workforce. | Capital structure, including debt refinancing and equity issuance. |

| Outcome | Improved cash flow, cost reduction, and sustainable business model. | Optimized leverage, improved credit profile, and better investor confidence. |

| Common Methods | Cost cutting, asset sales, layoffs, business segment divestitures. | Debt issuance or repayment, stock buybacks, new equity infusion. |

| When Used | During financial distress or performance issues. | To improve capital efficiency or support strategic growth. |

Understanding Restructuring and Recapitalization

Restructuring involves reorganizing a company's operations, structure, or finances to improve efficiency and address financial challenges, often including debt renegotiation or asset sales. Recapitalization focuses specifically on altering a company's capital structure by changing the mix of debt and equity to stabilize its financial foundation or fund growth initiatives. Both strategies aim to strengthen the company but differ in scope, with restructuring targeting overall operational improvements and recapitalization concentrating on financial leverage adjustments.

Key Differences Between Restructuring and Recapitalization

Restructuring involves reorganizing a company's operations, assets, or liabilities to improve financial stability, often including debt renegotiation or cost-cutting measures. Recapitalization focuses specifically on altering the company's capital structure by changing the mix of debt and equity to strengthen the balance sheet or raise new capital. Key differences lie in scope--restructuring is broader and operational, while recapitalization is financial and capital-centric, aiming to optimize leverage and shareholder equity.

When to Consider Restructuring

Consider restructuring when a company faces prolonged financial distress, operational inefficiencies, or shifting market conditions requiring fundamental changes to its business model or debt structure. Restructuring is essential for managing insolvency risks, improving cash flow, and realigning organizational goals without necessarily seeking new equity investment. It often involves debt renegotiation, asset divestiture, or organizational redesign to restore profitability and long-term viability.

When to Opt for Recapitalization

Recapitalization is ideal when a company needs to stabilize its capital structure by adjusting the mix of debt and equity to improve financial health without undergoing a full restructuring. It is often pursued when a business aims to lower interest expenses, manage debt maturities, or attract new investors while maintaining operational continuity. Companies facing liquidity challenges but with viable business models typically opt for recapitalization to enhance shareholder value and secure growth capital.

Common Types of Corporate Restructuring

Common types of corporate restructuring include mergers and acquisitions, divestitures, spin-offs, and organizational restructuring, each aimed at enhancing operational efficiency and strategic focus. Recapitalization, a subset of restructuring, involves altering a company's capital structure by changing the mix of debt and equity to improve financial stability or support growth initiatives. Both strategies address different aspects of business challenges but share the goal of improving overall corporate performance.

Major Recapitalization Strategies

Major recapitalization strategies involve altering a company's capital structure by replacing equity with debt, or vice versa, to optimize financial stability and growth potential. Techniques such as issuing new equity to reduce debt, debt refinancing to lower interest costs, and issuing convertible securities to attract investors are commonly employed. These strategies target improving liquidity, enhancing market valuation, and strengthening shareholder value while addressing financial distress or expansion needs.

Financial Impacts of Restructuring vs Recapitalization

Financial impacts of restructuring include improved cash flow management, reduced operational costs, and enhanced long-term solvency by renegotiating debt terms or downsizing assets. Recapitalization primarily affects the capital structure, potentially diluting equity but increasing liquidity and stabilizing debt ratios to support growth or prevent default. Both processes reshape balance sheets, with restructuring targeting operational efficiency while recapitalization adjusts financing mix to optimize financial health.

Legal and Regulatory Considerations

Legal and regulatory considerations in restructuring involve compliance with bankruptcy laws, creditor rights, and court approvals to ensure the reorganization process adheres to jurisdictional mandates. Recapitalization requires adherence to securities regulations, tax implications, and shareholder approvals, especially when altering capital structures or issuing new equity. Both processes necessitate thorough due diligence to manage legal risks and regulatory compliance effectively.

Case Studies: Successful Restructuring and Recapitalization

Case studies of successful restructuring and recapitalization reveal that businesses like General Motors effectively reduced debt and optimized operations through strategic asset sales and government-backed funding during its 2009 turnaround. Another example is American Airlines' 2011 restructuring, which improved liquidity and operational efficiency by negotiating labor costs and increasing capital injection from stakeholders. These cases highlight the critical role of tailored financial strategies and stakeholder collaboration in achieving sustainable business recovery.

Choosing the Right Strategy for Business Recovery

Choosing the right strategy for business recovery depends on the company's financial health and long-term goals. Restructuring involves reorganizing debt, operations, or management to improve efficiency and cash flow, making it ideal for businesses facing operational challenges. Recapitalization focuses on changing the capital structure by increasing equity or debt to stabilize finances and support growth, typically used when the firm's balance sheet requires strengthening to attract new investment or reduce leverage.

Restructuring Infographic

libterm.com

libterm.com